Category: Commodities

Commodity Investing – What is it all About?

What is commodity investing all about: 1. The curves and carry – backwardation/contango (inventory). Given the cash market for commodities is often not available for investing, the primary market for investors in commodities is the futures. Consequently, the shape and dynamics of the futures curve is a dominant factor for longer-term investing. Investors cannot think […]

Why a Buy-and-Hold Strategy in Commodity Index Investing May Not Work

An article in the Wall Street Journal, “Why Commodity-Index Investing May be Futile,” has attracted much interest from investors. However, there was no new information in the story. The reasons for avoiding commodity indices should be taken seriously; nevertheless, the broader issue of differences between commodity and equity investing is straightforward. Commodity investing in an […]

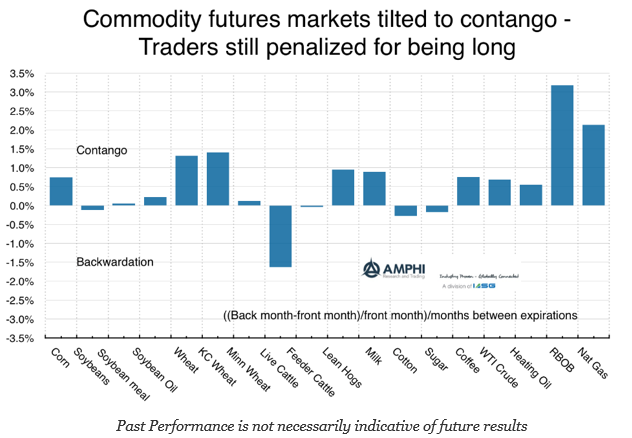

Contango Still Dominates the Commodity Markets

There has been increased interest in commodities and real assets with the increase in inflation. Commodity price as measured by the Bloomberg commodity are off the lows since February of last year, but he markets are still digesting the adjustments in demand and supply since the Great Financial Crisis. Most markets are still in contango because of high inventory levels. These contango levels have fallen over the last year, but are not like the long periods of backwardation during the 90’s and commodity super cycle. This places a significant roll drag on performance for pension funds that may choose to buy an index.

Commodity Exposure – Off the Lows and Worth Considering

From the high in June 2008, the Bloomberg Commodity index (formerly the DJ-UBS index) is still down from its high by 61.6%. The index is off the all-time lows since the crisis which was reached last February 2016 by about 16.5%, but the index is nowhere near old highs.

A Falling Correlation with Equities Makes for Greater Commodity Value

Commodities were supposed to be the great portfolio diversifier, a real asset that protects against inflation, offered positive roll yield, and gains from a super cycle. The reality over the last eight years has been much different. The roll yield disappeared as markets turned in many cases from backwardation to contango. Investors were penalized with negative roll. The super cycle ended with the Great Financial Crisis with a market decline over 75%. The markets have been digesting an excess supply/demand imbalance for years. The final kicker for investors was the financialization of commodities. Correlations with equities rose so investors did not get the diversification free lunch that was expected from looking at historical data. Now times are different, so throw out the old thinking.

Commodities – Is This the Time to Allocate?

Commodities have been an out of favor asset class. With a long-term return downturn, that has only partially reversed, many have avoided commodities even though it has been one of the best performing asset classes for 2016. A return of over 5% through November 11th as measure day the DJP total return has made it a strong gainer albeit the reversal in oil has caused declines from highs earlier in the year.

Momentum in Futures Not Spot – Hidden in the Basis?

Momentum strategies work with commodity futures, but a closer examination shows that the same momentum strategies are ineffective with commodity spot prices. This result, that the cash price action is not mirrored in the futures prices, seems odd. Of course, the futures are expectational markets, but the cross-sectional behavior in the spot should be represented […]

Kottke Commodities – Soybean-Corn Supply Imbalance to Continue

The world grain trade has been shocked in 2016 by the speed with which the entire exportable surplus from a large Brazilian soybean crop was consumed. While statisticians’ opinions differ, the more astute extrapolated early on from the pace of vessel loading that importers would not only come with equal alacrity for the U.S. crop next fall, they’d even need to tap more U.S. supplies yet this crop year. In short, demand for soy meal, a high-quality, high-protein feed ingredient key in efficient meat production, is beyond anything anticipated.

Kottke Commodities – A Half-Empty or Half-Full Glass?

We know of very few commercial entities or traders that were positioned last month to reflect much possibility that soybean prices at CME might be far too low. Plenty of different explanations have been offered as to the source of last month’s abrupt price explosion of grains and oilseeds prices. These can be roughly divided into two groups, “game theorists” and “statistical analysts.”

Investing in a Continuum of Change: Trading Futures Markets Amidst Rapid Transformations

Market Commentary from Kottke Commodities – Commodity Capital CTA – Kenneth Stein Most of our expectations are just knee-jerk reactions to day-to-day details, but today’s headlines rarely reflect tomorrow’s reality meaningfully. For example, how many tectonic changes in different areas of our lives have and continue to occur, only dimly perceived even by those attentive to […]

Narrow Ranges Reflect Ample World Supply

The amplitude of grains and oilseed prices last month was extraordinarily narrow. Soybeans were the most-contained, with a high-to-low closing price range of just 28c in the March contract, narrowest for January since 1998. It’s even more remarkable considering that on the 12th, USDA surprised the trade by reducing the 2015-16 U.S. crop by 50 million bushels. The reason that such stable matching of supply and demand rarely persists for a month is the constant fresh assessments of risks to production of crops in the field and the next to be planted. Today, such is the adequacy of supply and geographic diversification of growing areas that the market judges risk to be lowest in decades.

Commodity Prices and the U.S. Dollar

The chart above plots the performance of the Commodity Research Bureau (CRB) index, a benchmark measuring the prices of 19 diverse commodities. The legend is purposefully omitted so that we may pose the following question: If the lines represent one indicator, why are there 3 lines? The answer lies not in the commodity prices underlying the index, but in the currency used to express the prices. The blue line represents the CRB index as it is commonly expressed, in U.S. dollars (USD). The green line is denominated in euros and the black line in Brazilian reals. This graph highlights that the currency in which a commodity is denominated can have a meaningful effect on prices.

WEO: Adjusting to Lower Commodity Prices

Global growth for 2015 is projected at 3.1 percent, 0.3 percentage point lower than in 2014, and 0.2 percentage point below the forecasts in the July 2015 World Economic Outlook (WEO) Update. Prospects across the main countries and regions remain uneven. Relative to last year, the recovery in advanced economies is expected to pick up slightly, while activity in emerging market and developing economies is projected to slow for the fifth year in a row, primarily reflecting weaker prospects for some large emerging market economies and oil-exporting countries.