Once left for dead, gold speculators can sleep easily in 2025 as the yellow metal sits at all-time highs once again. Despite the shift to Bitcoin and other digital assets, the enduring nature of gold as an inflation hedge continues. What is driving this surge, and will cryptocurrencies still win the battle?

Reasons for optimism

Headline-grabbing price moves in Bitcoin often push the narrative that it may replace gold as a safe-haven asset. Despite this, the market capitalization of gold is estimated to be between $18 trillion and $25 trillion. This dwarfs Bitcoin’s value of $2.2 trillion and the entire crypto market, worth less than $4 trillion. Speculative buying is pushing both the Fed and other central banks to cut interest rates. This impacts the perceived value of the US dollar and other currencies relative to alternatives. Not surprisingly, the dollar index, which tracks USD versus the basket of worldwide currencies, is normalizing around its pre-2022 spike. It rose significantly when the US Federal Reserve got serious about combating inflation in this period. Many fear that the current easing cycle is too early and that we will see prices rise from here. The figures suggest this is true.

In the first eight months of 2025, the Consumer Price Index (CPI) is up 2.62%, excluding compounding. This represents an annualized rate of 3.93%, well above the target rate of 2%. Jerome Powell might like to blame tariffs for this shift, but the weakening dollar contributes as well. We discussed the dual mandate of the Fed last month. Signals in the labor market pose a dilemma as job growth slows and continuing unemployment claims get longer, indicating it is taking job seekers longer to find work. Thus, they may risk higher inflation to support employment and avoid a recession.

Like all commodities, supply and demand factors influence price. Central banks doubled their purchase amounts this decade, according to the World Gold Council, including 244 tons in the first quarter of 2025 alone. The rise of ETFs like the popular GLD, with a market cap of over $115 billion, makes it easy for retail investors to get exposure without having to worry about storage or transportation. Despite its reputation as a safe-haven asset, it sometimes moves in tandem with the market. Part of this relates to the devaluation of currency, which pushes equities higher, but also its use as both a precious and an industrial metal.

Reasons for Pessimism

Unlike many periods in history, cryptocurrency is a real competitor to gold. Limited supply of both, either by design for Bitcoin or by geological constraints for capturing bullion, keeps the value entrenched. Bitcoin’s volatility of over 50% might scare some people, but it delivers more bang per dollar of exposure than gold, with its volatility measure of 20%. Attracted by exponential returns, younger investors flock to cryptocurrencies and might ignore traditional safe-haven assets forever.

In the same way, the spike in gold attracts many investors with FOMO (Fear of Missing Out). Once the shine wears off, many of these same chasers might lose faith and move on to other options. A sharp sell-off could be the result. While the US Dollar decline is helping support the value, most other major countries continue to lower their interest rates as well. If the US economy continues to grow, foreign capital will migrate and support the USD valuation. The end of tariffs could hasten a strong response, and the revenue generation thus far due to these levies is already supportive of a stronger dollar. Many expected a more punishing response than the muted one thus far.

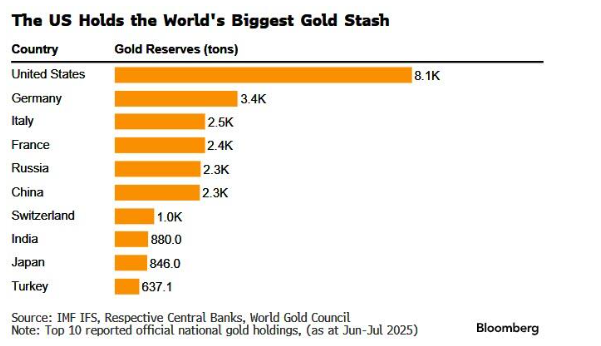

Central bank purchasing is extremely strong right now, but if those slow or shift to other types of collateral, the demand could fall off dramatically. It is estimated that the United States owns over a trillion dollars in gold reserves. This is not reflected on their balance sheet since the worth has not been marked to market for some time. In fact, it is worth 90 times more than currently reflected. Updating its true worth could add $700 to the Fed balance sheet, which could act as a stealth QE with uncertain results. The Trump administration seems crypto-friendly right now, and a new Treasury Secretary might diversify holdings into digital assets. This acceptance of cryptocurrencies could unleash a shift away from precious metals and drag the price down from its current highs.

Conclusion

Spiking gold prices occur with some regularity before normalizing. It is too early to tell if Bitcoin and other cryptocurrencies will follow similar cycles. Both remain stores of value that can act as safe-haven assets but also sources to pull revenue from in a crash. Easing cycles support returns for both, as we see now. As the Fed seems to move towards a 3% inflation target, a long-term re-pricing is possible. For now, the gold bugs will enjoy the ride as the spike they predicted for years arrives.

Illustration created by ChatGPT (OpenAI / DALL·E)