Trading Advisor Research & Selection

Interested in the potential of managed futures? We’ll work as futures specialized financial advisors who help you identify alternative investment managers that suit your investment goals. No contracts. No obligations.

Register for Access or Request a Free Investment Plan

Personalized Investment Strategy

Our trading advisor selection begins with an in-depth consultation. We review your current portfolio and explore what you want to achieve in an alternative investment portfolio. We take the time to understand your investment goals, timeframe, tolerance for risk, and rate of return objectives. Once we complete these steps, we move on to CTA (Commodity Trading Advisor) research and selection.

CTA Research & Evaluation

Drawing on our in-depth industry knowledge and our exclusive database of over 350 managed futures strategies, we help you identify professionally traded programs that best suit your investment goals. Then we analyze each potential strategy in detail, set up meetings with the managers you’re interested in, and conduct a thorough due diligence process utilizing both qualitative and quantitative methods.

Portfolio Design

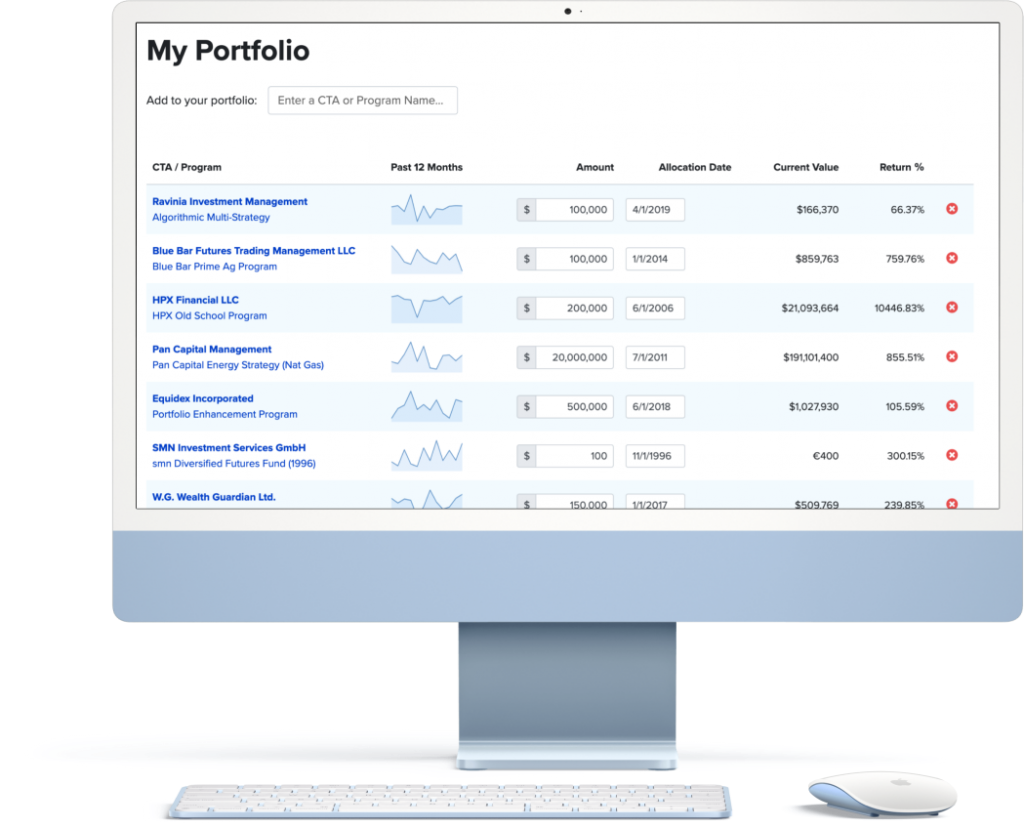

Next, we construct a portfolio that complements your existing allocations and matches your personal risk-return profile from our database of alternative investment advisors. We then review the portfolio together and answer any remaining questions you might have. When satisfied, you can select a futures commission merchant (FCM) to open your account.

Our CTA research and selection process is complimentary. You decide when and if you want to move forward with the customized portfolio.