On August 2, 2023, Fitch Ratings cut the outlook for US debt from AAA to AA+. While still considered one of the safest investments, it is a sign that despite a widespread belief in Keynesian economic principles, where each dollar expended yields multiples in benefits, we may encounter a reality check following the massive spending blowout of the COVID era and the eventual consequences. It is worth noting that the United States is not alone in its profligate spending through the crisis. This circumstance contributes to a favorable view of many countries by comparison. Yet peering ahead, uncertainty prevails about the nation’s economic trajectory.

Many figures in government and finance simply downplay the significance of credit ratings. After all, it happened before with no apparent long-term effect. Standard and Poor’s set a historical precedent on August 5, 2011, moving from the same AAA to AA+ measure. The market responded swiftly, losing 15% of its value while the VIX spiked 300%. The Federal Reserve promptly intervened to support the markets, selling shorter-term securities and buying long-term government debt. Equities then stabilized. This time around, Warren Buffet says, “There are some things people shouldn’t worry about. This is one.” Goldman Sachs simply says that the Fitch downgrade contained no new information. Nevertheless, prudence dictates a degree of apprehension, as exemplified by the Congressional Budget’s Office perspective on our finances.

If current laws governing taxes and spending generally remained unchanged, the federal budget deficit would nearly double in relation to gross domestic product (GDP) over the next 30 years, driving up federal debt, the Congressional Budget Office projects. In CBO’s extended baseline projections, debt held by the public rises from 98 percent of GDP in 2023 to 181 percent in 2053—exceeding any previously recorded level and on track to increase further.

Source: https://www.cbo.gov/publication/59233

Current Economic Indicators

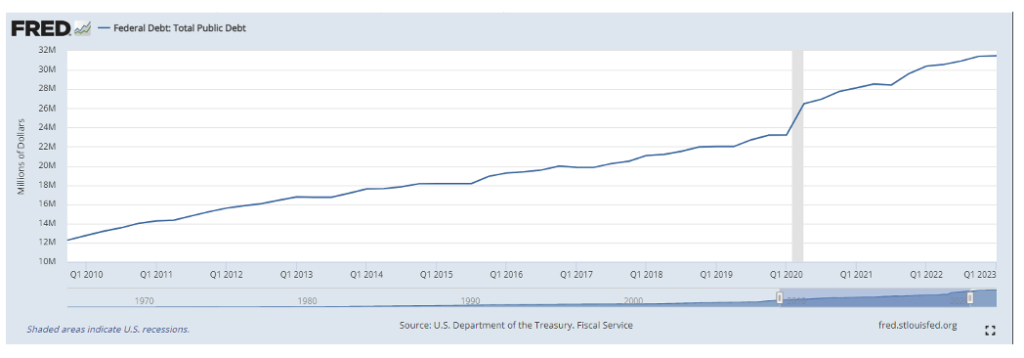

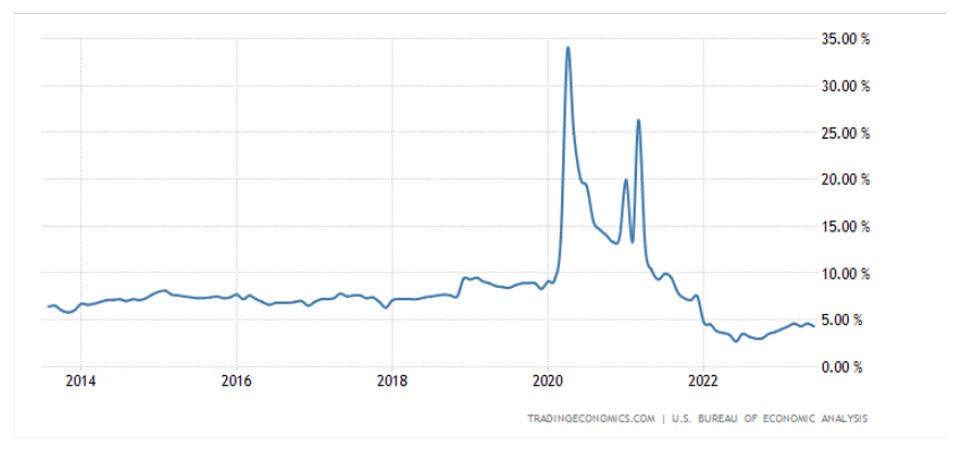

This is their baseline projection assuming no changes to current laws and outlook. Does anyone expect politicians to spend less in the future? Perhaps we can grow our way out? The latter is more likely and historically the solution. Periods of excessive spending are common, especially during wars, recessions, and national emergencies. Unfortunately, we are not in one of those situations now, and the hole is getting deeper by the day. Consider our current state through the first seven months of 2023:

- US Federal revenue is down 10%

- Income tax revenue is down 20%

- Interest on Federal debt is up 34% ($146 billion) from this time last year

- Interest on debt now takes 15.5% of all Federal revenue (and growing)

- US public debt increased from $12.3T to $31.4T since the beginning of 2010, a 255% increase (See chart)

Consumer Behavior and Economic Impact

I recently spoke to my local craft beer store owner, who provided some interesting insights. After record-breaking sales during COVID, that growth hit a brick wall recently, with purchases to take home down 25% YOY. Spending is shifting to his bar as “going out with a friend” trumps at-home consumption. I believe this reflects a squeezed consumer spending dollars more carefully because of tighter budgets due to inflation. A declining savings rate below the long-term average seems to validate this view. However, accumulated savings during the pandemic might be a reason for this as well. Consumer spending drives the economy, and with high prices here to stay, student loan payments starting again, and smaller bank accounts to draw from, we could see a decline.

Global Comparisons and Lessons from Argentina

We can learn a lot from Argentina. Their peso is collapsing again, and restaurants sometimes change prices intraday and even multiple times a day at that. Argentines rush to convert their paychecks to US dollars before losing value. This conversion supports the US dollar in many countries worldwide as limited supply and high demand protect its value. This status should not be taken for granted. A lot of dollars have been printed that still need to be absorbed. The Fitch downgrade is a warning that we should be careful. Hopefully, our leaders heed it.

Photo by Pietro Jeng on Unsplash