Argentinians have spoken, and their message to the government seems clear: they are sick of lurching from inflation crisis to inflation crisis. As is often the case, currency debasement affects the countries that can least borrow or print their way out of it the most. Argentina earned this skepticism with a 200% inflation rate in 2023. By electing Javier Milei, they demonstrate that they are willing to suffer in the short term to achieve stability. Or not.

If he can get his plans through, it may redefine how Western governments spend money. The media and many in positions of power do not like the direction, calling him a “radical libertarian economist” and worse.

Milei’s Economic Agenda

- Privatization of state-owned companies and reduction in subsidies to public transportation.

- Reduction or cancellation of workers’ rights, including maternity leave, and easing dismissal policies.

- Allowing foreign investment in real estate and removing limits on rent increases.

- Suspending all public works.

- Cutting the value of the currency in half (officially).

- Canceling 366 separate rules and laying off 5,000 government employees.

- Scrapping export limits.

Milei’s Ideological Standpoint

Javier covered his economic philosophy in depth during a speech at Davos. Much to their chagrin, he maligned the “Western World” for their embrace of collectivism, which he says will lead to poverty. He points out that exponential growth in world GDP started with the embrace of capitalism after remaining constant (flat) for all of history, with few exceptions until 1800. The period following saw GDP increase by fifteen times and a reduction in poverty by 90%. He states that the modern shift to define capitalism as immoral is inaccurate for this reason and, to the contrary, is the most moral form. He contrasts this with government intervention that would take money under threat of force and redistribute it.

He states that the market economy is the fairest idea because it requires two willing partners and open price discovery. “If transactions are voluntary, the only context in which there can be market failure is if there is coercion, and the only one that can coerce generally is the state, which holds a monopoly on violence.” He points out that in places where “market failure” occurs, it is often the result of government intervention. “Today, states don’t need to directly control the means of production to control every aspect of the lives of individuals. With tools such as printing money, debt, subsidies, controlling the interest rate, price controls, and regulations to correct so-called market failures, they can control the lives and fates of millions of individuals.” He describes this as socialism under the guise of fairness. He assures entrepreneurs that THEY are the heroes for helping create prosperity for the world. He concludes, “Let no one tell you your ambition is immoral. If you make money, it’s because you offer a better product at a better price, thereby contributing to general wellbeing.”

Challenges and Opposition

Argentinian courts have already suspended many of his reforms, and opponents are lining up without a majority for his party in Congress. A positive initial reaction in international markets included a spike in asset prices, narrowing exchange rates, and re-engagement by the International Monetary Fund (IMF), which will buy him some time, but the clock is ticking. Workers who lose their jobs, get lower pension payments, and pay full price for services previously subsidized may start to lose faith. Thus, the speed at which they can get through the initial pain will go far to determine if the reforms are sustainable. If they do not work, or worse, get delayed while everyone fights, it is possible that we may never see the result of this level of shock to a system. For a country that defaulted on its debt nine times since its independence in 1816, failing again would follow its normal path.

Implications and Future Outlook

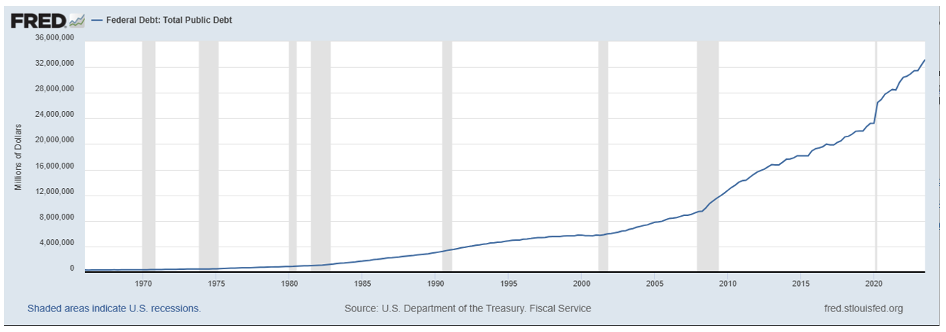

All these proposals fly in the face of Keynesian economic theory that government intervention is key to a stable economy. Namely, that the positive effects of massive Federal spending provide a net benefit that outweighs not spending enough. Pandemic-induced largesse is testing this theory, and the resulting inflation shows that the potential downside is massive. US Federal debt went from $23T to over $34T since just the beginning of 2020 (a 48% increase). Politicians argue this is necessary and point to a currently stable US economy as proof that everything is fine. Perhaps Argentina is just showing us our future. If Milei is successful, he may also show us a path to fix the impending crash.

Related

- Argentine President Milei’s plan to remake the economy with a wrecking ball

- Davos 2024: Special address by Javier Milei, President of Argentina

- What might happen to Argentina after Milei’s mega-decree?

- Milei’s “shock therapy” faces an uphill battle in Argentina

Photo by Agustín Lautaro on Unsplash