As previously written by Covenant Capital Management

Placing undue focus on short term performance is a very slippery slope – it can be hazardous to one’s trading health. A seemingly ‘anomalous’ bad (or good) month may cause a manager to try to avoid (or replicate) his actions in that particular month going forward, when in reality, this ‘anomaly’ may have been nothing more than typical short term randomness. Yet by changing his actions the manager may lose some of his inherent ‘market edge’. It is not only dangerous to managers and the psychology they take into trading, but it is also dangerous to investors.

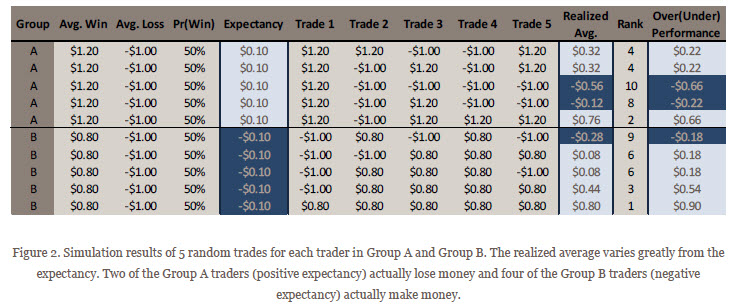

Let’s look at one more example to drive this last point home. Imagine two groups of traders – five in ‘Group A’ and five in ‘Group B’. The five traders in Group A win 50% of their trades, gain $1.20 on winning trades and lose $1.00 on losing trades. The expectancy for each trader in Group A is $0.10. The five traders in Group B also win 50% of their trades, but gain only $0.80 on winning trades and lose $1.00 on losing trades. Thus, the expectancy for each trader in Group B is -$0.10. Clearly over the long run the traders in Group A will earn money while those in Group B will lose money. But let’s look at a simple simulation of a single month in which each trader does five distinct (random) trades.

Figure 2 shows the results of this simulation. The realized averages are in some cases very different from the long term expectation. In fact, two of the traders in Group A actually lose money while four of the traders in Group B actually make money. Now imagine a portfolio manager who keeps traders who made money the previous month and does not use traders who lost money the previous month. After the month shown in Figure 2 the manager would have four traders with negative expectancy included in his portfolio for the next month, and would not include two traders with positive expectancy. In fact, after each month the portfolio manager would almost always be keeping traders who recently outperformed their long term expectancy and removing traders who recently underperformed their long term expectancy. The point is clear – focusing too heavily on short term performance not only carries little information regarding a trader’s skill, but it can be a very dangerous activity for both traders and managers alike. GroupAvg. WinAvg. LossPr(Win)ExpectancyTrade 1Trade 2Trade 3Trade 4Trade 5Realized Avg.

About the author: Scot Billington co-founded Covenant Capital Management, a boutique CTA that has been managing client assets for more than 15 years. He co-developed the CCM trading models and manages the CCM office in Chicago. Founded in 1999, Covenant Capital Management, LLC (CCM) is an alternative asset manager. CCM is registered with the Commodity Futures Trading Commission as a Commodity Trading Advisor (CTA), and manages client assets using global futures markets as an investment vehicle. CCM currently trades in over 40 different markets including equity indexes, fixed income, foreign exchange, agricultural, metals, soft commodities, and energy. CCM offers three primary programs, the Original Program, the Aggressive Program and the Optimal Program. The Aggressive Program is a more leveraged version of the Original Program.