Commentary by Dan Schindler of Schindler Capital

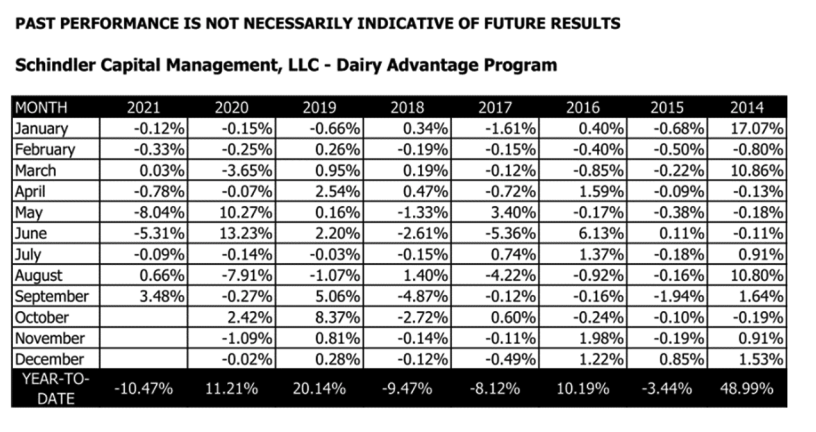

A 3.48% gain during the month of September helped the Dairy Advantage Program improve to -10.47% YTD ROR at the end of Q3, compared to -13.96% at the end of Q2. And October has started with a bang, adding another 3.32% as of 10/14, bringing the YTD ROR to -7.49%.

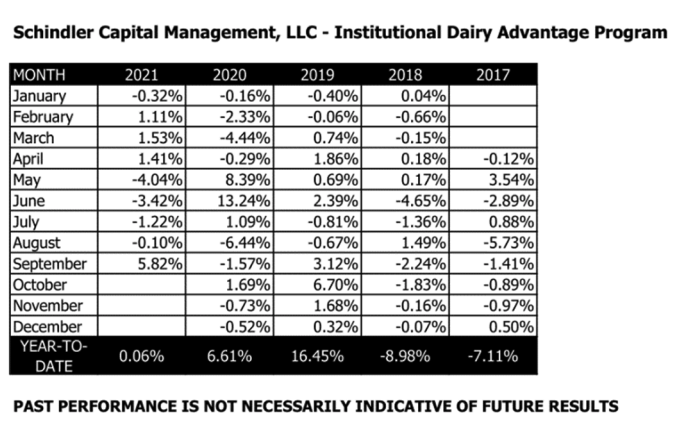

The Institutional Dairy Advantage Program picked up 5.82% in September, to bring the YTD ROR to 0.06% at the end of Q3. Gains in October through 10/14 now have the program up 4.85% YTD.

Things are heating up for dairy, which I believe will continue well into 2022. There are several factors pushing prices higher:

Commodity prices, as an asset class, are going higher. Everything from fuel to food is going up. Economists will argue as to why, but a combination of excessive government stimulus to both businesses and individuals has demand way up (for now). “Inflation” is a word we’re hearing regularly in the news these days, after a decade or more of very little mention.

A labor shortage is putting a damper on everything from transportation of goods to service staff to factory workers. Specifically for dairy, many cheese plants are not able to produce as much cheese as they would like due to lack of workers. Meanwhile, cheese demand is strong.

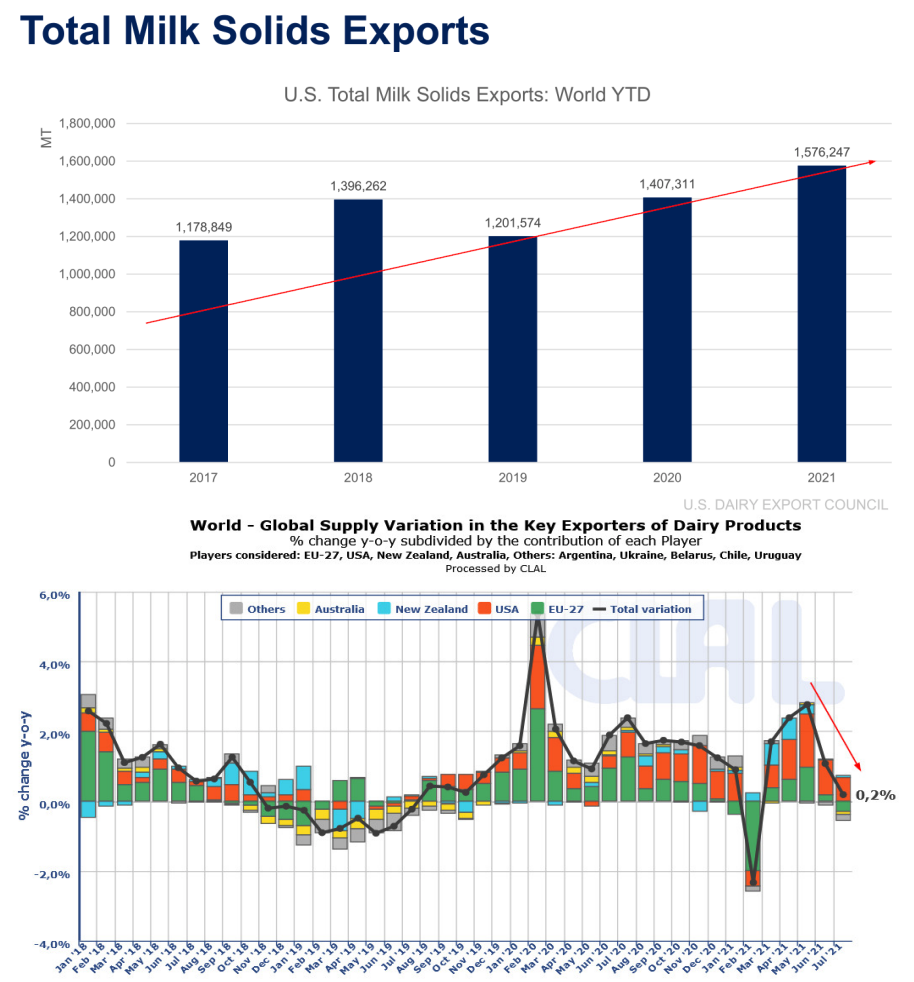

Despite the labor shortage, including the well documented backup at Western ports, international demand has been on fire. Total dairy exports Jan-Aug are up 12% compared to last year, and at a 5-year high (see graph). In August, cheese exports were 18.1% higher than last August. Exports have been particularly strong to Southeast Asia, Mexico, China and Latin America.

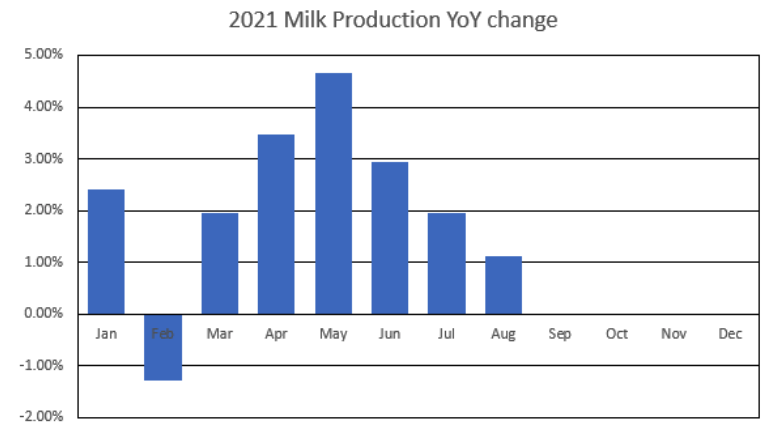

Global milk production is struggling. New Zealand and Australia are off to a slow start in their new production season, while the milk supply is tight in the European Union. Global output had been sharply rising in the early part of 2021, but since May the increases have been shrinking (see graph).

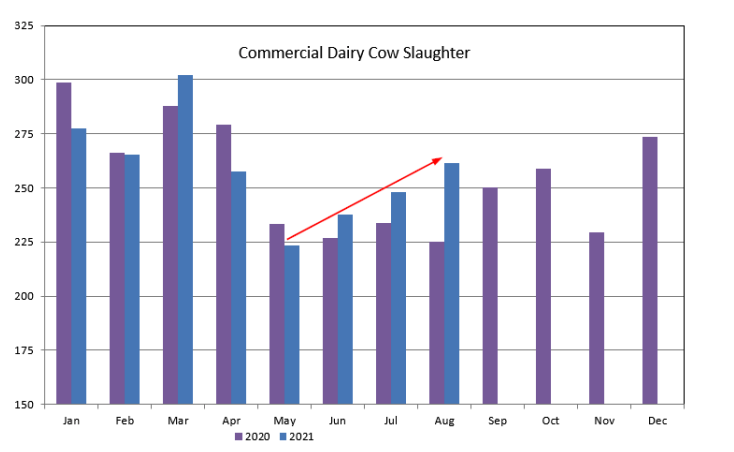

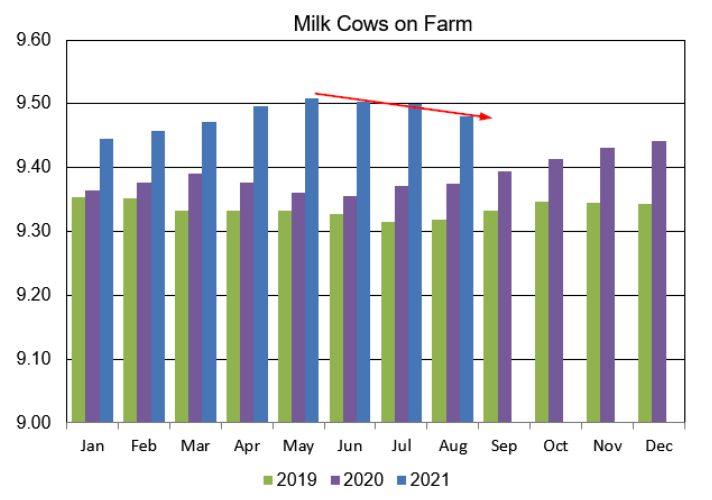

The USA has been the only major dairy production region with sizable growth, but even that appears to be slowing (see graphs). The most recent numbers from USDA show that Year-over-Year growth in milk output is slowing. There are several reasons for this. Feed costs are much higher (corn, soybeans), increasing the cost of production, while beef prices are strong. Dairy operations are therefore getting more aggressive in culling their herds (fewer mouths to feed and needed cash from cull sales). August slaughter numbers were up 16% vs. a year ago. As a result, the total dairy herd in the US, while still very high, is finally starting to decline, shrinking nearly 20,000 head from July to August.

A scarcity of milk powders has the nonfat dry milk price at a 14-year high (see chart above). Dry whey prices have also been strong lately. The higher value of these products pull for available milk, meaning less will be available for cheese production, which in turn drives Class III milk futures, the main product we trade.

The reopening of most schools to in-person learning has school lunch programs back up and running, while resumption of high school, college and professional sports with full stadiums has jump-started pizza sales back to pre-COVID levels.

Currently both programs are in long positions, hoping to take advantage of a further rise in milk prices. Momentum appears to still be with the bulls as the most recent Commitment of Traders report showed a significant reduction in short positions amongst Managed Money traders. I expect volatility to be elevated as price discovery attempts to determine fair value, but continue to think the longer term trend is up. After taking a sizable hit the first half of the year, I’m hopeful we can still come out ahead by year’s end.

Trading futures and commodities involves substantial risk and may not be suitable for all investors. You should carefully consider whether the risks involved in trading in commodities is suitable for you or your organization in light of your financial condition. While the information we gather and present is deemed to be reliable, it is in no way guaranteed. Past performance is not necessarily indicative of future results.

Photo by Stijn te Strake on Unsplash