Commentary by GZC Investment Management

Sell-side analysts and consultants remain extremely constructive, upgrading their oil price targets significantly for mid-year, and investor positioning has resumed in oil futures and options. At the end of Q3, the portfolio was positioned for upside risk as we entered the winter months; however, following further lockdowns due to Omicron and a much warmer than expected winter, sky-high LNG prices were averted. Consequently, we started to position against the bullish market consensus.

Below we summarize why the bullish consensus in oil is at risk:

The idea of a supercycle supported by supply erosion is not a new concept per se. This theme has already largely played out over the past ten years. Analyzing global production over the past decade does not suggest that any single country is at peak production today. Only one region had a very significant increase in capacity: North America.

The supercycle bullish argument for oil prices is backed mainly by the notion that such peculiarity in North America is ending. At the same time, other regions continue to lag behind their historical peaks. In this scenario, demand growth would not be matched by sufficient additional production, as was the case in the 2010s.

Since actual oil resources shortage is not the problem, what matters most is understanding the price level required to activate production growth again. In addition, the perception of price stability (floored prices) is essential for producers to reactivate CAPEX confidently. We think both conditions are met at this stage in the recovery cycle. The oil price level ($85/barrel) is sufficient to deliver very comfortable free cash flows for almost all crude oil production projects worldwide, and the OPEC+ alliance has strengthened the idea that price stability is here to stay.

Therefore, the current environment seems to support maximizing output for the producer group at large. As we have noticed in the past, dismissing that some producers will grab those attractive returns relatively fast is generally not a good bet. For short-cycle production plays, it is likely that private US producers will surprise to the upside, and for longer-term plays, it is likely that large sovereign Middle East producers will be able to ramp up production – starting with the UAE this year.

In the event where oil demand becomes disappointing, a scenario in which those actors end up competing for market share also seems quite possible. In other words, while analysts mainly focus on production disappointment, the oil market could end up being more of a demand story.

On the demand side, China remains the weakest link in the oil market. China’s demand has stalled since 2021 after having been the leading engine of growth for the past 20 years. Is it just a short-term pause before a resumption of growth?

We think this recent phenomenon is likely to be more secular since the Chinese party has firmly decided to rein in overcapacity from independent refiners for ecological reasons and to make space for newer, more efficient, and less polluting state-owned refineries. China also pushes for low carbon processes that support natural gas consumption at the expense of oil products. Furthermore, China is most likely to remain affected by Covid measures that should limit mobility for the rest of 2022 and maybe longer. We continue to think that post the winter Olympics (end of February), Chinese consumption could remain relatively weak.

On the monetary policy front, crude oil should not be unscathed from a Federal Reserve intent on fighting inflation, and we would warn against fighting the Fed. We think this unwise for the following reasons:

We would caution against the notion that oil adjusted for inflation is a good value at these levels. Current oil prices could appear relatively cheap when broad inflation was low as in the past decade. However, when the general level of inflation is rising rapidly, a high and rising oil price would likely trigger a sharp contraction in consumption. Hence, a supply-driven spike is always possible but likely followed by a quick collapse thereafter.

Furthermore, we always look at oil in conjunction with interest rates. Simply said, oil prices increase during expansion and decrease during slowdowns even if, since 2015, oil prices remained stable due to the boom in US shale production.

A number of forward-looking macro variables such as credit impulse or commodity demand growth and consumer sentiment surveys suggest that we are rather late in the economic cycle. In this context, the Fed is likely late in its hiking cycle, and global consumers, having already experienced significant inflation last year, may not have the appetite to digest higher oil prices and/or interest rates.

Over the next few months, the risk-reward in oil favors a defensive allocation. Short-term supply-demand remains quite robust and hardly blinked on Omicron. We think, however, that the risk going forward is for a looser supply-demand balance. Winter Olympics allowing for more virus spreading and restriction in China, US crude oil production increasing faster than earlier estimated, and the late economic cycle should start to weigh on supply-demand balances and prices in the coming weeks.

We keep exposure in Gold as the upside remains good value and an attractive hedge against USD weakness and/or a geopolitical event.

Trading futures involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results.

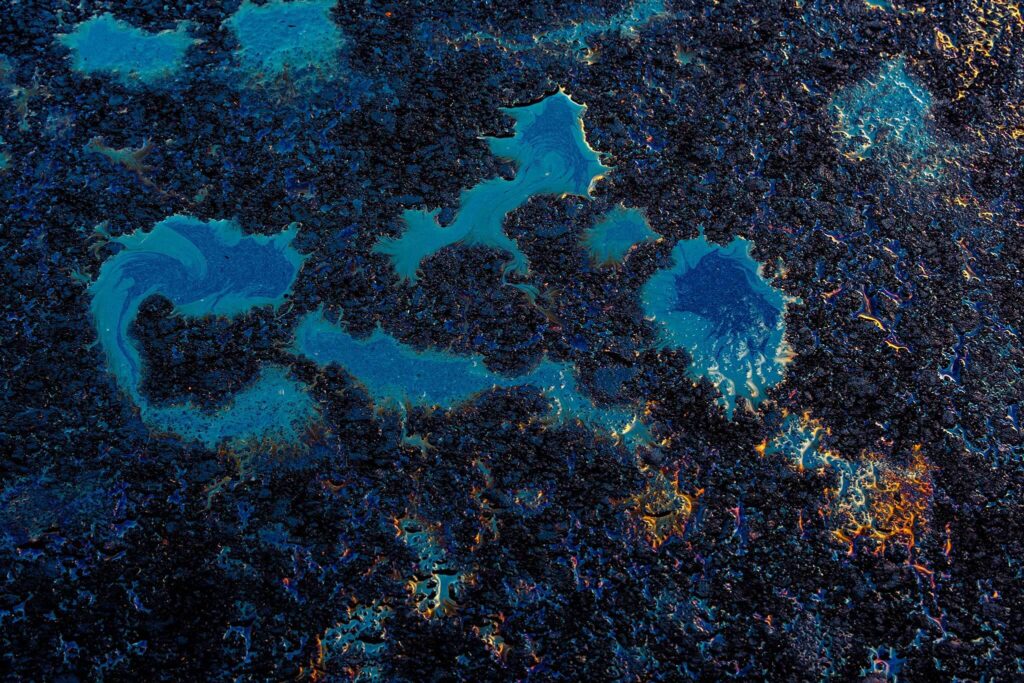

Photo by Roberto Sorin on Unsplash