Commentary provided by David Zelinski of Opus Futures.

In last month’s commentary, we reviewed various data points indicating that inflation is starting to roll over. While inflation readings are sure to remain elevated for several more months, the worst is clearly behind us, and the more pressing concern going forward could be slowing economic demand. Nothing has changed on this front in the past month, so I won’t spend much time reviewing any of it in this month’s commentary. Instead, I want to focus on the direction of the dollar.

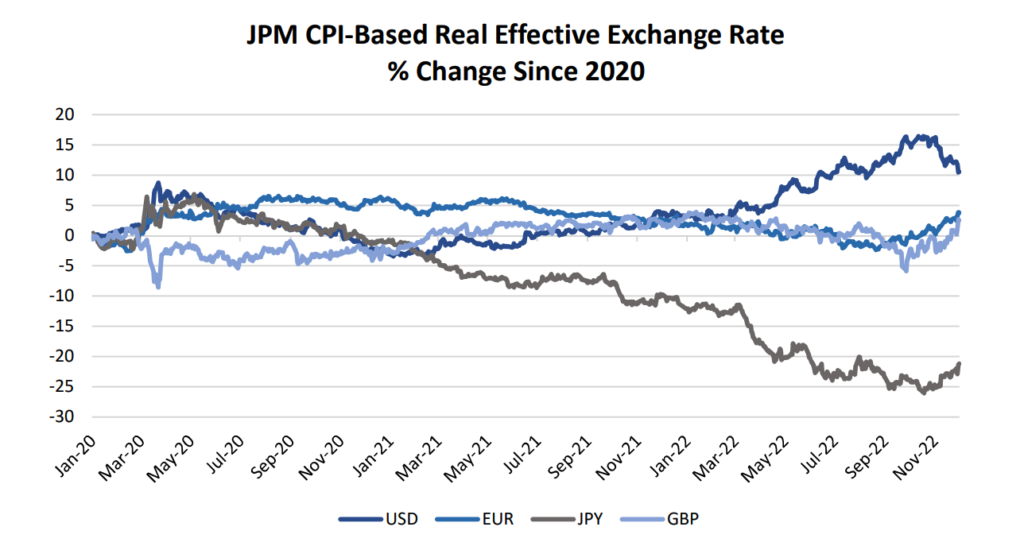

Let’s start with the obvious…the dollar is richly valued vs. other major currencies. At one point just a few weeks ago, the real effective exchange rate for the dollar was up 15% from its 2020 starting point. All other major currencies were weaker; as shown below, the JPY is dramatically weaker. In the past few weeks, we have seen the dollar back off, and the Euro and other currencies gain back some value. I would anticipate this is just the start of the move.

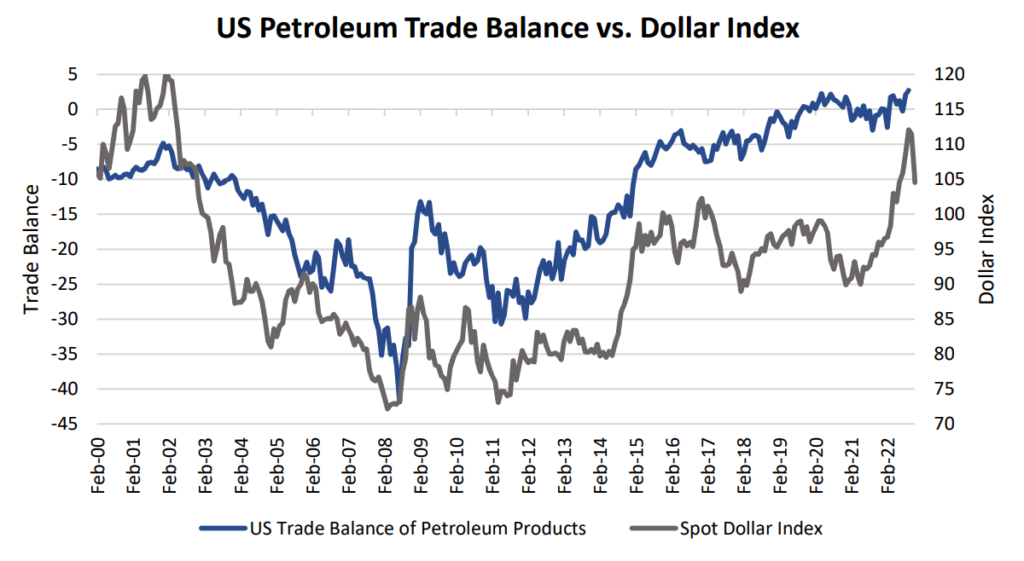

Various factors have fueled the dollar’s strength. Obviously, the Fed’s hawkish shift earlier this year is a big reason. More than that, however, the outperformance of the US economy has been critical to dollar strength. Also, supporting the dollar has been strength in US petroleum product exports. The chart on the following page shows how the dollar tends to strengthen as US exports of petroleum products increase. This makes intuitive sense. As global energy markets are priced in US dollars, when energy prices increase, it means more “demand” for dollars to fund energy imports. It also helps that the US has become an aggressive net exporter.

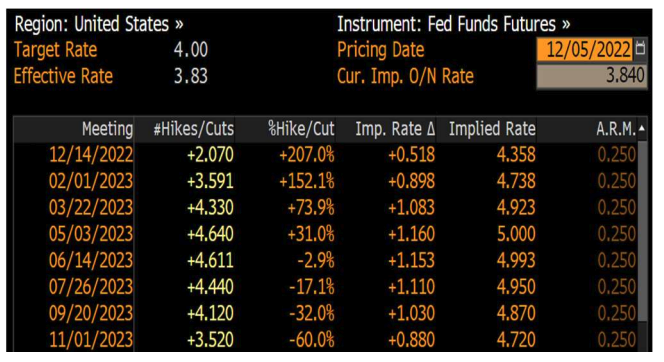

As noted in last month’s commentary, there is strong reason to believe many of these supportive factors are starting to roll over. Last week’s ISM manufacturing index showed the first contraction in US manufacturing since mid-2020. Energy prices have rolled over sharply, and there is an open debate about whether OPEC may need to cut production to match weakening demand. Bank lending standards and overall financial conditions in the US and the global economy are tightening. And last but not least, the Fed has clearly indicated a slower pace of rate hikes ahead and even a potential for a pause in 2023. As upcoming economic data is likely to weaken further, in my opinion, I expect the Fed to amplify its forward guidance for a pause.

A US and global recession seem to be a near-certainty at some point in 2023. This should eventually prompt the Fed to signal rate cuts at some point next year. This shouldn’t be viewed as a controversial statement. The futures market is already pricing in rate cuts as soon as June 2023 (shown above). That seems like a reasonably reasonable projection for now.

The bottom line to my thought process on the dollar right now – as the US slowly moves towards recession, the Fed will back off on hawkish rhetoric. But, eventually, the Fed will be forced to cut rates to support the economy. As a result, US outperformance vs. the rest of the world will lessen, taking away another major support factor.

Global energy demand appears questionable at best right now, and it would seem likely that petroleum product exports might not provide the same support as we’ve seen in the past few years. As a result, the outsized strength in the dollar is likely on borrowed time.

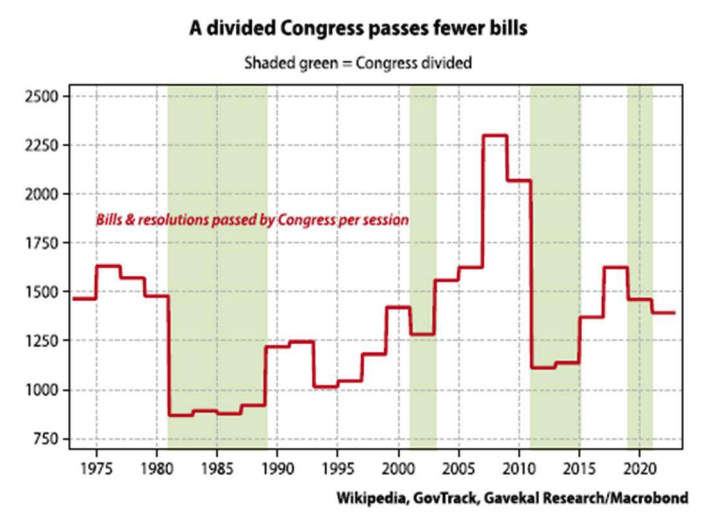

In addition to a pending US recession weighing on the dollar, the likelihood of a recession will likely provide support for the US Treasury market. Treasury yields have rallied sharply due to the strong inflation and Fed rate hikes. However, as we’ve gone over, the inflation readings have likely peaked, and the Fed will likely soon pause rate hikes. Recessions usually tend to be friendly for US Treasuries, and I think we’re headed in that direction through mid-2023. The Fed will be forced to support the market and economy, but thanks to the split Congress following the recent midterms, it is doubtful we’ll see any fiscal support from the US government.

As you can see from the right, a split Congress normally leads to inaction. Additionally, Congress had become accustomed to borrowing money for essentially zero interest in the past few years. That is clearly not the case any longer. Higher interest rates will force the government to tighten the purse strings if only a little. All of that should serve to support the Treasury market in the coming months.

Photo by Christopher Burns on Unsplash