We can always count on the government for a few things, including surprise that their policies led to negative outcomes, fixing those decisions by throwing massive amounts of new money at the problem they created, and finally blaming others for the mess that occurred. Inevitably, “the fix” will cause another issue in the future, but they hope that crisis will happen on somebody else’s watch. Meanwhile, traders attempt to be mind readers to determine the next move for rates. These moves affect everything from borrowing costs to equity valuations to currency fluctuations. Each revision to their thought process creates unnecessary volatility that affects everyone. This month was no exception.

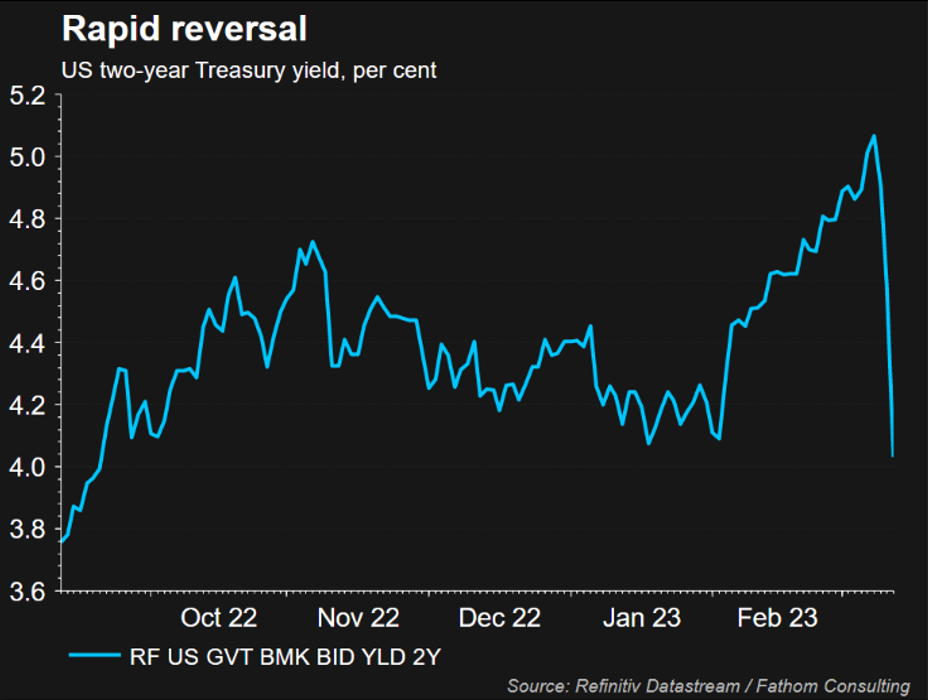

Chair Jerome Powell gave Congress his semiannual monetary policy report on March 8th, 2023. He said, “The data from January on employment, consumer spending, manufacturing production, and inflation have partly reversed the softening trend that we had seen in the data just a month ago.” Further, “inflationary pressures are running higher than expected… and remain well above the FOMC’s longer-run objective of 2 percent.” So, naturally, the consensus for slowing the rate increase cycle went away, and the potential for a 50 basis point increase went up measurably. Two days later, Silicon Valley Bank imploded along with the expectations of significant rate changes going forward.

What followed was the most significant one-day drop in the two-year note yield since October 1987, and the ICE BoFA MOVE Index, which tracks treasury volatility, went over its COVID-era highs and neared levels not seen since the 2008 mortgage crisis. As our friend David Klusendorf from Typhon Capital Management points out to Reuters, “The bulk of market participants have not experienced a rate hike regime from the Fed nor a large bank failure, let alone simultaneously.” The chart does well to show the reaction.

Hedge funds and futures traders were following the Fed lead that told them that higher rates were on the way. The decline hit them particularly hard. A 25-basis point increase followed.

We discussed many similarities between the saving of Bear Stearns while Lehman was allowed to fail in 2008 following a liquidity crisis in our article SVB Banked on Low Rates and Lost Big. Once again, we see the same moral hazard playing out. While SVB was allowed to fail, the FDIC and the Fed pledged to guarantee the deposits for the remaining banks and flooded the system with borrowing facilities for the survivors. The Troubled Asset Relief Program (TARP) provided similar assurances in 2008. That program purchased “toxic assets” from banks up to a $700 billion level. They held some of these assets all the way until 2014, when they sold Ally Financial. The pandemic brought along new challenges and spending levels that were previously unfathomable—six major bills approved up to $5.3 trillion supporting states, families, employers, and more. Previous confidence from programs like TARP convinced many in government that this would not lead to inflation or require higher borrowing costs. Those expectations have changed.

A recent list of events is listed below. In each, one could argue that government policies should have prevented the issue in the first place, directly caused it, or the solution laid the groundwork for later extreme measures.

Event

- October 2008 banking crisis caused in part by sub-prime lending backed by policy.

- May 2010 Flash Crash, blamed on a single 36-year-old British trader working from his parent’s house who placed orders he planned to cancel (spoofing) to manipulate the market. The 36-minute crash wiped a trillion in value off the market. “Spoofing” is now illegal.

- August 2011 US Credit Rating downgrade by Standard and Poor’s following a debt ceiling stand-off. They cited that the Congressional resolution fell short of what was needed to stabilize the government’s medium-term debt dynamics leading to a 5.5% one-day Dow loss. The debt at the time was $14.3 trillion. It is now $31.46 trillion.

- February 2018 Volmageddon, multiple short VIX products implode following a period of excessive calm potentially brought by the so-called “Fed Put,” where investors believed the Fed would step in with accommodative rates if the equity market ever fell too quickly.

- The February 2020 COVID-induced crash precipitated over $5 trillion in new spending, leading to higher inflation.

According to Stanford University Professor Amit Seru, approximately 11% of US banks suffered even larger percentage losses than SVB on their assets due to higher rates. Still, they avoided the deposit flight long enough to earn a Federal backstop. Despite this, customers pulled $120 billion from small and regional banks in just the one week following SVB. $67 billion of that went to the largest banks. The ones once deemed “Too Big to Fail.” At the same time, one might argue that each step taken is necessary and for the greater good; there is no question that each step replaces market forces with government action. We are left to mind-read. Will they save the banks? Will they prop up all businesses or just the biggest?

One thing will always be certain, it won’t be their fault when the crisis happens again, and spending a few trillion will solve the problem. I can guarantee they will not see it coming. They never seem to.

Links

- Fed Chair Powell: Inflation fight will take ‘a significant period of time’

- Semiannual Monetary Policy Report to the Congress

- Small banks lost $120 billion in deposits during SVB tumult

- Analysis: SVB collapse unleashes Treasury volatility, whiplashing investors

Image by Midjourney