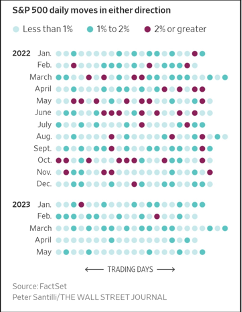

The current headlines include a debt ceiling crisis, inflation issues, rising rates, collapsing home sales, and bank failures piling up at a rate exceeding the 2008 mortgage crisis. With this, the equity market seems nonplussed as it motors along at a pedestrian rate with few days even moving in the 1-2% range, let alone higher. Futures traders depend on movement to trade, so not surprisingly, results have been mixed. The bigger question is, where did the volatility go and why?

The Rise of Computer Trading

It is no surprise that computer trading is becoming a dominant force in the investment world. These systems, which include many commodity trading advisors (CTAs), simply follow price movement or seek to balance exposure across asset classes. To do so, so-called risk parity strategies ramp up exposure based on how much an underlying asset is moving. Therefore, if a market is calm, it gets a higher weighting. As you can see from the chart below, the equity market is as calm as can be. This creates a feedback loop where assets continue to flow, reducing volatility, increasing the weighting, and ultimately pushing upward trends for more systems to allocate. The WSJ reports that quant funds have their highest level of long exposure since December of 2021.

Corporations and Stock Buybacks

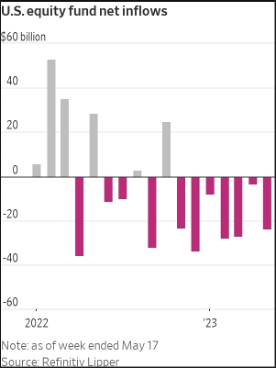

Not to be outdone. Corporations also continue to participate in the process through stock buybacks. Massive liquidity caused by low rates allowed many to accumulate “dry powder,” and they seemed to know what to do with it. Nvidia is the top-performing stock of 2023 and hit a $1 trillion market cap today. It also spent almost $9 billion in repurchases last year and authorized another $15 billion for 2023. Meta is another big performer and approved $40 billion in buybacks this year on top of $91 billion from 2017 to 2022. If I were a corporation designing a program to accumulate equity in my own company, I might create an algorithm that bought every time the stock fell, thus propping up my share price. I might even target thin markets where I could impact the price the most. These types of markets with lower liquidity see bid-ask spreads widen, and news and other events can potentially impact the price disproportionately. Last week, Nvidia jumped over 19% after hours after an already 100% gain for the year. Gap saw a similar jump up 15%, while Ulta Beauty fell 8%. Meanwhile, actual stock funds traded by the public saw outflows for the seventh month in a row.

Option Trading and Delta Hedging

According to Edward Tilly, Chairman of the CBOE exchange, options activity is increasing, particularly for shorter holding periods. Many of these trades begin and end on the same day. Market makers who sell these positions do not take directional bets in most cases. Rather they delta hedge. This means that they may go long the underlying instrument to offset call exposure or go short to offset put exposure. If a large number of option positions are entered on a given day and then exited, we might see an increased volume of stock purchases and then sales once the option unwinds or as the value of the option fades with time decay. Since share purchases offset the option risk, we will see volume in the direction of the option sales. Same-day traders are not long-term investors, so we would not expect them to consider the future value of the shares. Instead, they are playing a mean reversion game where they see a move, sell their option for a gain (or loss), and exit the market. This means rallies get sold, and drops get bought to lock in profits that will otherwise disappear quickly when the option expires.

Lastly, it seems nobody believes the Federal Reserve as rate expectations out on the curve continues to be lower than short-term rates. Investors might think that buying every dip with Fed support makes sense; it has for quite some time. This would contribute to the lack of conviction we are seeing in the markets. Perhaps everyone is waiting for the crisis and the eventual rate drop to “save us” again. The problem with this theory is that events rarely play out the way we expect, and for the first time in over a decade, the “easy money” policies of the Fed really hurt the economy. While they may want to support the market, that backing will be more tepid in the future lest they exacerbate inflation again when consumers already struggle to keep up.

We could see this level of calmness prevail, but when market sentiment gets overloaded to one side, we often see a vacuum occur when it moves the other way. This happens because buyers do not step in to arrest the fall. Systems trading then begins to hit stop losses and get out of their positions when everyone else heads for the exits. Poor breadth in the stock market, with index gains concentrated in just a few names, could be a warning sign. Half the S&P companies are negative for the year, but 60% of the index weight is concentrated in just 50 companies out of the 500. Names like Apple, Nvidia, Microsoft, and Meta make up the majority of gains for the year. Hopefully, they continue to thrive, the banks get fixed, inflation improves, and we avoid debt default. And maybe this time will end differently.

Photo by Dave Hoefler on Unsplash