There is a common belief that active investors set the pace in the market, while passive indices merely follow their lead. As a result, passive indices can operate with lower fees since they abstain from making subjective judgments about individual companies and instead focus on constructing weights and making necessary adjustments. Given the substantial surge in the popularity of passive investment strategies, one may question whether sophisticated investors still drive market pricing or if index investing has taken the lead. This concern is warranted, considering that since 2019, passive funds have surpassed active funds in total assets, and index funds dominate the top ten rankings for the most money in investments. Regardless, all investors must clearly understand the investment vehicles they choose for their portfolios and their construction.

Selecting Companies for an Index

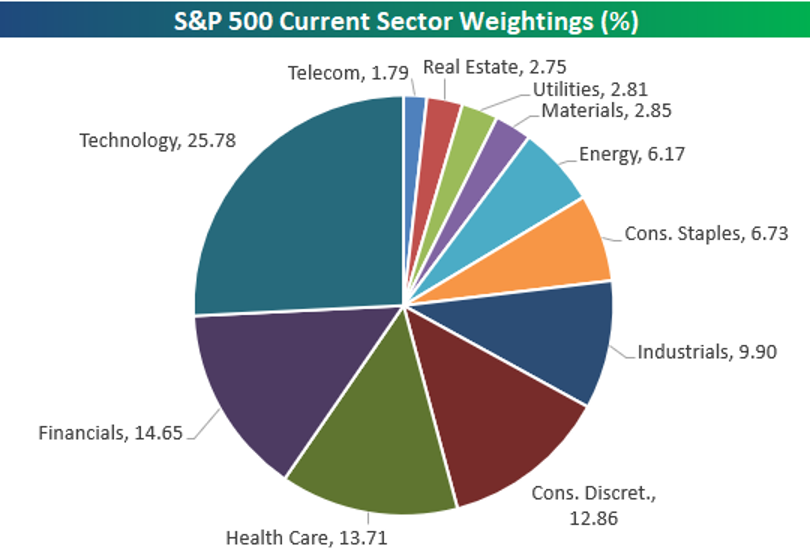

The first step in creating an index is determining which companies get selected. The Nasdaq, Wilshire 5000, and Russell 3000 provide the most straightforward explanation as they include all the companies available in their market or a cross-section of all the equities available in a specific region. The Wilshire 5000, as an example, includes all US headquartered stocks trading on US exchanges, including large cap, small cap, and micro stocks. Many indices simply reflect a market, such as energy or technology, and include stocks that fall into those classification areas. Indices such as the S&P and the Dow Jones Industrial Average (DJIA) use a selection committee to choose companies. In the case of the S&P, they must achieve specific characteristics. Among these traits include a minimum number of shares available to trade, a specific market capitalization, broad industry representation, and financial viability. A snapshot of the S&P is shown below, which can and does change over time. The Dow Jones selects thirty top stocks reflecting various sectors of the economy, but the criteria are not as rules-based as the S&P. Rather, the committee has more leeway in determining members. This discretion could impact allocations dramatically.

Weighting Companies in an Index

The second step in setting up an index is to determine the weighting of the various companies in the index. Most major indices, including the S&P, Nasdaq, DAX, and the FTSE 100, use market capitalization (price times shares) to determine the amount to be allocated to each of the companies. The current weight of various equity shares for the S&P is below. You will notice that the top 10 holdings take up almost 30% of the total. Therefore, despite the broad diversification offered, much of the risk and success (or peril) is concentrated in a smaller number of companies. The performance of technology this year is contributing to the returns of the index, with seven of the top ten companies falling into this category.

Top 10 Holdings

| AAPL | Apple Inc | 7.24% |

| MSFT | Microsoft Corp | 6.56% |

| AMZN | Amazon.com Inc | 2.70% |

| NVDA | NVIDIA Corp | 1.96% |

| GOOGL | Alphabet Inc | 1.83% |

| BRK/B | Berkshire Hathaway Inc | 1.70% |

| GOOG | Alphabet Inc | 1.61% |

| META | Meta Platforms Inc | 1.53% |

| XOM | Exxon Mobil Corp | 1.40% |

| UNH | UnitedHealth Group Inc | 1.32% |

Conversely, Japan’s DJIA and the Nikkei index use price weighting for their allocation amounts. Therefore, if only two stocks were trading, one at $100 and another at $200, the first would get a 1/3 weight and the second a 2/3 weighting. While the actual methodology is a bit more complex, this demonstrates that companies in these indices need to weigh the benefits of splitting their shares or issuing dividends. By doing so, they will reduce their share price and ultimately erode their influence and inflows from the index. That being said, if it makes their shares more attractive to a broader audience, their market capitulation might increase, adding to the weight in the S&P or Nasdaq indices.

Rebalancing Rules

The third step in creating an index is to create the rebalancing rules. This is one area where price weighting is helpful, as the DJIA and Nikkei rarely need to adjust weights unless a company chooses to affect their price through corporate action. If a split or similar change occurs, the board for each of these index companies might decide a change is warranted. Market capitalization is another story as the value of the underlying shares, and therefore their component organizations, might substantially increase or decrease in value. NVIDIA is an excellent example of this phenomenon, as they are up over 170% year to date. Meta is also up 115% since January 1st. Naturally, if target sector weights are maintained, growth of that nature needs to be rebalanced to reflect the new reality, and both will see an increase in their allocations. In the case of the S&P, this change occurs each quarter. The Nasdaq is adjusted annually. Expect more interest in the names above come rebalancing time when all the ETFs will need to add shares for 2024.

Diversification across many stocks is a valuable idea. However, the growth of index investing can make it difficult to “find winners” as a market decline or rally can hit more broadly these days. This makes portfolio weights more critical than ever. Choosing buckets of asset classes that perform differently in various market conditions is one key to evening out returns over long periods and increasing risk-adjusted returns. Knowing what you are buying is the first step in deciding what to add next.

Image by midjourney