Category: Uncategorized

AG Capital – Volatility Expansions and Contractions

We had an interesting conversation with an extremely sophisticated allocator recently. He asked, given that you have had a good run with a long gold position this year, with large open profits, how much will you lose if it reverses hard and you are stopped out at lower levels?”. It’s a question that gets to the heart of trading, and ultimately deals with the difference between what’s known as open equity and closed equity.

Warrington Asset Management – Looking back on July

The S&P 500 continued to climb steadily up to the last trading day of the month even though market participants knew that day could bring volatility, as the U.S. Federal Reserve (the “Fed”) was scheduled to announce their latest monetary policy update on July 31st. Speculation about their intentions to lower interest rates for the first time in ten years had been a market focus for months. Fed Funds futures pricing is often used to estimate the probability of pending Fed interest rate changes, and had signaled the most likely decrease to be between 25 and 50 basis points. However, when Charmain Powell announced the 25 basis point cut he also implied it might be a “one and done” scenario rather than a prolonged rate cutting cycle favored by market participants, causing an immediate decline in stock prices. The selling in the S&P was strong, sending the Index to its largest intraday decline since early May. In fact, prior to that drop, the S&P had not had a 1% daily gain or loss in the previous 36 consecutive trading days, the longest streak since early October 2018.

Sortino: A Sharper Ratio

Many traders and investment managers have the desire to measure and compare CTA managers and / or trading systems. Risk-adjusted returns are one of the most important measures to consider since, given the inherent / free leverage of the futures markets, more return can always be earned by taking more risk. The most common risk-adjusted […]

Changing the dynamics of enhanced cash – Switch from credit to alternative risk premia

Investors are always looking for ways to enhance cash returns – higher yield with liquidity and limited principal risk. The timing for using different enhanced cash techniques changes with market conditions. Widening the choice set through investing in alternative risk premia may be a way to meet enhanced cash goals without significantly increasing risk.

Mike Lombardi, football coaching and investing

I am not a football fanatic, but I picked up this book on a recommendation and was amazed by Lombardi’s insights on leadership and management. Mike Lombardi is long-time football executive and media analyst. The book focuses on Bill Belichick and the New England Patriots, but his conclusions could apply to any money management firm. A good money management firm is successful because it acts like a well-disciplined organization with a common purpose. That is no different than a competitively run sports organization. Lombardi finishes his book with five key recommendations for firm success that are worth presenting in bold.

“The Emeril Lagasse Theory” – Practical knowledge and culture is not often transferable

After hundreds of discussions with hedge fund managers, I am still surprised that there is a fear of revealing investment processes under the assumption that someone will steal their ideas and intellectual capital. There are few investment styles that are truly unique and special. What is special is still strategy execution – the practical process of delivering returns. Skill is with the decision-making execution of information and strategy.

Time-varying correlation – Diversification benefits are dynamic

What is the correlation between two assets? The correlation is critical because it is the driver for any diversification decision. The better question is, “What is the correlation now, and what can it be in the future?”. Correlations are often time varying and regime specific. In bad times, correlations rise, so the diversification expected is not present when you need it. This phenomenon requires more thinking about tail risks and how to best address them.

Diverse ARP return pattern consistent with macro environment

A comparison of ARPs across asset classes and styles from the HFR indices shows consistency with the macro environment. We equalized the HFR ARP indices to a ten percent volatility for ease of discussion. April monthly returns are in grey while year to date returns are in red. The returns were generally lower than the market exposures, which were expected. The HFR numbers are averages and have shown significant dispersion. The low correlation across ARPs will create opportunities to improve the return to risk ratios through portfolio blending.

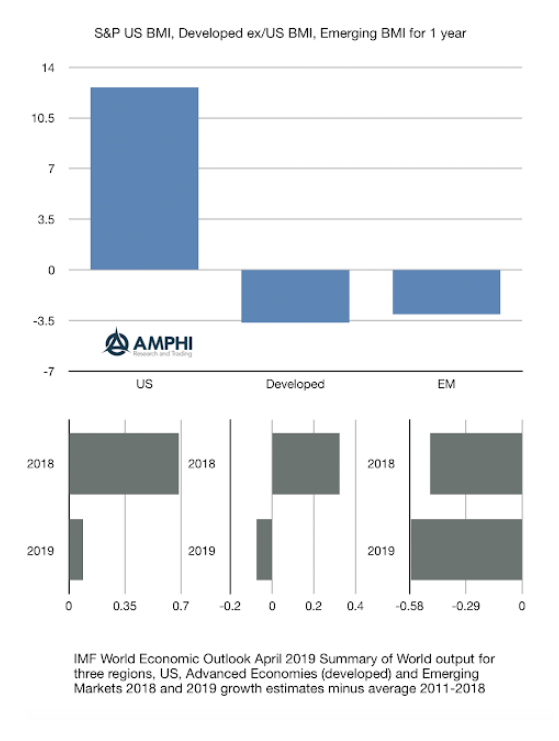

Global Macro Rationality and Equity Returns – Consistent With Growth Story

While some question the rationality of markets over the last few quarters, we believe equity markets are global macro consistent. This consistency can be seen in the return pattern for the US, developed markets, and emerging markets. As a simple surprise number, looked at the difference between the average growth rates for three macro categories from the IMF WEO from 2011-2018 against 2018 growth and expected 2019 growth.

Credit risk – Profitability more important than leverage

There should be concerns about the amount of corporate leverage in the economy, but if there is no catalyst credit event, current risk is limited. We are not downplaying potential credit risk, but there needs to be focus on the right issues that will drive corporate bonds spreads higher.

How many animals should be in the factor zoo?

Investment factor growth has exploded to the point that are now close to 400 identified through research published leading finance journals. This factor explosion has been called the factor zoo and it is overcrowded. A careful review of the statistical testing procedures will tell us that it is highly unlikely that all of these identified factors will be true. Many are statistically significant only by chance given multiple testing problems. Additionally, if we impose transaction costs on these factors, their profitability will be diminished and in many cases not useful.

IASG Fund Services LLC (“IASG-FS”) Launches to Promote a Highly Disruptive Fund Administration Software to CTAs, CPOs and Other Alternative Managers

CHICAGO, APRIL 24, 2019 – Institutional Advisory Services Group (“IASG”), an independent advisory firm specializing in alternative investments for institutional and high net worth investors, is pleased to announce the formation of a new company: IASG – Fund Services or “IASG-FS”. Incorporated in 2019, IASG-FS will offer fund services to investment managers. This new company, […]

Factor Investing – Not as easy as many expect

Investors can form exaggerated expectations on what can be the potential return performance from factors. Some have described a “zoo” of factors. There are now hundreds of factors that have been analyzed and reported in the academic literature. Nevertheless, many have been hard to replicate, show performance return declines after being researched, and have failed when tested out of sample under realistic market conditions. These poor results may be from data mining, not accounting for transaction costs, data mining, poor design, and potential crowding. There are successful factors that have stood the test of time, yet even their performance has been time varying and may be less successful factor after accounting for all costs. Don’t be disappointed if actual returns are less than what is reported in academic studies.