As previously written by Covenant Capital Management and printed in FuturesMag.com

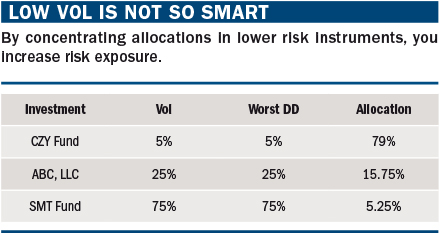

When investors think of risk, they usually associate it with volatility. This probably stems from Nobel Prize-winning economist Harry Markowitz’s use of volatility in the 1950s and fellow Nobel Prize winner William Sharpe’s use of volatility in creating his self-named method of risk adjusting returns. The lower the volatility of a given investment theoretically indicates that investment carries less risk. Risk, however, could be viewed from a different angle. The impact of a high volatility investment on a portfolio can be mitigated by the allocation size given to that product. By normalizing for volatility, theoretically, high and low volatility investments can have an equal impact on a portfolio’s total return. This leads us to a different way to view risk. Risk is the difference between the anticipated worst loss and the realized worst loss. When viewed through this lens, lower volatility equals higher risk (see “Low vol is not so smart,” below).

Inside the numbers

While its low volatility seems safe, CZY Fund has almost all the risk in this portfolio. First, its allocation is quite large because of its low volatility. Second, its potential for a downside surprise (realized loss > anticipated loss) is also quite large. The bulk of the money has been given to the investment with the greatest potential of portfolio devastation. Look at SMT Fund. Even if SMT went bankrupt, that loss would only be 1.33 times the worst anticipated loss.

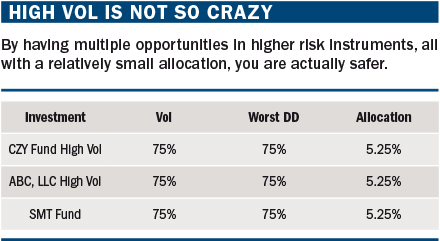

The portfolio would feel the same pain if CZY fund lost 6.67%. If CZY fund lost 15%, that pain exceeds the worst possible performance of SMT. The banking system did not go bust in 2008 because mortgages lost 80% of their value. The banking system went bust because mortgages lost 80% of their value, AND the banks thought mortgages could only lose 5% of their value. If SMT above loses 80% of its value, the portfolio does not like it, but it is far from catastrophic. Here’s the other kicker. The portfolio pays CZY fund 15 times the fees of SMT for the same exposure and 100 times the catastrophic risk. Quite the bargain. This portfolio would be much better served by using a higher volatility vehicle for the exposure procured from CZY fund and ABC (see “High vol is not so crazy,” below).

Why it works

This allocation has done several things for the portfolio. Most importantly, the exposure to the asset classes and potential upside if these investments has been maintained or amplified depending on the allocation of profits. This allocation only uses 15.75% of the capital. Downsize surprises have virtually been eliminated. The maximum loss has been capped at 15.75%. Fees have been cut by 84.25%. All the things you look for in a diversified portfolio are accounted for:

- Increased liquidity, check.

- Increased upside; check.

- Maintain exposures; check.

- Limit downside; check.

- Eliminate catastrophic losses; check.

All of this for an 84% discounted price. Seeking rather than avoiding volatility can lead to a lower cost, more liquid portfolio with a reduced level of risk and an increased potential of returns.

About the author: Scot Billington co-founded Covenant Capital Management, a boutique CTA that has been managing client assets for more than 15 years. He co-developed the CCM trading models and manages the CCM office in Chicago. Founded in 1999, Covenant Capital Management, LLC (CCM) is an alternative asset manager. CCM is registered with the Commodity Futures Trading Commission as a Commodity Trading Advisor (CTA), and manages client assets using global futures markets as an investment vehicle. CCM currently trades in over 40 different markets including equity indexes, fixed income, foreign exchange, agricultural, metals, soft commodities, and energy. CCM offers three primary programs, the Original Program, the Aggressive Program, and the Optimal Program. The Aggressive Program is a more leveraged version of the Original Program.