“Bracketology”, a term coined by ESPN, is the study of the annual NCAA college basketball tournament. Interestingly the art or science of filling out an NCAA tournament bracket also provides insight into how investors select investment assets. Before explaining, we present you with a question: When filling out an NCAA bracket do you A) start by picking the expected national champion and work backward or B) analyze each matchup, and pick winners starting at the earliest rounds, working toward the championship game?

In A, one has a pre-determined idea for which team is the best in the country and disregards the path that team must take to become champions.

Those using B’s methodology look at each game and consider the participants, compare their respective records, their strengths of schedule, demonstrated strengths and weaknesses, record against common opponents and even how travel and geography could affect performance. In a methodical, rigorous evaluation, the result is a conclusion about which team can win 6 consecutive games and become the national champion.

Outcome vs Process

Outcome-based investors start with an expected outcome, typically based on prior results, and select assets accordingly. How many times do we hear the gurus of Wall Street preach that stocks return 7% on average and therefore a well-diversified portfolio should expect the same thing this year? Many investors take the bait and few question the rather simple approach that drives the expected outcome and ultimately the investment selection process.

Process-based investing, on the other hand, is a tactic to better determine how assets should perform. The method may be based on macroeconomic expectations, technical analysis or a bottom-up assessment of individual companies to name a few. Process investors do not just assume that yesterday’s winners will be tomorrow’s winners nor do they diversify just for the sake of diversification. They create a procedure to help them forecast which assets are likely to provide the best risk/reward prospects and deploy capital opportunistically.

“The past is no guarantee of future results” is a common investment disclaimer. However, it is this same outcome-based methodology that many investment managers use to allocate their assets. Process driven investors employ thoughtful analysis to determine what investments should perform the best. Potential outcomes are the ending point of their analysis not the starting point of their work.

A or B?

So, why would people use a less rigorous process in investing than the one they use in filling out their NCAA tournament brackets?

Starting at the final game and selecting a national champion, is similar to identifying a return goal of, for example, 10%. How that goal is achieved is subordinated to the idea that one will achieve it. In such an outcome based approach, decision making is predicated on an expected result.

Considering each of the 67 possible matchups in the NCAA tournament to ultimately determine the winner applies a process-oriented approach. Each decision is based on the evaluation of comparative strengths and weaknesses between teams. The expected outcome is a result of the analysis of factors required to achieve the outcome.

Summary

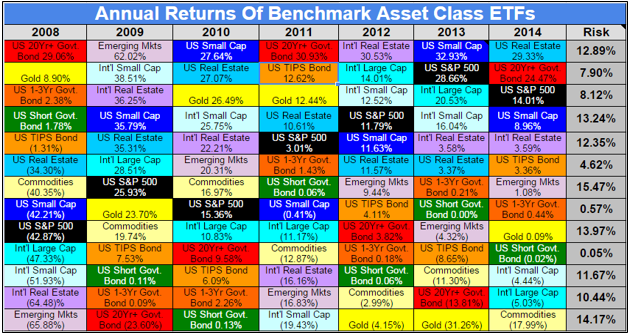

Very few filling out brackets this year will pick Duke solely because they won the tournament last year. Many investors, however, will select investments based on what performed well last year. The following table (courtesy invest-assist.blogspot.com and Koch Capital) is a great reminder that building a portfolio based on last year’s performance is a surefire way to ensure you are not making the most out of your portfolio.

Winning or losing a basketball pool has benefits like bragging rights and potentially winning some money. Managing a client’s investments deserves much more thoughtfulness. Those who apply a well thought out process-oriented approach provide their clients a much more rigorous, durable and time-tested method to consistent performance.