In recent years, sustainability has moved from the financial sector’s periphery to the mainstream, and the industry has increasingly embraced a transition to a more sustainable and inclusive economic model. This, in turn, has made ESG investing is a hot topic right now. Environmental, social, and governance programs look at not only financial factors for investing but also non-financial criteria. Companies increasingly report on these initiatives, which include climate impact, diversity, employee engagement, and executive compensation, amongst other things. One asset class that has largely been absent in the space is the futures category.

On its face, this makes sense as trading these contracts is a zero-sum game. Each long has a corresponding short. However, the futures industry can play a crucial role in sustainable investing by supporting carbon emission contracts and lower-carbon energy markets. The CME and ICE have extensive derivatives offerings linked to defined carbon and renewable energy markets that already exist. While trading in these derivatives does not directly reduce emissions, it does help the market function by providing users of the underlying market with more effective risk hedging mechanisms and price signals that help the market function overall.

Carlos Arcila-Barrera, CFA at Sigma Advanced Capital Management, believes his firm will be the one to bridge the gap and give futures investors a way to make money while contributing to sustainable impact. Given the growth of ESG investing, one might cynically think that it is a marketing strategy but doing it right is no simple task.

Operating between Chicago, where operations and much of the support for trading occurs, and Colombia, where he is a university professor and research associate at the Center for Sustainable Finance, Sigma Advanced has developed a business model in order to align Sigma’s purpose with its impact to sustainability. Sigma began calculating their carbon footprint two years ago and decided to become a carbon-neutral alternative investment firm by reducing airfare, printing, and improving energy efficiency while supporting and purchasing voluntary carbon offsets on certified Nature-based projects in areas such as Brazil and Colombia. But what exactly is the carbon market, and how does it contribute to climate change mitigation and transition?

Compulsory and Voluntary Carbon markets as an investment opportunity

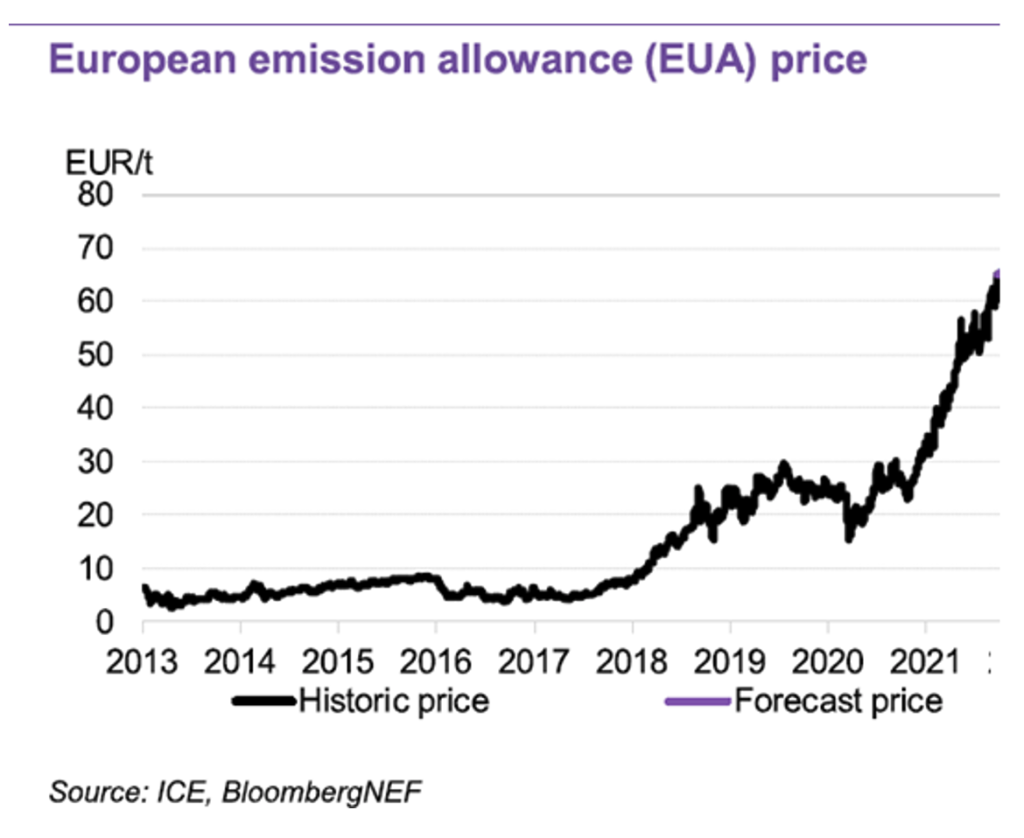

The compulsory market is based on the Emission Trading Schemes (ETS, also known as Cap-and-Trade) to reduce greenhouse gas emissions. An ETS structure sets a cap on emissions and assigns specific emission allowances to participants. Participants who are more efficient at reducing emissions can sell their allowances to participants who are less efficient. This achieves the overall emissions reduction target (the “cap”) while allowing market participants to determine the most cost-effective method. In Europe, 20 countries participate in this system, in which allowances are sold in an auction and the CAP is reduced year by year, thereby limiting supply. Carbon allowances (EUA) in Europe have increased by 80% in the last year alone, and they now trade for more than 60 euros. As the cost of emitting increases, renewables become a better option, and a price of 100 to 120 euros by 2030 will be required for a climate transition. China, New Zealand, South Korea, Colombia, and Chile are newer markets to the strategy but moving towards net-zero goals themselves. California and New Jersey in the US both have their own cap and trade models as well.

The Voluntary Carbon Market (VCM) on the other hand, allows companies to fund mitigation actions outside of their value chain. The VCM also provides a potentially valuable private financing route to help protect and enhance important natural habitats and carbon stores, such as forests, as well as to support the development of new low-carbon technologies. The demand for these carbon credits is expected to increase significantly, and prices, which are currently trading around 6 – 8 USD, are expected to rise to 15-30 USD in the coming years. To provide a standard price on this voluntary market, the CME has launched futures contracts for the CBL Global and Natured Based carbon offset futures.

The Sigma Advanced Carbon Neutral Program trades these markets in the futures contracts in both EUA allowances and CME CBL Voluntary Offset contracts. This increases the market’s liquidity and stability, allowing producers to get price discovery and make long-term decisions for their businesses while also capitalizing on opportunities created by long bias and market inefficiencies.

While Sustainable investing makes everyone feel good, without profits it will not be sustainable. Carlos is well aware of this, but with performance comes opportunities. The key to the Sigma Advanced Sustainability strategy is to re-purpose a portion of the management and incentive fees to drive positive change in the world. This includes regularly supporting and purchasing carbon credits in environmental and social certified projects in rural areas. This leads to financing for their schools and hospitals to further enhance the quality of life in the region. This is a way of aligning all interests; more assets and higher returns will result in greater impact.

On September 1, 2021, Sigma Advanced became one of 4000 signatories of the United Nations-Supported Principles for Responsible Investment (PRI) representing $100 trillion in assets. “By becoming a signatory to the PRI, we reaffirmed our firm’s long-term commitment to being a positive force in the alternative asset management industry,” said Carlos Arcila-Barrera. Time will tell if Sigma Advanced is the first of many to go down the ESG route in the futures industry but results indicate there is an audience thus far as attention is growing for his Carbon Neutral Alpha Program which is planning to open officially for a January 2022 launch. A Sharpe ratio greater than one and a Sortino ratio greater than three in a growing and unique asset class such as carbon are additional motivators for investors looking to use their success to help others achieve theirs.

If you would like to learn more about Sigma Advanced Capital Management and ESG investing please reach out to Greg Taunt at +1 847-877-0887.

Photo by Flash Dantz on Unsplash