Commentary by John Knott of Numberline Capital Partners.

The Numberline Macro Risk Program was down 4.36% net of all fees for November and is up 19.37% year to date. Additionally, the program has returned 14.85% over the previous 12 months. These numbers are compiled by Turnkey Trading Partners.

We left off last month worried about the flattening yield curve, the strength in the dollar, and just the overall volatility in rates. Our vol indicator was running very hot, but equities were ignoring everything. We finally saw equities catch up and start to price in some risk. From the highs, the S&P 500 sold off 5.2%, the Nasdaq 7.3%, and the Russell 2k 13.2%. We were unfortunate enough to be exposed to the weakest of the 3, the small-cap index, which at the time was breaking out to the upside after a nine-month base. News of the Omicron variant hit, and as usual, the small caps, the cyclicals, and all the economically sensitive stocks got hit the most immediately, overruling that breakout in the small-cap sector.

The other issue we had to contend with this month is before the selloff, most of the economically sensitive hedges already got hit hard. Emerging market currencies were well off their highs, oil had already been weak, and copper had a brutal selloff months before. Therefore, there was not as much meat on the bone to offset index losses in the short term. The portfolio is pretty well-positioned now for 2022. We will break down the usual models below and summarize risk going forward.

Economic Outlook

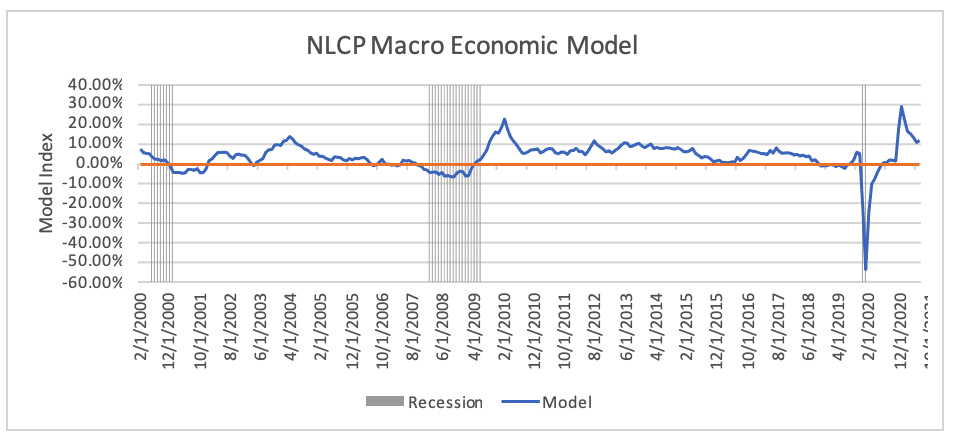

For the first time in 6 months, the NLCP Macro-Economic Model saw an increase reading from 11.04% to 12.05% this month. The average reading over the last 20 years is about 4%. The economic data continues to be very strong. Most notably, the ISM Manufacturing and the ISM Services data. Our consumer spending data is also very hot, running at 7.18% year over year. There is nothing that worrisome in the data, with the exception of consumer sentiment, which is being weighed down by various Covid headlines that keep refreshing daily.

Volatility Outlook

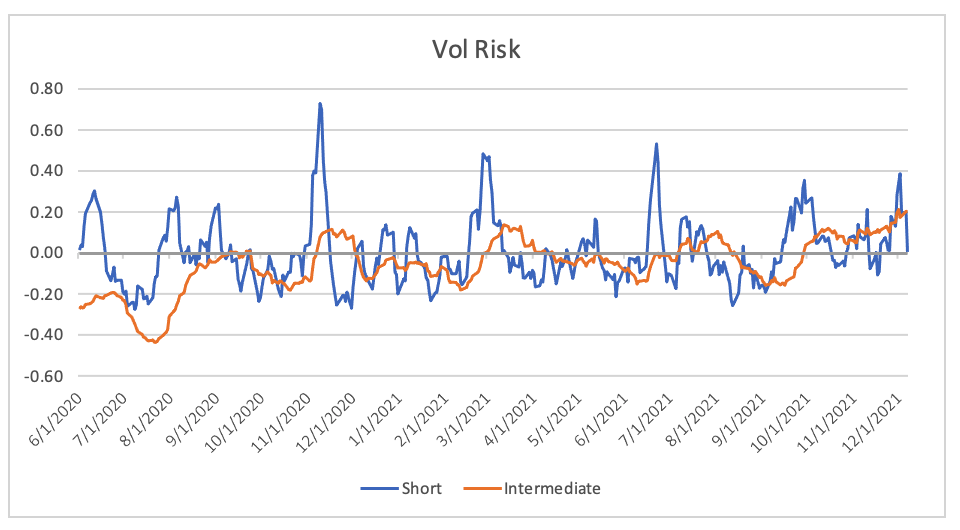

Last month we warned about the elevated vol levels in the rate and FX market. And that volatility continued this month. Equities finally responded with a spike in the VIX. The short-term vol has been jumpy, currently settling back down. But the longer-term vol is still elevated. While the past few days have seen a sharp rise in risk assets off the lows, we’re probably not out of the woods. Interest rates continue to make very sharp moves up and down, and the yield curve is trading like a Cathie Wood stock. That is not a healthy sign. It’s possible we settle down into the end of the year as trading activity gets quiet, but things could get volatile again once we flip the calendar to 2022.

So, what is driving this volatility; omicron or the Fed? We think it’s probably more the Fed. We have a Fed meeting coming up where they will be able to offer further guidance on the taper timeline and future rate hikes. It’s possible they weasel out of their previous taper comments by inserting that they will be “data dependent”. This gives them a lot of leeway to adjust the taper without admitting a policy mistake. Also, in about another week to 10 days, we should have more conclusive data on the omicron variant and the efficacy of the current vaccines and anti-virals on this particular variant. This is tricky and one of the reasons why vol is starting to ramp up. If the omicron news is good, risk assets will respond in kind and this puts pressure on the Fed to hold to the faster taper. If the omicron news is concerning, the Fed will likely slow the pace of the taper.

Because the market has not completely worked out exactly what it wants, we are seeing a lot of uncertainty and very jumpy price action in both the rates market and stocks. We suspect the better path for risk assets is good omicron news and a data-dependent Fed that speeds up the taper and waits for confirmation on the jobs front to start raising rates. Raising rates with a strong economic backdrop is good for risk assets. Raising rates because the Fed is behind the curve is not.

Technical Outlook

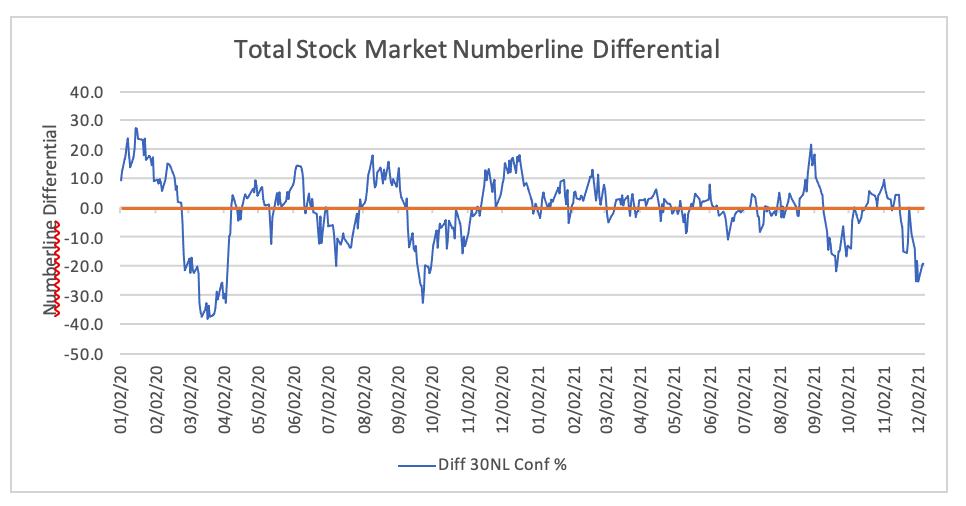

When we left off last month, the technical outlook was looking promising. That quickly changed after the Fed meeting. The only good news from this reading is that the data is really bad. Meaning stocks really got washed out. Individual equity names dropped a lot more than the overall indices did. A lot of the froth got washed out and a lot of the optimism did as well. That is not to say this backdrop is bullish, there was a lot of technical damage that was done. At best, equities need time to rebuild. At worst, this bounce will fade and we will have to probe the lows again and maybe take them out.

Summary

The final weeks of 2021 will likely calm down. But we expect 2022 to be much more volatile. It’s looking more and more that we are comfortably in the middle of the mid-cycle part of the business cycle. This part of the cycle should see improving economic data, rising rates, and more volatility. This should favor small-cap stocks and more cyclical names. We are moving through the business cycle much faster than normal though. The volatility in 2022 will work much more in our favor. When everything is going straight up, it makes hedging much more difficult. Two-way price action is much more in our wheelhouse. We wish everyone a happy holiday season and look forward to a profitable 2022.

Past performance is not necessarily indicative of future results.

Photo by Patrick Assalé on Unsplash