Commentary provided by David Zelinski of Opus Futures.

In last month’s commentary, we went through a few reasons why grain and oilseed prices were likely to come under some pressure. We pointed out the low river water levels, which were restricting export capacity and the usual seasonal harvest pressure on prices. The river situation has played out exactly as expected so far. Boat loadings at the Gulf have been slower than normal for this time of year, and that is largely due to the low water levels. This, combined with seasonal harvest pressure, has lowered interior basis levels across the country.

However, it is interesting that the futures market has seen all of this and largely ignored it. Looking at a chart of most nearby grain and oilseed futures contracts, you’ll see that October was mostly characterized by sideways and choppy price action. Despite being bombarded with negative news and information, futures refused to crack. This strong price action in the face of negative news flow is definitely worth noting.

The news flow in the past couple of days has turned decidedly more price-friendly. As you are almost certainly aware, Russia has said it is stepping away from the UN-brokered deal that allows grain exports to navigate the Black Sea safely. This doesn’t necessarily mean that grain shipments will stop immediately. Still, it certainly raises the risk of an “accident” as the Russian navy is no longer willing to guarantee safe passage for grain shipments. Already we’ve seen insurance companies back away from covering new cargoes in the region.

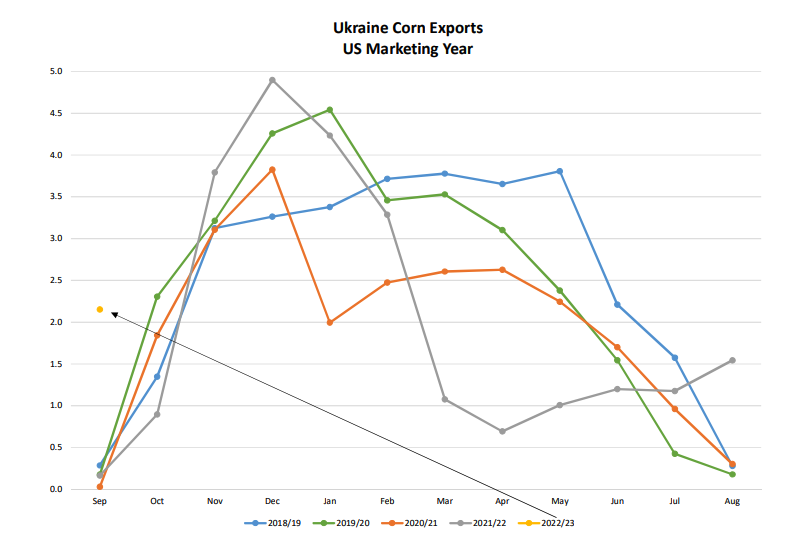

The “corridor” has been hugely successful in allowing Ukrainian grain to flow in the past several months. The chart below shows the history of monthly Ukraine corn shipments. Ukraine’s corn shipments have been much stronger than they would normally be during the past three months due to leftover old crop supplies and the grain export corridor. The fact that US corn export sales have lagged so badly in recent months is largely due to these Ukrainian exports. If Ukraine’s shipments of both corn and wheat are going to be severely curtailed again, it will increase demand for US supplies. While the wheat market seems to get most of the attention when it comes to the articles surrounding this story, it is corn that I think will be most impacted.

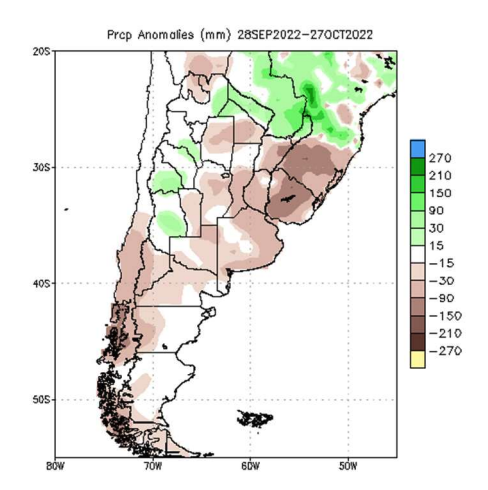

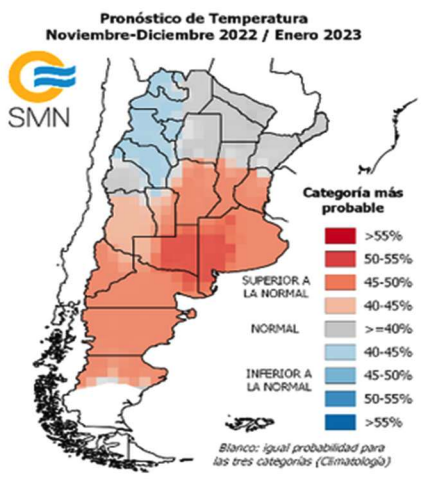

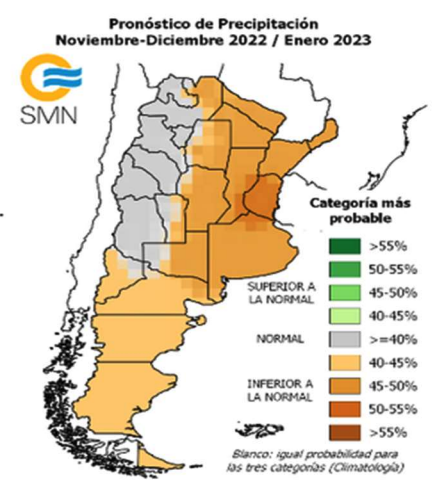

In addition to the storyline out of Ukraine, crop development in South America is getting off to a less-than-ideal start. I won’t focus much time on Brazil this morning but rather on Argentina. Significantly drier-than-normal conditions have plagued Argentina over the past several months. We’ve already seen this impact wheat production as estimates have dropped from 15-16 MMT to 12-13 MMT. Argentine farmers are now starting to plant corn, and the dry soils are still a concern. The map at the right shows just how dry Argentina has been over the past ~30 days. The following maps show the Argentine weather service’s forecast for the Nov-Dec-Jan timeframe. Obviously, that is a key development period for corn and especially soybeans. They are showing a lot of below-normal precipitation combined with widespread above normal temps…hardly a recipe for good yields. While the market will focus its attention on the dry weather’s impact on soybeans, I think the combination of the renewed restrictions on Ukrainian supplies and the potential crop losses in Argentina would create a very interesting situation for the corn market.

Over the past four months, we’ve seen Ukraine and Argentina combine for roughly 5-6 MMT of corn shipments each month. Anything that limits exports of these levels will translate into increased demand for US supplies. Due to significant crop losses in the US following adverse summer weather, any such uptick in demand would further stretch already thin supplies. US grain and oilseed markets have weathered the storm of near-term negative fundamentals and appear likely to find support in the weeks and months ahead.

Photo by Waldemar Brandt on Unsplash