Commentary provided by David Zelinski of Opus Futures.

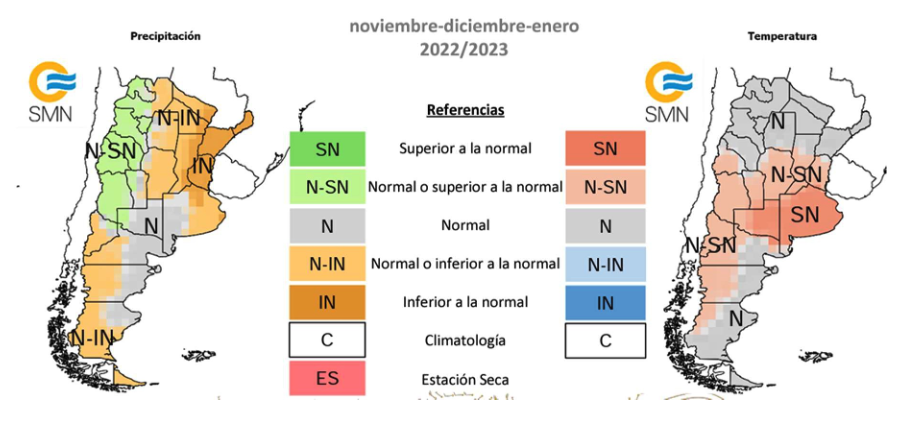

I struck a bullish tone toward corn and soybean markets in last month’s commentary. Part of the bullishness was due to the recent (at that time) news of a breakdown in the Ukraine export corridor. We now know that the Russians backed down very quickly from their harsh rhetoric and have even signed the deal extending the corridor for several months. Additional military defeats during the month even questioned their ability to control the Black Sea even if they wanted to. So that potentially bullish input has gone away. The other bullish item I mentioned in last month’s commentary, Argentine weather conditions, remains in place today. The past month’s weather posted well below-normal precipitation along with above-normal temperatures. Planting progress is running well behind normal as seed germination is questionable, given the dry and hot weather. The outlook going forward shows more of the same. The graphic below is from the Argentina meteorological service, showing mostly below-normal precipitation and above normal temps through the Nov-Jan timeframe.

Despite the unfavorable weather backdrop for Argentina, I believe the situation has developed to maintain a bearish bias toward markets going forward. While the Argentine weather story is potentially significant, I think that the overall balance of fundamental inputs leans bearish for prices.

A key reason to lean bearish toward prices is the ongoing good weather in Brazil. Planted area in Brazil is again forecast to hit a new record high. With favorable weather conditions, we should be looking at a massive record soybean crop out of Brazil this year. Keep in mind that last year Brazil dealt with crop losses, so the YOY increase in Brazilian supplies should easily dwarf crop losses experienced in Argentina.

Not only should supplies out of Brazil be significantly bigger YOY, but despite the potential production losses, we might even see an uptick in available supplies from Argentina. Considering the fears of production losses, it sounds difficult to believe, but remember that the Argentine economy has been turned into a barter economy due to the sky-high inflation that has run rampant for years. Argentine farmers would hoard soybeans and use them to barter for inputs, equipment, etc. The Argentine government has announced a special FX rate for soybean (and soy product) exports, which means the farmers are selling hoarded supplies. Despite the prospects for smaller new crop production (which won’t be available until March), we’re seeing a big uptick in Argentine soybean shipments right now. Sep-Dec soybean shipments out of Argentina could be up ~5 MMT YOY.

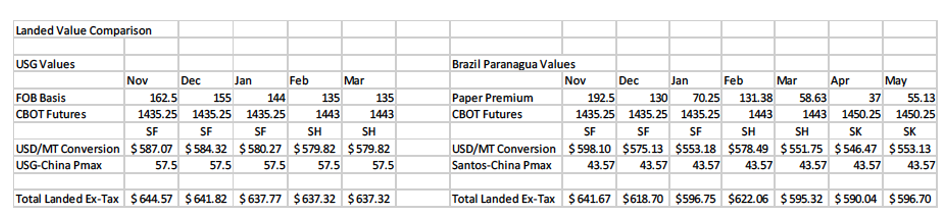

This uptick in available supplies out of Argentina limits US export demand at the front end of our marketing year. The big Brazilian crop will limit US export demand in the second half of our marketing year. The breakdown below compares the landed values of soybeans into China from the US vs. Brazil. From Jan- forward, Brazil is the market for soybeans to China. The window of opportunity for US exports is rapidly coming to a close.

US exports are very likely to fall well short of current USDA projections. The initial pace of shipments has been slowed by low river water levels (refer to previous comments) and the surprising uptick in Argentine exports. Going forward, demand will struggle to compete with record Brazilian supplies…or at least it will from these price levels.

The bulls might try to argue that US domestic consumption could support soybean prices, but I also view that as a questionable prospect. The sharp rally in soyoil prices had led to a massive surge in soybean crush margins. However, that soyoil strength could be on borrowed time. US soyoil prices are at record premiums to other global vegetable oils, meaning US export demand for soyoil is virtually zero. That is going to require domestic consumption to absorb the entirety of soyoil production. While demand for soyoil in biofuels is strong and growing, suggesting it can absorb this much supply without some headaches along the way is a very questionable assumption in my mind.

We’ve spent all our time so far discussing the soybean market, but a lot of the same principles apply to corn. US corn export prospects might actually look worse than soybeans. The SON export total could be one of the lowest amounts we’ve seen in several years. Brazil is coming off a very big crop last year, which should continue to weigh on US prospects for the coming few months. The Ukraine export corridor has been very successful, and that will also be a counter to US demand. And Chinese import demand, for now, remains non-existent.

Domestically there are signs of weaker demand as well. Cattle on feed numbers are the lowest in several years, implying less feed usage. Contacts in the cattle industry note that corn costs are declining a little bit. Gasoline prices are well off their highs, and demand appears relatively soft, which should keep a lid on ethanol use.

And don’t look now, but input costs for 2023 planting appear to be rolling over. The surge in diesel prices has, at least for the moment, unwound a bit. Fertilizer costs are slowly trending lower.

The bottom line, it is becoming harder and harder to justify historically elevated corn and soybean prices. It will be a long process of unwinding some of this risk premium, but unless there is a significant weather development, it would seem that the highs for this cycle have been set.

One additional market that has my attention right now: feeder cattle. We know we’ve been aggressively culling the replacement herd over the past two years. We know placements have been front-run aggressively this calendar year due to drought conditions during the summer. We *think* corn prices are in the process of topping. All those conditions would seem favorable for an upside in feeder cattle prices. If we were to get a break in the drought conditions in the Plains this upcoming spring, which would seem possible with a weakening La Nina, it could spark a very considerable rally.

The information contained herein has been taken from trade and statistical services, and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. Opus Futures, LLC does not guarantee that such information is accurate or complete, and it should not be relied upon as such. There is a risk of loss in trading futures and options, which is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. This document contains only commentary on economic, political, or market conditions and is not intended to be the basis for a decision to enter any derivatives transaction. The contents of this commentary are for informational purposes only. Under no circumstances should they be construed as an offer to sell or a solicitation to buy or sell any futures or options contract.

Photo by James Baltz on Unsplash