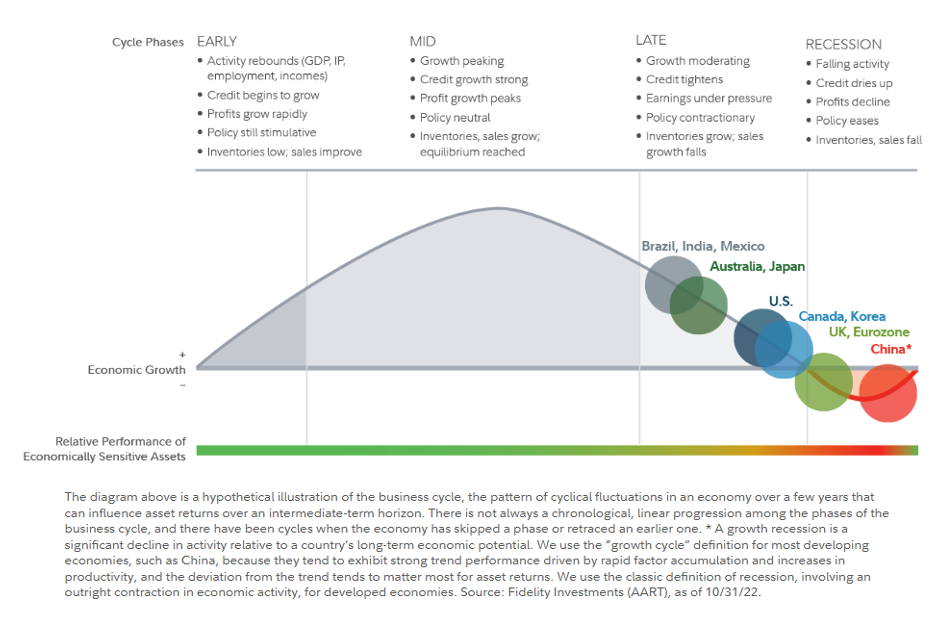

All economies go through fairly predictable patterns as they go through a business cycle. In simple terms, we go from expansion to peak, contraction, and trough. The depths of this drop vary based on both predictable and unpredictable factors. Let us look at some quantifiable factors as well as some wild cards that can impact our trajectory. For simplicity, we can use Fidelity’s checklist below, which shows that we are approaching a recession and that the Eurozone is already there.

Growth Moderating

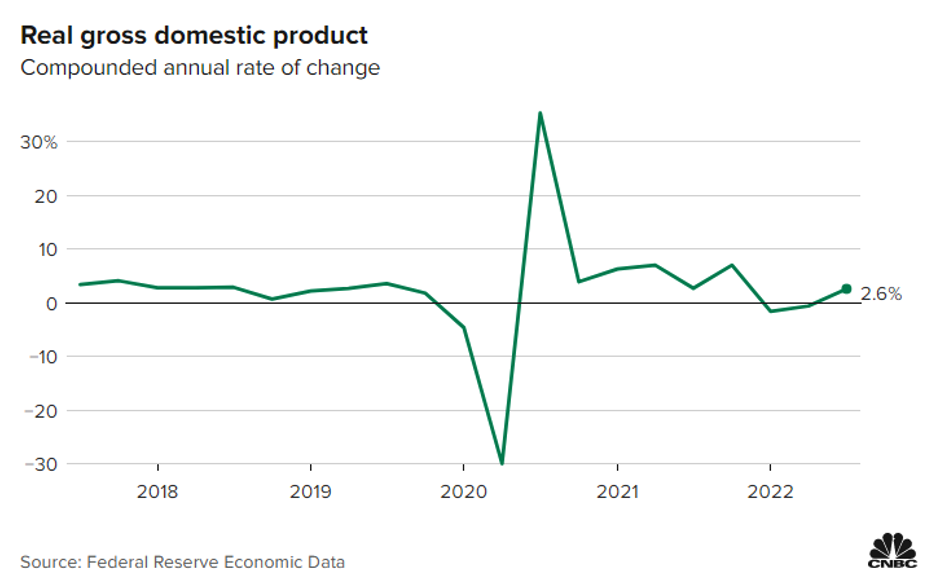

A sharp contraction caused by the COVID pandemic, followed by rapid recovery, gave way to moderate United States growth until the beginning of 2022, when the economy contracted for two quarters (technically a recession) before posting a positive Q3 number. Banks like JP Morgan continue to warn that they expect a mild recession in the upcoming year. Many large employers announced they are cutting staff in anticipation of this expected slowdown.

Credit Tightens

In the United States, mortgage rates doubled in 2022, and demand for new purchases is down 41%. This is consistent with Fed’s goals to reduce the money supply and tame inflation. The ECB and even the Bank of Japan, for the first time since 2016, also tightened their monetary policy.

Earnings Under Pressure

Despite headlines of doom and gloom, earnings continue to grow. Some of this increase is due to inflation and higher prices that pass to consumers. While wage growth has not kept pace with the higher prices, it is trending upward. This cost to employers and the exhaustion of savings during the pandemic could affect this path. Government transfer payments added during the COVID emergency will also impact the ability of retail to keep up. Credit card data showing growing balances supports this conclusion.

Policy Contractionary

Clearly, the Fed and other central banks were caught off guard by the rise of inflation and then scrambled to salvage their reputation through aggressive rate hikes and balance sheet reductions. Their balance sheet’s $95 billion monthly runoff is pulling liquidity from the system and increasing bond prices. This is welcome news to older investors who can shift their assets into bond funds. Meme stocks and speculative traders may not see the skyrocketing prices they became accustomed to through the easier money period. Leverage costs will affect hedge funds with lower returns which could be offset by higher volatility. Futures contracts may begin to look more interesting as the leverage is embedded in the contracts and therefore does not require borrowing at higher rates to achieve exposure.

Inventories Grow, and Sales Growth Fades

The US Commerce Department showed an increase in wholesale inventories of 21% on an annualized basis in November 2022. In a growing economy, this might indicate confidence in future orders. Still, the spike in demand as the pandemic ended seems to be receding, so this might show that the pace of production is now outpacing sales. This is consistent with the contraction portion of the business cycle. Car sales may be the proverbial “Canary in the Coal Mine” as Tesla announced large price reductions to move growing inventory.

The good news is that Fed policy appears to be working to slow the economy. As inventories outpace demand, prices may come down, causing inflation to ease. An area that I believe deserves special scrutiny is the productive use of capital to drive efficiency. Low rates made it easy to secure funds for virtually any project. The internet, globalization, cheap energy, and cheap money drove an impressive boom in the growth of our economy as well. Many of the key drivers we became accustomed to appear to be flagging. The COVID pandemic and subsequent lockdowns in China caused major delays in shipping and production. This is forcing companies to rethink their exposure and bring supply chains home. While this is prudent, consumers and profit margins will bear the cost.

Similarly, the green revolution will add costs to virtually everything as the replacement energy costs more than the fossil fuels we utilize now. Rising interest rates will pull money into US Treasuries and other sovereign debt. Outside of one’s opinion on government efficiency or lack thereof, this will pull dollars that might otherwise go to begin a new company or finance a project. Fewer dollars mean less growth which we are already seeing.

Time will tell if Fidelity was correct with their chart. Experience tells me that forecasters are poor at predicting the timing and depth of recessions. We may look back ten years from now and wonder how we missed the obvious signs of the next crisis. Perhaps, we will skip the through entirely. The best advice is to always carry a portfolio designed to withstand shocks. I guarantee they are coming.

- https://www.forbes.com/sites/qai/2023/01/11/real-estate-trends-increasing-interest-rates-continue-to-drive-down-mortgage-demand/?sh=3549837f286b

- https://tradingeconomics.com/united-states/corporate-profits

- https://www.aa.com.tr/en/americas/us-wholesale-inventories-grow-more-than-expected-in-november/2773924