“When the United States sneezes, the world catches a cold.” This saying reflects the dominance of the US markets, and with it comes the gift of producing the “world’s reserve currency.” However, the rise of digital currencies and competitors to the dominant US dollar is becoming a daily conversation. Governments worldwide desire the benefits that derive from producing a currency that is in the most demand. This hidden luxury lets the US government borrow and print money at a rate that exceeds any other country simply because people want the perceived stability of the “almighty dollar.” But is there a legitimate threat, or is it just idle talk? Severe ramifications for the United States are at stake if it loses its status. So how did we get here, and will we see it change anytime soon?

The US Monetary Policy and its Effects

The United States is the world’s largest economy, with a GDP of almost $27 trillion, outpacing second-place China by 38%. Third place, Japan lags even further at just 16% of the US level. If we looked at US states individually, California would be the 6th largest country by GDP, beating the United Kingdom and France. Five states would be in the top 20 in world GDP rankings, and New York would displace Russia in 11th place. Thus, the US monetary policy affects everyone since their customer base is vital to most developed economies. Trading requires the conversion of their currency to USD each time a product is bought or sold between countries. And with numbers like these, it is truly big business. Other reasons exist for the dollar’s status too.

Petrodollars and the Changing Oil Market

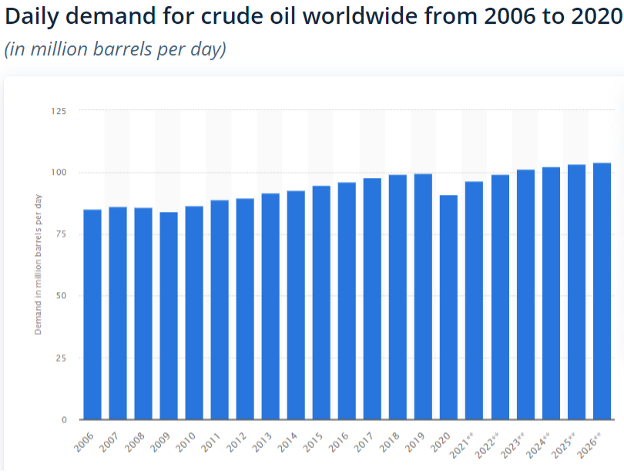

In the 1970s, oil-producing countries agreed to price their product in US dollars. These so-called “petrodollars” added stability to the trade and made the dollar the de facto currency for not only oil but other commodities as well. Current tensions between the United States and Saudi Arabia, Russia, China, and others are breaking this long-standing practice as more oil is being traded in Yuan, giving rise to the new “petroyuan.” Considering global crude demand of approximately 37 billion barrels a year, even a small change in this massive market is impactful. Despite government incentives to reduce consumption in the name of carbon dioxide reduction, the oil consumption trend continues to be steady, as shown in the chart below.

The US Treasury Market and the Fed’s Balance Sheet

Lastly, the US Treasury market is seen as a safe and attractive investment around the world, and the massive balance sheet of the Fed provides ample liquidity to trade. We see the strength of this debt the most during times of crisis. In 2008, as the US mortgage crisis began, investors ironically fled to US Treasuries. This “flight to quality” allows flexibility that other countries simply do not have, especially in times of stress. It also lowers borrowing costs relative to other countries that cannot sell more bonds whenever they feel like it. The COVID spending binge showed that the Federal Reserve thought they could print with impunity to prevent a recession. Many other central banks joined in with their printing presses, but eventually, the bill comes due.

Challenges to the US Dollar’s Status

Once upon a time, the British Pound dominated currency reserves. The United States currency now makes up almost 60% of all reserves. For the reasons listed above, China and others would like to establish themselves as the default currency but need international trust to earn it. That trust is hard to come by with a currency pegged to the US dollar and kept artificially low to stimulate exports. Outside access to their markets is also limited. This is particularly true for its bond market, which caps foreign investment. The developing alliance between the BRICS nations (Brazil, Russia, India, China, and South Africa) is becoming more entrenched. One of their goals is to replace the dollar with their currencies. This is especially important for Russia as the US and Europeans seized their reserves following the invasion of Ukraine. The others noticed. While trust may be hard to come by, it can be lost quickly.

Conclusion

The near-term likelihood of the dollar falling out of favor appears slim, but a country that borrows and spends with impunity and uses it as a geo-political tool opens the door to competition. Digital currencies provide transparent growth rates and tracking of each “dollar” produced. Unlike individual countries that can and do print their way out of trouble, this could provide a reliable store of value. However, fragmentation makes finding one that could handle the volume and be the long-term solution difficult. If the United States can weaponize its reserve status, then China would as well. So, while we may not change soon, American politicians should do what they can to protect the status quo. If they do not, we might not like the results. After all, the whole world could catch a cold or even worse.

Related links

- List of countries by GDP (nominal)

- List of U.S. states and territories by GDP

- Daily demand for crude oil worldwide from 2006 to 2020, with a forecast until 2026

- Petrodollar vs Petroyuan: Can China overthrow US in the global oil market?

- Could the US dollar lose its reserve currency status to China?

Photo by Marc-Olivier Jodoin on Unsplash