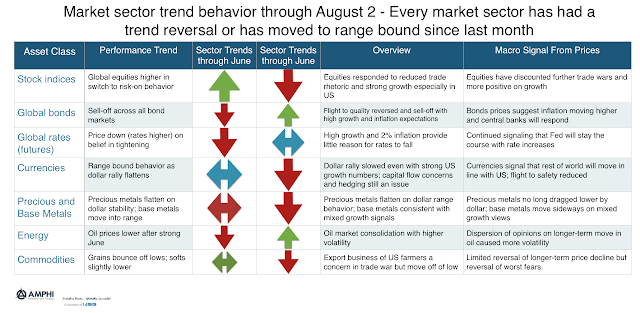

Our tracking models for the end of July show that there have been changes in direction for all major sectors. This would usually suggest significant loses for trend managers but the relatively mild volatility and the slow reversals allowed for adjustment of signals to mitigate loses.

Equity indices moved higher around globe while bonds reversed and sold-off. Between good economic numbers and the worst fears not being realized, the market moved to risk-on positioning. Rates suggest that quantitative tightening will continue. The dollar rally slowed which cause precious metals to move sideways. The energy rally also slowed albeit there is a large dispersion in market views. Commodity markets were mixed but the strong grain price declines in June have started to reverse, but soft prices are trending lower.

Given the sector reversals between June and July, it is hard to say what will be the potential winners for August. With vacations for many this month, position changes will be limited without a major economic surprise.