The Efficient Market Hypothesis, introduced by Benoit Mandelbrot and popularized by Eugene Fama, infers that investing markets reflect all information to determine prices. Therefore, if the Fed is expected to raise rates by 75 basis points, the current market levels should reflect that consideration. This also means that nobody should be able to “beat the market.” Recent experience shows that despite well-telegraphed moves, the reaction to these announcements continues to be severe. Seemingly, this theory should make this unlikely, but it continues to repeat monthly. This leaves us with a few possibilities, including the poor ability to forecast, unpredictable human behavior, or the likely culprit, a market that no longer trades on its merit.

Let’s start with the Fed’s predictions for 2022. In December 2021, the US central bank predicted a target Fed funds rate for the following year of 0.90%. This increased to 1.9% in March, 3.4% in June, and now at 4.4%. In September, GDP projections dropped from 1.7% to 0.2% for the year, a startling 88% decline. Inflation projections and the unemployment outlook were also revised to the downside. If one were only to depend on them and other central banks for clarity, we would be consistently behind the data. Alternative sources of information, such as housing, might be a better indicator of direction, with a 64% annualized drop in mortgage applications as measured by the Market Composite Index for the week ending September 9th. Fundamental traders depend heavily on accurate information, so when it is incorrect, it results in lost opportunity or lower returns, forcing them to re-evaluate. We see this anecdotally where despite large moves, many of these types of programs are positive but not excelling as much as expected.

In a market economy, government reporting is meant to buttress the wisdom of crowds that collectively determine prices efficiently. When the Fed gets too big and controls too much of a stake, the efficiency of markets degrades. We see that the Fed is either not predicting very well or is hiding its expectations, so they do not create panic in the markets. Either of these options is scary on its own, but the possibility is strong that it is both at the same time. Likely, the models they use do not work simply because the situation is novel. Coordinated action across worldwide central banks to stem the tide of the pandemic (and previously the mortgage crisis of 2008) provided them with false confidence that their actions would yield positive results. Clearly, they misjudged and now need to maintain trust in their actions while not really knowing what will happen next.

When we talk about the human element of the market, behavioral finance, we typically focus on the core concepts of fear and greed. If we look at historical averages, the market’s price-to-earnings ratio trended well above its normal course as easy money coursed through the system since 2008. Investors followed the money and the returns pushing equity markets to all-time highs even amid a pandemic. Bitcoin rallied as the fear of missing out drove it and other cryptocurrencies to stratospheric heights. We now see the flip side of that coin, as easy money is removed from the system, fear results in big drops that occur suddenly and unpredictably. Similarly, we may overshoot to the downside, providing opportunities for reinvestment on the way up.

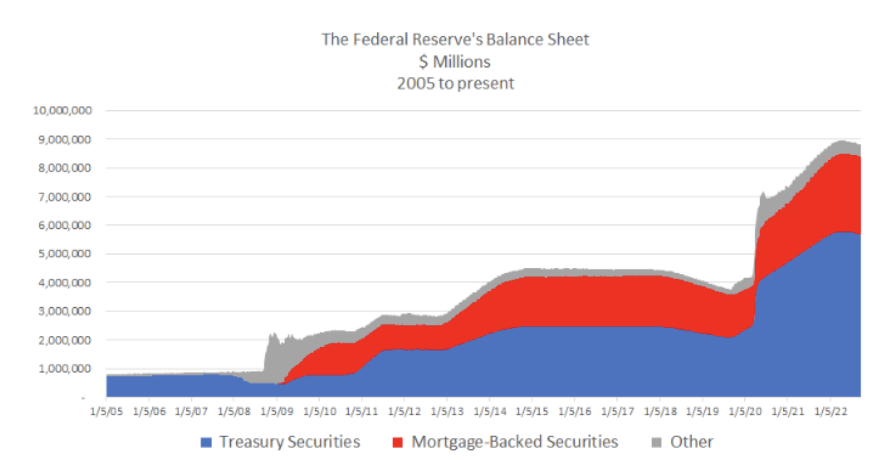

Unlike previous periods where the Fed raised rates, this time, they are not doing so as a sign of economic strength but rather as a reaction to inflation. This is markedly different than previous periods where returns improved as rates increased. The chart below demonstrates why. Prior to 2008, Fed holdings ran below $1 trillion and consisted of mostly treasury securities. That changed during the financial crisis. Since then, holdings increased 900% in just 14 years, including by $4 trillion in a single month at the outset of the pandemic. The entire value of all the publicly traded companies in the United States is $53 trillion as of the end of 2021. As a comparison, the Fed balance sheet equals 17% of that amount. Thus, when the Fed speaks, it is all the market hears, and even the stock prices of the best companies will be affected.

So, we can expect more of the same, a Fed behind the curve trying to catch up to an inflation problem. Their outlook will likely change dramatically, affecting the “known information,” which will cause continued volatility. After all, while markets may not be fully efficient, new data gets priced in more quickly than ever. The consequences could be severe if the cost of credit continues to spike. Governments and corporate treasurers loved the cheap money, as did consumers. We will not like the alternative, but all good things must come to an end. While risk may be delayed, it cannot be eliminated. Maybe markets are efficient, after all.

Related:

- https://siblisresearch.com/data/us-stock-market-value/

- https://www.americanactionforum.org/insight/tracker-the-federal-reserves-balance-sheet/

- https://www.msn.com/en-us/money/realestate/e2-80-98some-companies-are-closing-their-doors-others-are-shutting-down-divisions-e2-80-99-rocket-ceo-e2-80-99s-plans-to-navigate-the-dramatic-decline-in-mortgages/ar-AA120t4p

Photo by Pietro Jeng on Unsplash