Visiting a place like Rome, where history permeates every corner, is truly a remarkable experience. The juxtaposition of ancient columns alongside “modern” apartment buildings and the view of centuries-old defensive walls en route to savor gelato exemplify the captivating allure of this city. However, it is within the magnificent structures such as the Colosseum and the masterpieces crafted by the greatest artists of all time that Rome’s grandeur truly shines. The city’s piazzas are adorned with statues, each one a testament to the awe-inspiring talents of their creators. Yet, amidst the marvels that surround us, it is impossible not to ponder how this extraordinary civilization eventually faltered and what valuable lessons we can glean from its decline.

Rome’s Historical Significance and Decline

The city of Rome is chronicled throughout history as the seat of perhaps the most powerful empire of all time. We encounter Julius Caesar’s name through grade school classes, Shakespearean literature, and his 365-day calendar with his namesake month, which we just entered. Immediately following his assassination, he was brought to his temple, where he was cremated so his ashes could be spread throughout his kingdom. Today, all that remains of that iconic building and that legendary spot is a pile of rocks with a bare wooden roof that seems oddly odd of place. We might expect that throughout centuries everything would degrade. Still, it is hard to imagine that this legendary city would be abandoned with its population going from hundreds to tens of thousands, leaving the Forum as a dumping ground and eventually a cow pasture. Plagues, invading armies, and a shift of the capital to Constantinople rendered it an unattractive place to live.

Parallels in Contemporary Society

I am sure they never imagined their majestic empire would fall. Everything eventually does, though, as companies falter, countries fail, and economies crash. Which one will happen next? In the early 1980s, Russia and the United States were both superpowers. Much like societies before them, poor leadership in the former Soviet Union caused confidence to falter, spawning a currency crisis, and a new system of government took over. Their invasion of Ukraine may be the next step in their decline. While the United States looks strong now, challenges to its status continue to grow. A chaotic (embarrassing) exit from Afghanistan, massive borrowing to support an economy through COVID (and before), and two Presidents in a row with impeachment chatter surrounding their administrations, to name a few.

Fragility of the Market

In the early ’90s, Apple was just making a comeback, and Motorola sold 58% of the cell phones in the world. Apple did not even sell phones at the time. Within ten years, Motorola was down to 15% of the market and sold to Google for just $12.5 billion in an attempt by them to accumulate patents. Google sold most of the remaining company for $2.5 billion two years later. Today, Motorola is a shell of itself, and Apple is the world’s most valuable company. Electric cars and the AI revolution could displace them at the top. While we do not know what will happen next, we do know with some certainty that they will lose their position at some point.

Lessons for Investors

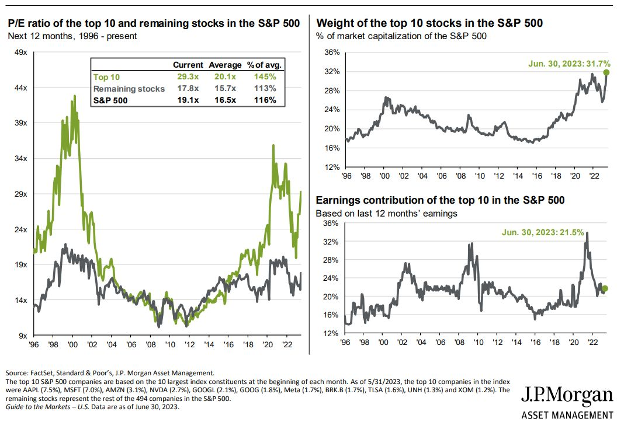

Today’s market shows why this is something to be wary of, as the top ten stocks dominate the S&P 500 with an all-time high weighting of 31.7%. This is despite the fact that their earnings continue to decline as a percentage of the overall basket. Breadth is an important measure of stock market health, as more companies participating in a rally means better health for the economy overall. We do not have that right now. Apple and Microsoft alone account for almost 15% of the index. Four hundred ninety-four companies represent 68% of the total. The top 20 companies in the SPY represent 93.8% of the total return this year (through May 24th, 2023). What would happen if one of them faltered?

Sometimes a few companies driving returns can work well, but linear upward streaks with few major corrections are rare throughout history. A rising rate environment, election season in the United States, and a move to index investing, which simply follows the herd, could result in surprises. Much like Rome, you can build the greatest portfolio the world has seen, but if you do not adapt and avoid disaster before it comes, you, too, can see a fall. As the saying goes, “Being right is not always popular, and being popular is not always right.” Tech stocks are certainly popular now. We will see in time if their investors are right. In the meantime, an all-weather portfolio is my chosen route to sleep soundly. What is yours?

Image: Midjourney