Following the 2008 housing bust, logic would suggest that a more significant increase in mortgage rates might similarly impact home prices and send prices falling. Surprisingly, this is not happening, and the reasons could have far-reaching effects. This is bad news for prospective home buyers who now face a double whammy of rising interest rates AND higher home prices. The commercial real estate market presents different issues as pandemic-driven work habits created a permanent shift away from the office and towards remote work. These buildings worth tens of millions of dollars just a few years ago might need to be repurposed or go through a total re-pricing. Any change to these sectors can be significant, with a US private residential real estate market of $43.4 trillion. We may be going through an adjustment similar to introducing e-commerce to the retail space or not. The unprecedented shutdown of the world economy and resulting inflation changed many things. How will it impact real estate moving forward?

Home Prices and Interest Rates

According to the National Realtors Association, at the end of May 2023, only 1.08 million homes were listed for sale, which was the lowest amount for that period going back to 1999. This stagnation seems to be driven by millions of homeowners who wisely refinanced at rates in the 3% range (almost 4% below the current levels) who do not want to trade into a higher payment. According to the Case-Shiller Home Price Index, existing home values increased by 45% from January 2020 to June 2022. Despite this, prices continue to rise in many areas even as populations shift to warmer climates and cheaper tax policies. KPMG LLP’s 2022 prediction of a 20% reduction in real estate for the current year seems wildly off. This is terrible news for the Fed as housing prices and rents comprise a third of the Consumer Price Index, as shown in the chart below. Despite higher carrying costs for undeveloped and in-process construction, new home builders cold almost a third of new residences (up from 10-20% usually) and passed along the rising costs to people desperate to find supply. A local builder in the Chicago area told me, “I paid $300k more in interest this year, but we can pass along that cost and more. Business is great, and the stock prices of the largest home builders show how well they are doing.”

Office Properties and Financial Pressure

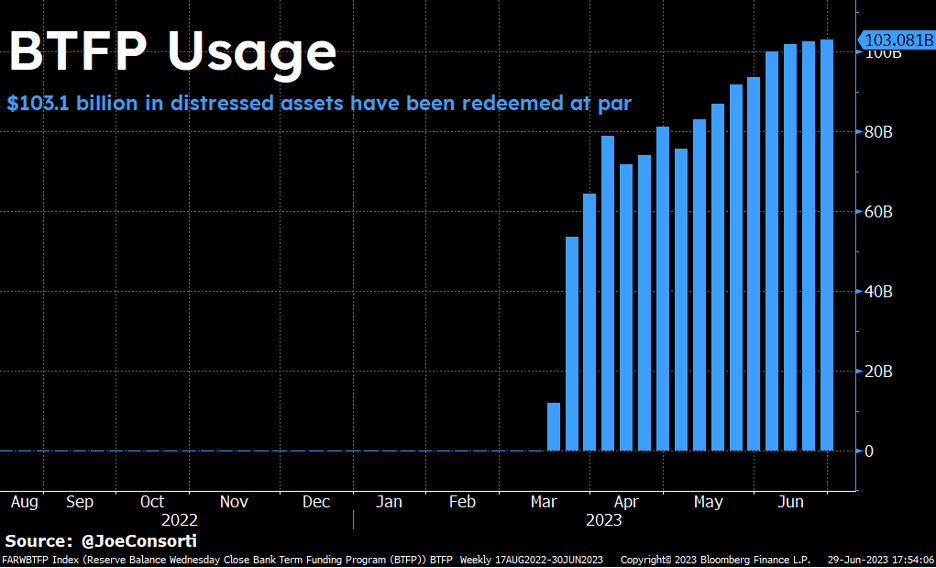

On the other hand, Office properties continue going on a different trajectory, which could worsen. Regional banks now face intense interest rate pressure and often finance these buildings. Silicon Valley Bank’s failure due to losses on US government bonds is still an ongoing risk for remaining lenders. The Bank Term Funding Program, created as a response to that bankruptcy, continues to grow to new highs despite better terms lenders could get in the marketplace. Participants must submit their existing bonds as collateral and agree to additional recourse beyond those in case of failure to pay back. As of now, all loans need to be repaid within a year. Therefore, they are unlikely to offer discounted rates to owners in distress. National office vacancy rates in Q2 surpassed 13% compared to 3.7% in the same period before the pandemic. San Francisco could be the “canary in the coal mine,” as many owners simply returned their properties to the bank as a form of default. Columbia Property Trust could not pay its $1.7 billion loan backed by California, New York, and Boston buildings. As leases come due, look for more issues here. Converting some of this excess space into apartments, entertainment, or hotels could be a long-term solution.

Surprising Growth in Leisure and Travel Spending

Speaking of hotels, one of the surprising areas of growth in the economy following the pandemic is the resumption of travel spending. Commercial properties in the leisure area seem to be making up for lost business travel, with Maui Island in Hawaii posting the strongest daily rate increase at 59%. Another contributing factor that caught many off guard is the so-called “Taylor Swift Effect.” The Federal Reserve Bank of Philadelphia credits her “Eras Tour” for the strongest month of hotel revenue in their region since the beginning of the pandemic. Chicago saw a similar result, with a record 44,000 rooms occupied. Their highest total ever. Industrial space also saw continued strength despite a slowdown in demand following the post-pandemic surge that pushed prices to their current levels.

Supply and Demand Dynamics

I often think of my supply/demand charts from business school in these situations. You can see the graphic below, which describes the residential mortgage market well. We have a decrease in supply, shifting that curve to the left. This, in turn, drives higher prices. The demand curve is going as well as fewer buyers can afford to purchase, moving that line down. The net effect so far is that prices remain stable but still increasing. Cash offers continue to be prevalent. This is logical as those buyers can avoid paying high rates. Hard assets such as real estate often provide a hedge against inflation. Office space, on the other hand, is seeing a shift down in the demand curve with the supply increasing. This is not sustainable, and we can expect more defaults until we reach a new equilibrium. Rapid conversion to residential space or other uses of these buildings is already taking place and may need to increase.

Many economists predicted a different outcome for 2023 as recently as December 2022. It may take longer for high rates to impact prices than expected. Many office tenants may be paying rent on unoccupied space now. As these leases come due, hope to hear more about trouble for the property owners and the banks that lent them funds. Much like those that paid a premium for office buildings in 2019, a slowing economy might affect housing prices similarly. Watch for the demand curves to shift again. Like many things these days, it happens faster than ever.

Photo by Max van den Oetelaar on Unsplash

![Both overall and shelter inflation are rising rapidly [chart]](https://www.iasg.com/wp-content/uploads/2023/07/cpi-shelter-inflation.png)