As we approach another government shutdown here in the United States, another segment of the population is also navigating a challenging path. Dwindling savings, exacerbated by record inflation, is depleting their spending power. It is important to note that they have not actually stopped spending yet, but they ran out of surplus funds months ago, compelling them to revert to credit for many of their purchases. For more than a decade, our nation relied on lenient monetary policies, which buoyed the economy but resulted in mountains of debt accumulated. This approach is now facing a critical test. The Fed’s tool to drop rates in a crisis might be harder to sell to a populace incensed about skyrocketing prices. Sadly, they may be out of options next time we have a crisis.

The Changing Financial Landscape

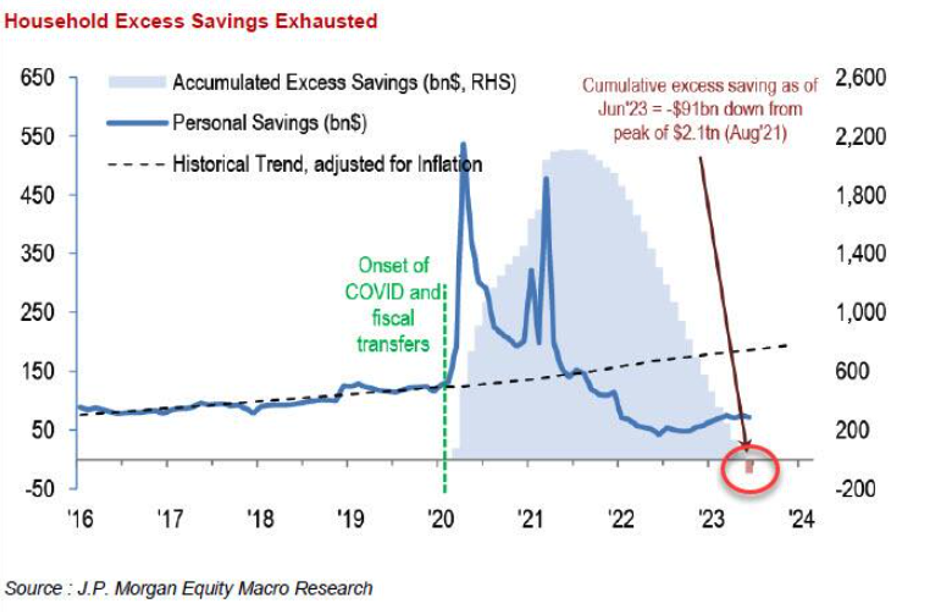

It’s not entirely surprising that the combination of easy credit policies and government stimulus during the pandemic led to substantial increases in savings. Still, we should brace ourselves for a potential reversal of that trend. It’s peculiar how, amid a crisis, we witnessed stock market surges and improved financial situations. This newfound financial cushion prompted adjustments in spending behaviors. Factors like the suspension of student loan payments, historically low mortgage rates, and the influx of “free money” encouraged decisions such as buying a new car or renovating kitchens, which made perfect sense then.

Reversal of Trends

However, the tides are changing as interest rates begin to climb, student loan payments resume and energy prices rise. Naturally, the excess savings that once seemed abundant are vanishing. This week, the government revised its estimates of how much Americans saved during the pandemic by a staggering $1.1 trillion from 2017 to 2022. Meanwhile, the government’s debt has ballooned to an eye-popping $33 trillion. To put this in perspective, consider that a trillion seconds equate to approximately 31,710 years. If they paid this debt off at a dollar per second, it would take over a million years to get caught up.

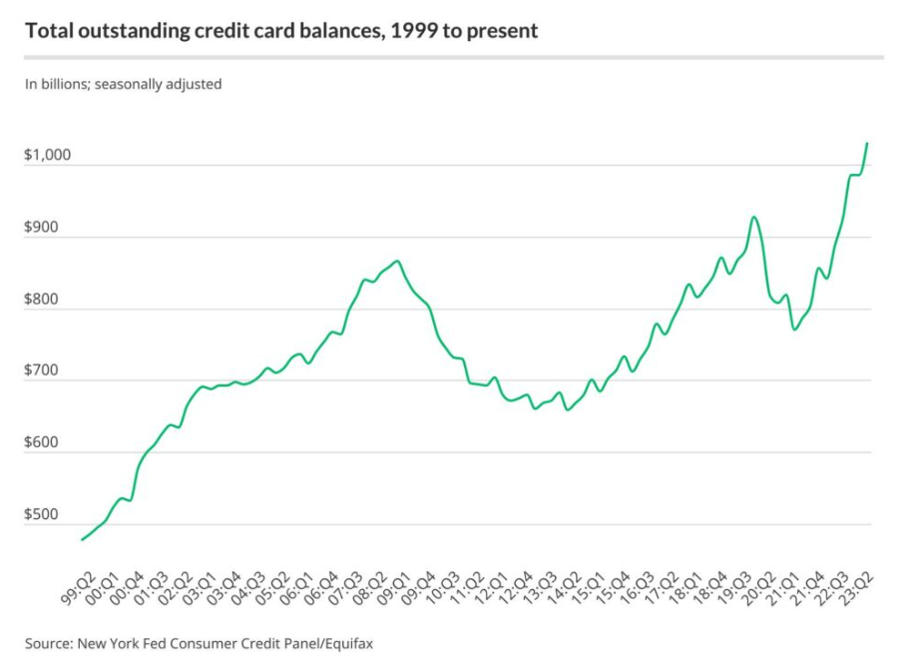

Early Warning Signs

So, we begin to look for changes in the underlying economy’s health and see a growing wave coming. Credit cards are the easiest early warning measure as balances roll from one month to the next. Along with the ever-increasing balances, higher rates make it harder to dig out of a hole. The next payment consumers start to miss is their car loan. During the pandemic, many sought their dream car, and with stimulus checks in their account, they paid full price for new ones. That bill is starting to get paid, as repossessions were up over 20% year over year recently after defaults returned to historical norms in 2022. More will be coming.

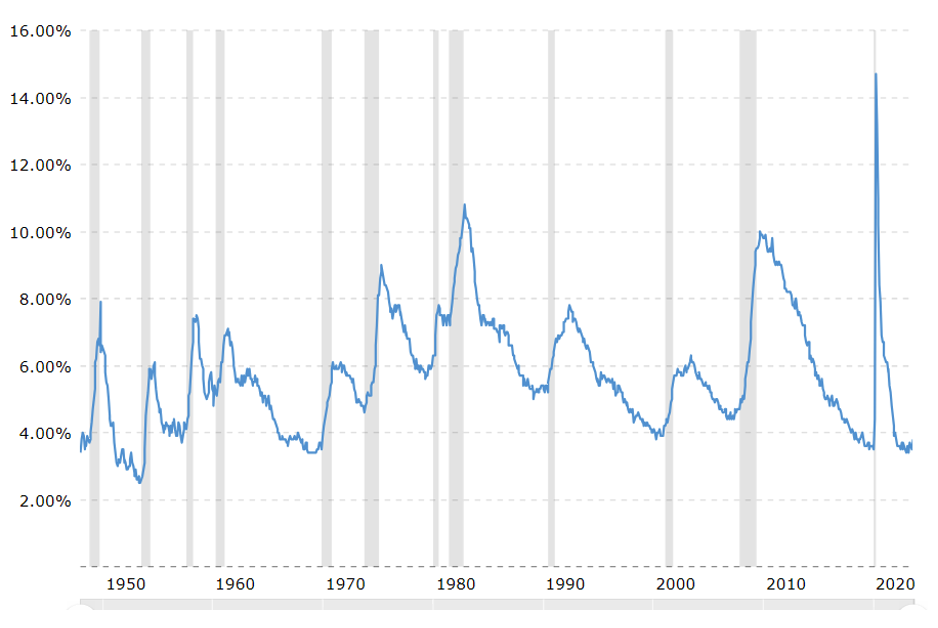

Even the good news comes with some warnings. The low US employment rate is near 50-year lows. This provided the support for the rapid rate hikes we have seen. Looking at the chart below, we can only head in one direction from here, as we are at a natural target rate for full employment. We also see that we rarely stay in this zone for long periods. This is important to note since wage growth is just starting to catch up to inflation. A jolt to the economy could push wages down from here. This would help in the inflation battle but hurt the consumer even more. Housing is another bright spot, with prices remaining stable despite higher mortgage rates, making buying a house more difficult. Like corporations who sold bonds when rates were low, most homeowners refinanced when rates were near 3%. Hesitancy to move and trade into a higher rate restricts supply, which balances lower demand to keep prices level.

US National Unemployment Rate

Fed’s Actions and Market Response

A rocky start to September where Jerome Powell, the Fed Chair, indicated that a higher long-term rate for government debt might be the “new normal” jolted markets. This surprised me for a couple of reasons. The first was that many expected a quick return to the low rates the world has become accustomed to based on recent history. The second is that whispers that perhaps the Fed does not know what they are doing or what the long-term implications are for their decisions. The cost of US debt servicing doubled from the second quarter of 2016 to now and is accelerating. In order to keep finding willing buyers, they will need to pay even higher rates. This means a bailout for consumers is less likely. At the current trajectory, this could mean trouble soon. Hopefully, emergency options will not be needed.

Photo by Jasper Garratt on Unsplash