One way to make sure you hit your targets is to simply adjust them lower. It looks like central banks worldwide will do just that in their fight against inflation. Despite a long-term target of a 2% annual rate, political pressure to sacrifice purchasing power in exchange for growth appears to be gaining steam. Given voters’ frustration over the rising cost of everything, why would they choose this path?

What got us to this point?

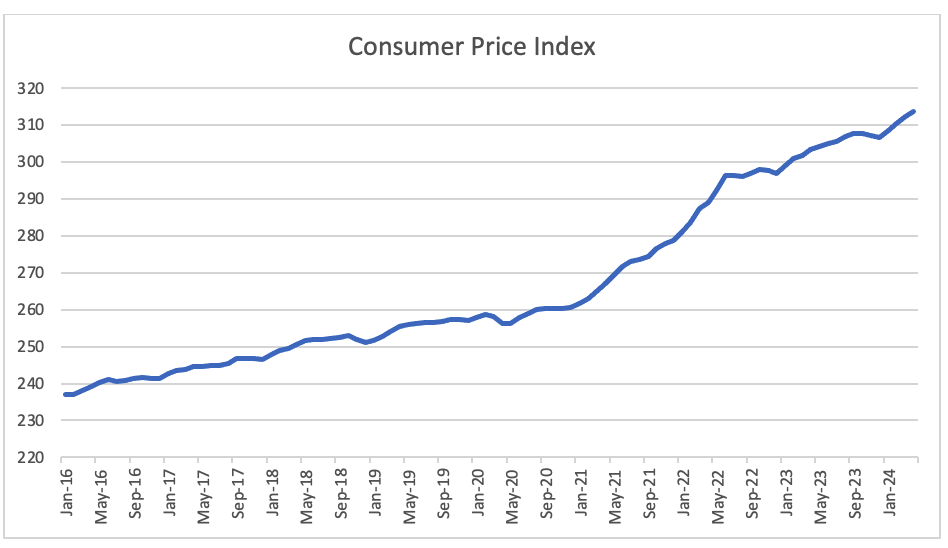

Jerome Powell, the Federal Reserve Chairman, predicted in December of 2023 that we would see three rate cuts in 2024. If you look at the consumer price index (CPI), a brief lull in December can be seen, followed by a resumption of the trend. You can also see that, contrary to popular thinking, inflation is not going “down,” but rather, the rate at which it is going up is slowing. This is a small comfort to those paying 21% more for groceries. Risks exist on the other side of this equation as well. Bond prices move inversely to rates, so when a zero percent interest rate environment switched to a 5% one, banks that held long-term bonds saw their value plummet. This puts the Fed in a bind as they hold responsibility for the soundness of the financial system AND the value of our currency. Rate cuts help one and hurt the other.

The European Central Bank (ECB) Situation

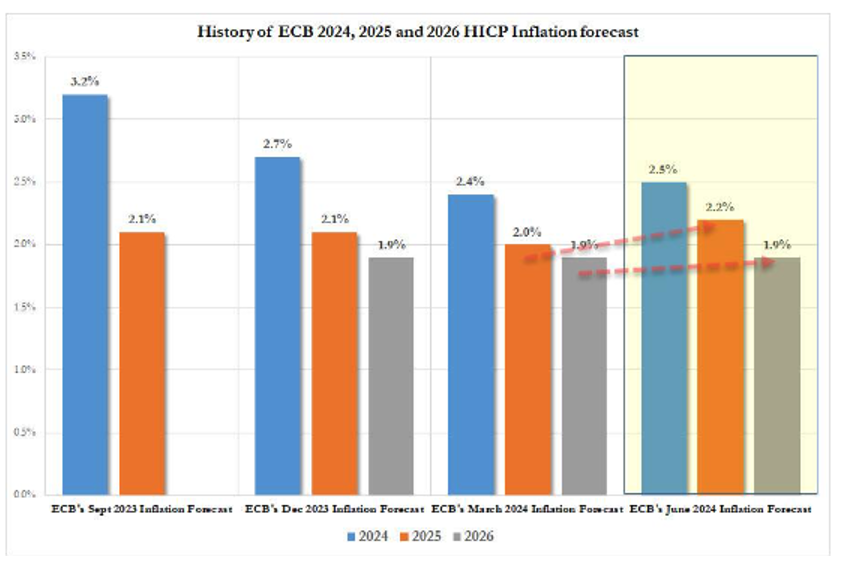

The ECB is in a similar position. They, however, experienced a larger early spike in inflation, reaching over 10%, which recently fell to 2.6%. This is significantly lower than the current 3.4% rate experienced in the United States but still well above their 2% target. Despite a recent price increase, they went ahead with their first rate cut since 2019 on June 6, 2024. Shockingly, on the same day, they adjusted their 2025 inflation projections to be 10% higher at 2.2% than their previous estimate of 2%.

Future Rate Directions

As shown above, Europe has already committed to a lower rate regime despite higher inflation expectations. While the US Federal Reserve estimated three rate cuts this year, they insist they are data-dependent. This puts them in a bind. They need to demonstrate that their policy is working to maintain credibility. High monthly CPI increases in the past four months would extrapolate to a 6.6% annual inflation level, a pace well beyond even the most tolerant levels. Employment numbers for May smashed expectations to the upside, putting further pressure to stay put. Looking deeper into the data, we see some cracks.

Economic Implications

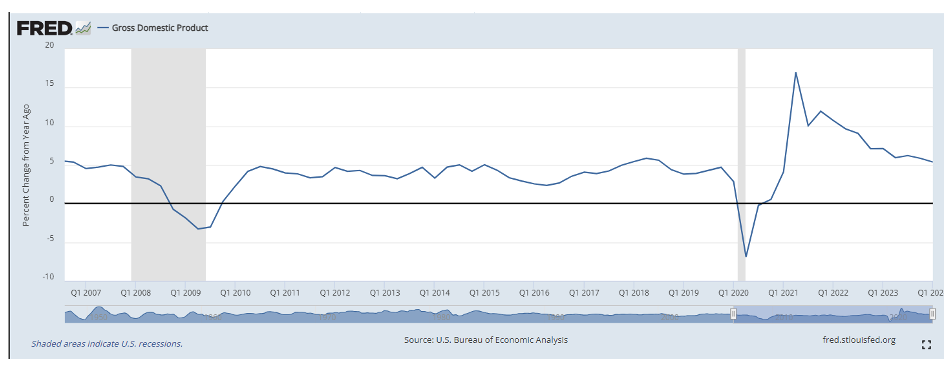

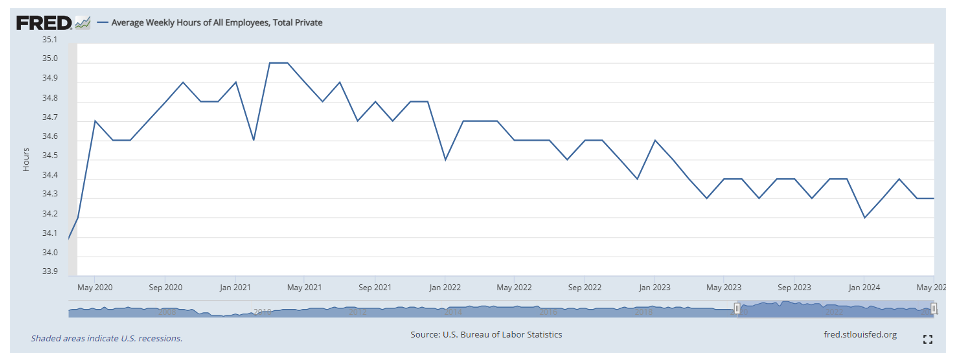

GDP in the United States is slowing. This growth rate is still running above recent levels, but the rate of change is declining. Much of the rise in the CPI is due to rents rising. This is logical, as the median monthly mortgage cost has been up a whopping 78% since 2020 due to higher interest rates and rising values. Meanwhile, part-time jobs count the same as full-time jobs on the employment surveys. Evidence shows that much of the “employment growth” occurred in this category. Hardly encouraging. Weekly hours worked declined since 2021 before settling into their current range. But is the underlying data enough to declare victory?

Economists’ Perspectives

Prominent economists, including Larry Summers, think a 2% target would trigger a recession. He advocates for a range of 2.75-3%. This might be very helpful in alleviating some pressure to pay back the $34 trillion in US debt, but it may fundamentally change expectations for how much one needs to save for retirement and more. Rates would have to compensate for the declining dollar value, putting homes and new businesses further out of reach. Nobody wishes for a recession, but sometimes, it comes with welcome effects. Lower rates, reduced price pressure, and a clear path for interest rates would be a few. Let’s see if that comes before or after central bank action.

References

- MSN: ECB Cuts Rates Despite Inflation Concern. What It Means for the Fed and Stocks.

- ZeroHedge: ECB Cuts Rates For The First Time Since 2019, Does Not “Pre-Commit To A Particular Rate Path”

- US News: Fed Signals Three Rate Cuts in 2024, End of Higher Interest Rate Cycle

Photo by Randy Tarampi on Unsplash