Is AI the next step in the evolution of trading? History proves new tools storm the markets, then high adoption erases their edge. What can futures trading history teach us about AI’s trajectory?

The 1980s: Rise of Rules-Based Trading

Building on simple regression models that aimed to identify patterns across sectors, the 1980s showed that following a logical process could be immensely successful. Richard Dennis famously proved that rules can trump talent. His “Turtles” followed emotion-free logic and banked $175 million in their first five years of trading. We broke down the experiment in our Trend Followers 101: Mastering Market Trends Like the Turtles article. Blind signal chasing backfired on Black Monday in 1987, exposing unforeseen risks to automated order execution. Stop-loss levels triggered cascading sell orders as new levels were breached, resulting in a 20.4% loss in the S&P. Regulators swiftly installed circuit breakers to guard against this type of panic selling following the event. The fix worked for a while.

The 1990s: Quants Take Over

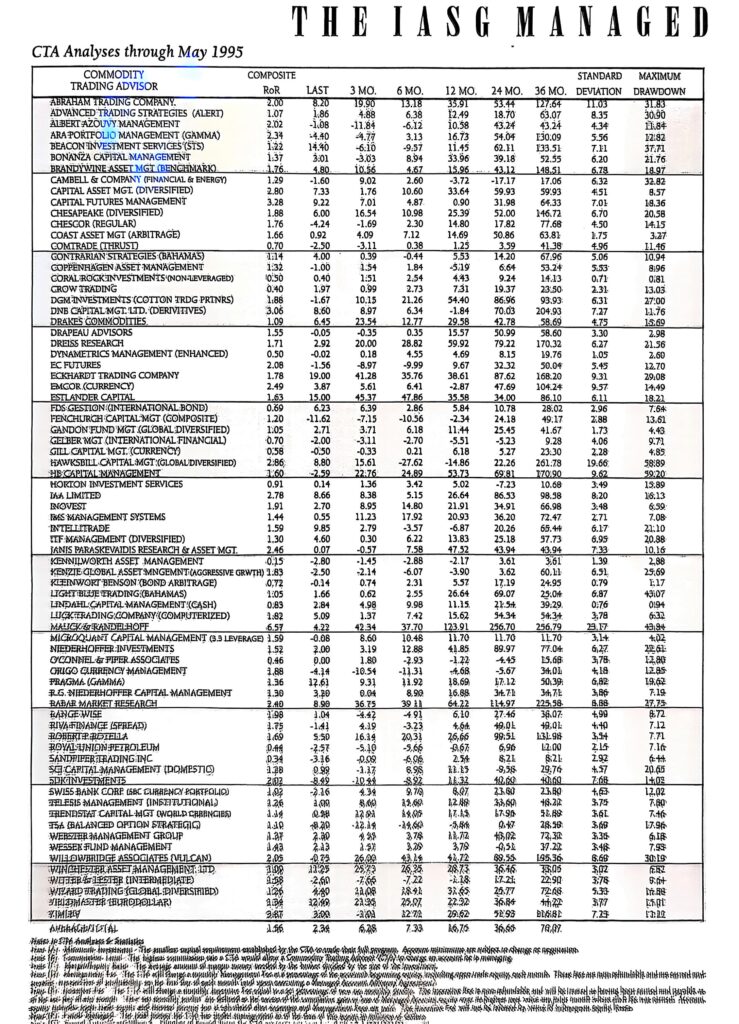

Widescale adoption of systematic trading begins in earnest with the earliest firms reaping the benefits. A snapshot of the IASG Futures Report from May of 1995 shows some of the biggest names of the generation (and others) annualizing well over 30%, despite a fee structure starting at 2/20 (management/incentive fee) and going above 3/25.

Perry Jonkheer, our founder, leaves his floor trading position to establish our company and offer these new trend-following managers. Computer technology makes it easier to analyze large datasets for back testing. This marks a shift towards systematic trading, away from discretionary decisions. Many traders find that they can automate their manual rules. High-frequency firms exploit small price differences in arbitrage trades. This liquidity narrows bid-ask spreads and shifts volume to electronic trading platforms instead of going through floor brokers.

The 2000s: Speed and Alternative Data

If the 90s were about building systems to understand the market, the 2000s were designed to do it faster. Co-location, hard-coded trading logic, and microwave networks took latency from a hundred milliseconds to less than one. $300 million fiber optic lines going from Chicago to New York were installed just to shave 3 milliseconds in trading time. The 2000 dot-com crash demonstrated that looking beyond pure price signals could provide alpha. Earnings, sentiment data, weather, and shipping data collections began to grow. This would provide the data for machine learning, the precursor to AI. The Financial Crisis of 2008 exposed mispricing in “niche” financial tools, such as credit default swaps. Trend followers benefitted from their consistent approach and provided some of the best returns of any asset class as equity markets began a slow but consistent slide into the crisis.

The 2010s: Machine Learning Takes Over

Despite the introduction of circuit breakers following Black Monday, the Flash Crash of May 2010 erased 9% loss of the Dow over just a few minutes as pre-defined exits again caused wild swings. This led to “upgraded” circuit breakers, as regulators once again adjusted to a new market cadence. Machines that could process massive data sets, identify patterns, and begin to predict price moves based on multi-dimensional factors became the norm. Access to cloud computing and faster GPUs (graphics processing units: i.e., computer chips) increased processing speed exponentially. This meant that the computers could learn at ever faster rates. A model needing two weeks to train on 1 million parameters in 2009 could do it in just a few hours by 2012. Real-time training can adapt to short-term market microstructures, unlocking edges that persist for hours instead of months. GPU cost becomes reasonable for almost anyone to use, especially in conjunction with the Amazon cloud (AWS) or others. Back testing, which once took weeks, now screens 10,000 strategies in a single night.

The 2020s: AI Becomes Mainstream

With the computing power available to everyone, AI becomes usable for everyday use. Large language models (LLMs) can read, write, and predict the human thought process. By reading trillions of words, it can absorb the implications of earnings calls, press releases, and financial reports in seconds and then trade accordingly. A simple prompt, such as the one below, can provide an instant summary of a call that lasts more than an hour, along with actionable insights.

You are a senior hedge fund analyst.

Read this earnings transcript and extract:

- Revenue guidance

- Margin trends

- Risks mentioned

- Bull/bear thesis

Reinforcement learning became more useful beginning in this decade, as decision-making shifted from identifying opportunities to managing positions and optimizing results. Prompts could be introduced to reduce risk, maximize the Sharpe ratio, rebalance, or minimize slippage. Imagine a market-making department replaced by a computer that can efficiently delta-hedge a large portfolio in real-time. Recent events, such as the “Meme Stock Rally” that defied the logic of previous regimes, can now be traded as behavioral updates in real-time.

2030 and Beyond – Autonomy

The natural progression of AI will inevitably lead to less human interference. Fleets of robotaxis will drive us to our destinations. Robots will be working in Amazon warehouses, packing boxes, and regulators will use AI to spot patterns or analyze language that constitutes insider trading. A question remains about what the workforce requirements will be to run large companies, as entire divisions will be let go and replaced with GPUs. One open question: How many humans will large firms still need?

Final Thoughts

A key element of a successful trading strategy is the creativity to build a unique approach. It remains to be seen if AI systems will correlate with each other, ultimately reducing their beneficial effect and possibly leading to future flash crashes. Conversely, we might see a new era of efficiency where company value is assessed fairly and bubbles become a thing of the past. Keeping an edge in financial markets is always a challenge. It is an exciting time to see how long the big players will keep theirs and if the nimble participants can use technology to catch up. The futures industry is built on the dissemination of data so prices can find their equilibrium. The best traders, human or silicon, will keep winning. May they earn every basis point.