Category: Uncategorized

Should I Care if a Managed Futures Fund has a Five-Star Rating?

So you see a manager with a good Morningstar rating. It has five-stars. Should an investor care? Past performance is not indicative of future returns, so should it matter if you had highly rated past risk-adjusted performance?

Certainly, a rating is not definitive, but as a heuristic on a fund’s relative performance, there is positive information to be gleaned from ratings.

A Difference between Theory and Practice

There is difference between theory and practice. The academic research study that identifies an obvious new risk premium may be difficult or impossible to implement in practice. The good firm is able to separate theory and practice and avoid implementing bad ideas. They will have a feel for whether it can be done in practice.

Networks and Plumbing – The Mechanics of Systemic Risk

Behind the backdrop of the vast changes in monetary policy over the post Financial Crisis period has been the movement to improve the regulatory environment for financial markets in order to reduce systemic risk. Significant work has been done to improve monitoring and rules to eliminate excessive speculative behavior, but as more regulations are proposed and more changes to the financial system are made, there is demising marginal benefit and a greater likelihood for unintended consequences. A rule that makes sense for one group may lead to a shift in risk capital and changes in behavior toward unregulated areas. Simply put, risky behavior will shift to the places where the cost of speculative behavior is least.

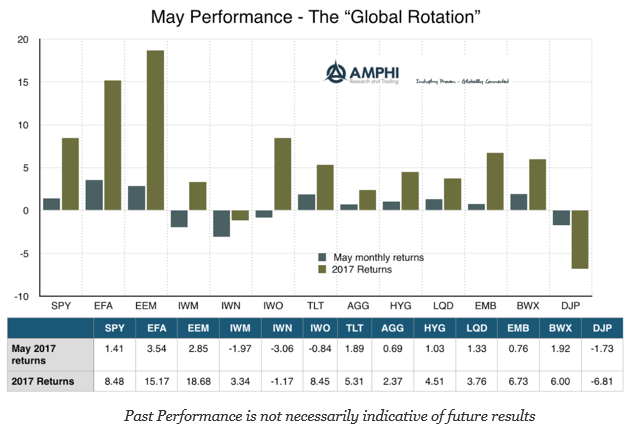

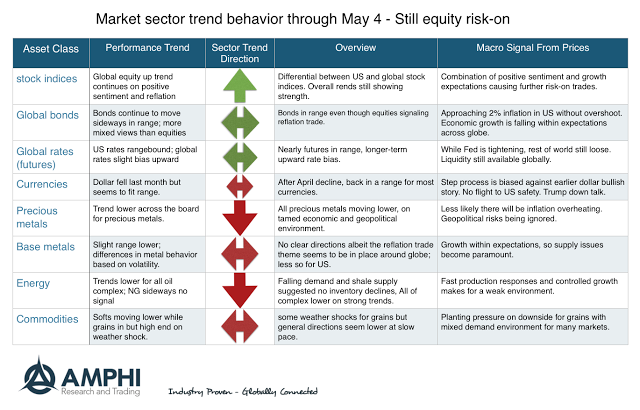

Sector Behavior Consistent with Economic Story but Wider Dispersion

While large cap and international stocks continued to move higher, the markets are starting to see more dispersion with small cap, growth, and value indices all posting negative returns for the month. The Russell value index has fallen to negative returns for the year. A growing dispersion is also evident in sector and country returns. Bonds have been a safe asset with positive gains for the year across all sectors. The returns are consistent with slow but positive growth around the world with controlled inflation.

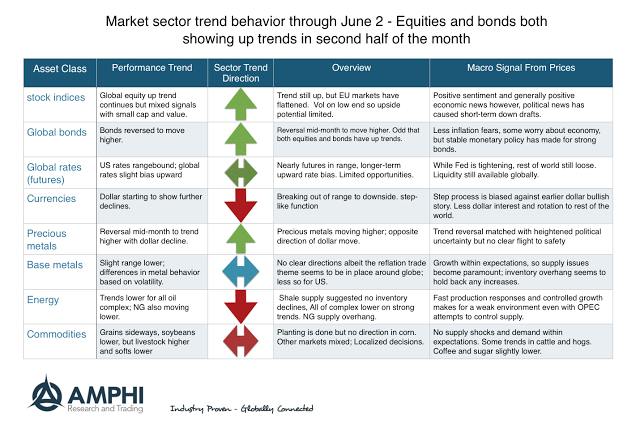

Trends for June – Up for Equities and Bonds

May was a mixed month for many trend-followers. Some did well while others got caught on the wrong side of mid-month reversals. The month saw a mid-month equity sell-off which could have stopped-out a number of key positions in equities and bonds. This sell-off was based on political uncertainty and not macro fundamentals.

Asset Class Performance – The “Global Rotation”

Call it the “Global Rotation”, but last month was a continuation of what we have seen for the year. There has been a flow of money into international stocks and increasing divergence between the rest of the globe and US risky assets. There is a dollar adjustment component to these returns, but there is no mistake that there is a preference for cheaper opportunities around the world.

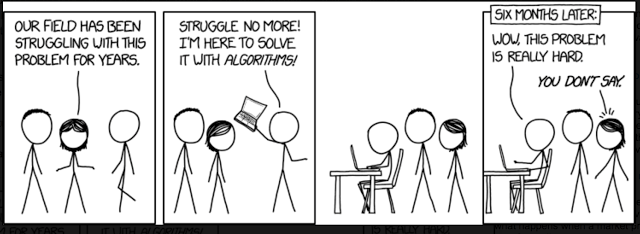

Avoid Atheoretical Data Analysis – A Rule for any Data Specialist

The process of scientific discovery, even within finance, is essential. One approach to finding new strategies could be to generate observations and then provide explanations, such as an inductive approach. The other is to first form a theory and then test a hypothesis, deductive reasoning. Much of machine and statistical learning is inductive reasoning, where […]

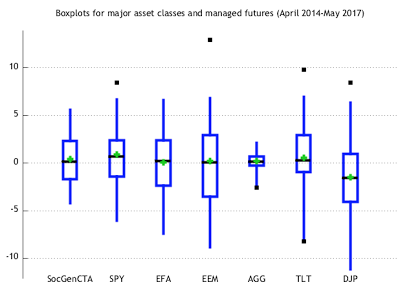

Looking at Asset Class Risk through Boxplots

Investors are so used to looking at standard deviation to define risk that they forget some easy exploratory data analysis tools that can be very helpful. The boxplot focuses on a greater description of the data through a simple display of a brand array of information. The box is formed by the first and third quartiles, the whiskers are 1.5 times the interquartile range, the green diamond is the average, and the black boxes are the outliers.

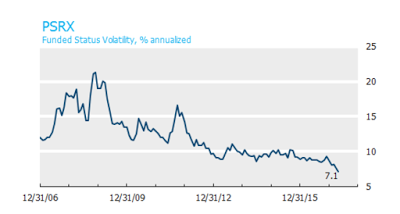

Pension Surplus Risk at all Time Lows

The Funded Status Volatility index (PSRX) from NISA is a useful tool for understanding pension risk exposures. It is an aggregate of the risks for pension based on the combination of assets and liabilities associated average allocations for the 100 largest pension funds as measured through public information and 10-k filings. The index, which represents $1 trillion in AUM, will move up and down with the volatility of all asset classes. Hence, falling equity and bond volatility as well as changes in the discount rates will translate into a falling PSRX index.

Quant Research and Managed Futures – Key Areas of Focus

Managed futures research is hard. This is especially the case in the quantitative area. There always are new models being tested by almost all managers, but finding a truly new model or process that adds value is truly difficult. Data mining is an issue.

The Importance of Liquidity in Metals Exchange and Futures Contracts

There should not be a lengthy discussion on what investors want from a metals exchange or futures contract—liquidity, liquidity, and liquidity. We use the word three times for each liquidity form that attracts trading. It does not matter if you are a hedger or speculator; the demand is the same; deep liquidity, so the cost […]

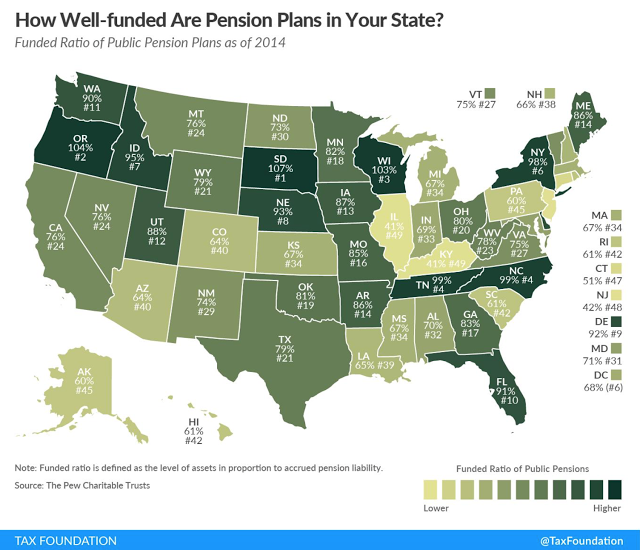

Who Needs Alternatives Like Managed Futures the Most? Underfunded State Pensions

The Tax Foundation map of state funding ratios for public pensions is very sobering. The amount of state under-funding is significant. These numbers are determined by the discounted expected liabilities relative to the assets held. To stay even with these ratios and assuming there is no surprise increase in liabilities, the states have to return the discount rate. These discount rates or expected returns seem unrealistically high.

Market Trends for May – Some Developing Strength

Going into the month, there are good up trends in place with global equities and down trends in oil, precious metals, and selected commodities. What is interesting is the inconsistency across some markets sectors. The reflation risk-on trade is still apparent in the global equity indices, but we are not seeing strong evidence of bond sell-off or rally. Oil prices suggest both supply strength and demand weakness. Gold and precious metals are out of favor with long-only investors. The idea that we will have a dollar rally on Fed hikes seems misplaced and there is less risk-on demand for the US relative to the rest of the world.