Category: Resources

Futures Commission Merchants Explained

New investors to the futures world often ask, “How does opening an account work?” It is a good question. Unlike traditional brokerage accounts, the rules of margin, how trades clear, and the counterparties involved operate differently. A Futures Commission Merchant, typically called by its FCM acronym, is a key player working between all the various […]

In Search of Crisis Alpha: A Short Guide to Investing in Managed Futures

By Kathryn M. Kaminski, Ph.D. Senior Investment Analyst,RPM Risk & Portfolio Management DisclaimerWhile an investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and, in fact, result in further losses in a portfolio. In addition, studies conducted on managed futures as a whole may not be […]

Frequently Asked Questions About Managed Futures

Individual and institutional investors are increasingly including Managed Futures as part of a diversified investment portfolio as they search for non-traditional and alternative investment opportunit

Analyzing the performance table

Disclosure documents include performance summaries for managed futures investments. Find out how to decipher the different pieces of information these summaries provide. Upon receiving a Commodity Trading Advisor (CTA) disclosure document, the first thing investors usually do is turn to the performance table found in the Past Performance section of the document. This is where […]

The Basics of Managed Futures: Understanding the Role of Commodity Trading Advisors

Managed futures are operated by licensed Commodity Trading Advisors, or CTAs, regulated in the United States by the Commodity Futures Trading Commission and the National Futures Association. Commodity trading advisors (CTAs) are asset managers who follow systematic investment strategies. Essentially, they are the operators of managed futures accounts and are directly responsible for the actual […]

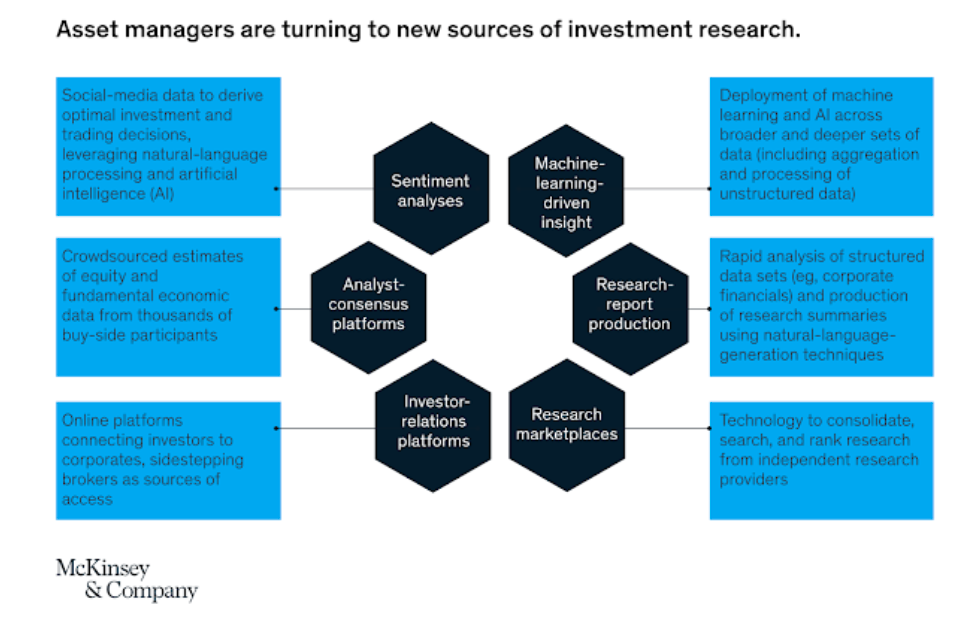

McKinsey & Co on investment management – Embracing advanced analytics only the beginning

A new research piece from McKinsey and Co focuses on the investment management industry, “Advanced Analytics in Asset Management: Beyond the Buzz”. This work is not cutting edge. It is straight forward advice that more analytics are being used in the distribution, back office, and the investment process, and investors are going to have to step-up their analytic game.

The Capital Appreciation Program: Spreads ‐ A Unique Approach to the Energy Sector

Corporate Summary Tyche Capital Advisors, LLC is a New York based registered commodity trading advisor currently offering trading programs to qualified investors. Through its trading programs, TCA will engage in speculative trading of futures and options contracts offered on the United States commodity exchanges and overseas futures exchanges. Tariq Zahir and Steve Marino are the […]

Peering Over the Fiscal Cliff

by Tyler Resch, Portfolio Manager, IASG As we go into the final few months of the year, we are more and more concerned with how we position ourselves going into 2013. A term I am hearing more often from concerned investors is the looming “fiscal cliff.” This “fiscal cliff” they are referring to is the […]

10 Reasons to Consider Adding Managed Futures to Your Portfolio

1. Diversify beyond the traditional asset class Managed Futures are an alternative asset class that has achieved strong performance in both up and down markets, exhibiting low correlation to traditional asset classes, such as stocks, bonds, cash, and real estate. 2. Reduce overall portfolio volatility In general, as one asset class goes up, others go […]

Definitions and Formulas

Arbitrage: Several sub-strategies fall under arbitrage. The most prevalent in the managed futures industry is statistical arbitrage. A simple example is simultaneously buying gold on one exchange (for a lower price) and selling gold on another exchange (for a higher price). This strategy looks to profit from the price difference. Average Commission: This represents the […]

Observations On the Death of Trend Following

This paper addresses issues contributing to the underperformance of trend following programs during the investment environment of the past five years, a set of conditions that may continue for some time. As the “trend following” debate rages on, our ultimate concern pertaining to the current conundrum is whether trend following strategies are no longer profitable. While I review comments from a variety of leaders in the field, both data and comments focus more heavily on the CTA (Commodity Trading Advisor) space than on that of other fund managers. Nevertheless, details are applicable to a variety of strategies. It is my hope that a broader perspective will encourage investors to ask more pragmatic questions, ultimately improving their manager selection process.

Lintner Revisited: The Benefits of Managed Futures 25 Years Later

Dr. John Lintner, a Harvard Professor, presented the seminal paper entitled “The Potential Role of Managed Commodity – Financial Futures Accounts (and/or Funds) in Portfolios of Stocks and Bonds” at the annual conference of the Financial Analysts Federation in Toronto in May 1983. The findings of his work, namely that portfolios of equities and fixed income exhibit substantially less variance at every possible level of expected return when combined with managed futures, remain as true as ever more than 25 years later. In this brief paper, we attempt to update Professor Lintner’s work by demonstrating that the beneficial correlative properties of managed futures presented in his research persist today. We also reintroduce managed futures as a diverse collection of liquid, transparent hedge fund strategies that tend to perform well in environments that are often difficult for traditional and other alternative investments.

Choosing a CTA …

… or maybe more than one. If you’ve decided to include Managed Futures in your investment portfolio, the next step is choosing the right mix of Commodity Trading Advisors to help achieve your investment objectives. Just as managed futures help diversify an investment portfolio, different CTA programs can provide another layer of diversity within the […]