Category: Managed Futures

Bowmoor Capital – A Different Approach to Trend Following

Competing head-to-head to outsmart others doing the same strategy is often a tough road. In trend following circles, giants like Man AHL, Winton, and Aspect dominate assets under management. This enables them to hire top PhDs, deploy better technology, test ideas rapidly, and outspend smaller players on sales and marketing. So how can a smaller […]

The 6 Biggest Myths About Diversification and Non-Correlation

“If everything in your portfolio goes up and down at the same time, you have a bad portfolio.” This simple but powerful observation from Mark Rzepczynski, former CEO of John W. Henry & Company, is one I think of often – for both my customers and my own investing. A losing position in your portfolio […]

Anatomy of a Tough Month for Trend-Followers: Tariff Shocks & Volatility Spikes

It is often said that trend followers provide “crisis alpha.” This means that market stress often benefits their strategies. This follows logically as moves get larger, coordinate together, and run consistently, trading becomes easier. These managers quickly caution that they do not always provide this negative correlation. Price action can swing unpredictably against long-standing trends […]

Cayler Capital | April Performance Commentary

After finishing off one of the wildest quarters of my trading career, April managed to take the cake. For those that missed it (not sure how you possibly could have), oil settled negative $37. The effects of this were immediate: risk barometers had to be recalculated, option models switched, and most importantly was the immediate […]

Warrington Asset Management – Looking back on July

The S&P 500 continued to climb steadily up to the last trading day of the month even though market participants knew that day could bring volatility, as the U.S. Federal Reserve (the “Fed”) was scheduled to announce their latest monetary policy update on July 31st. Speculation about their intentions to lower interest rates for the first time in ten years had been a market focus for months. Fed Funds futures pricing is often used to estimate the probability of pending Fed interest rate changes, and had signaled the most likely decrease to be between 25 and 50 basis points. However, when Charmain Powell announced the 25 basis point cut he also implied it might be a “one and done” scenario rather than a prolonged rate cutting cycle favored by market participants, causing an immediate decline in stock prices. The selling in the S&P was strong, sending the Index to its largest intraday decline since early May. In fact, prior to that drop, the S&P had not had a 1% daily gain or loss in the previous 36 consecutive trading days, the longest streak since early October 2018.

Bending the return curve with rebalancing using trend-following

Rebalancing has become an essential tool for portfolio management. Nevertheless, market return patterns will affect the return impact of rebalancing. Regular rebalancing is a mean-reverting strategy. For example, suppose there is a simple 60/40 stock/bond portfolio. In that case, stronger stock performance will cause the allocation to deviate from the strategic allocation and lead to […]

Thinking about skew – Alternative skew measures

I was having a discussion about the merits of managed futures relative to other hedge fund styles. Managed futures funds will often have positive skew versus other hedge fund styles. The measurement of skew is tricky and is not present with all managers but for trend-followers who allow profits to accrue, it is more likely. The argument for positive skew is embedded in the behavior of the managers.

Managed futures trend-following performance – It is not volatility but the stress that matters

“Crisis alpha” is used as a quick description of managed futures trend-following, but there has been very little work to explain what the term means. A generic definition is that a crisis is when equity markets have a significant decline, but that definition tells us nothing about what will be the conditions for a crisis or when a crisis will occur.

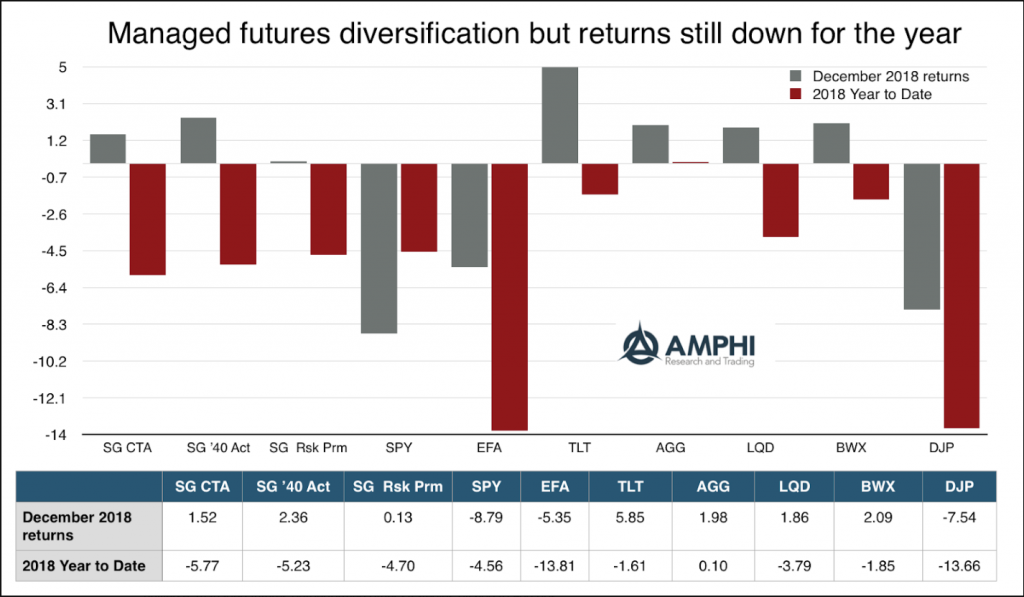

Managed futures – Provided return and diversification during difficult December

With strong trends in both bonds and equities, managed futures generated good positive returns for December. The index average does not do justice to the positive performance for some managers. For example, the CS Managed Futures Liquid Index was up around 6% for the month or four times greater than the SocGen CTA index. All of the CTA indices from BarclayHedge reported gains except for Agricultural traders. Managed futures also did well versus other hedge fund strategies and proved to be uncorrelated during the December market disruption. Versus other hedge fund strategies within the Credit Suisse liquid beta universe, managed futures outperformed other strategies by 600 to 900 bps.

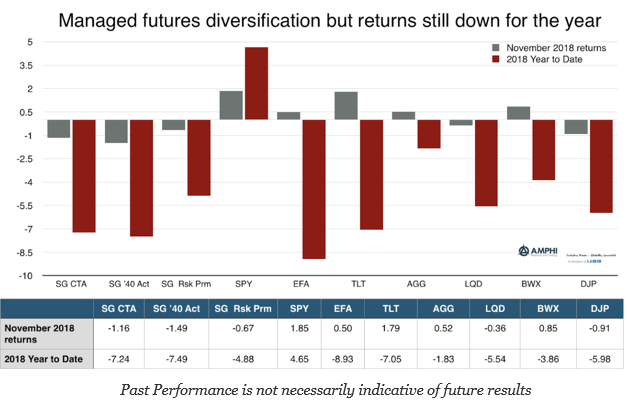

Managed Futures Funds Not Able To Find Trends

This was a negative month for managed futures funds as measured by peer indices for a simple reason, range bound behavior in equities and a reversal in bonds. Equity indices have started to trend higher, but longer-term trend followers were not able to effectively exploit these moves in the second half of the month. Global bonds have trended higher for most of the month but smaller position sizes based on higher volatility limited gains. Oil prices offered strong gains, but the size of positions may not have large enough to make an overall impact on fund returns. Commodity trades are generally a small portion of the total risk exposure for large funds.

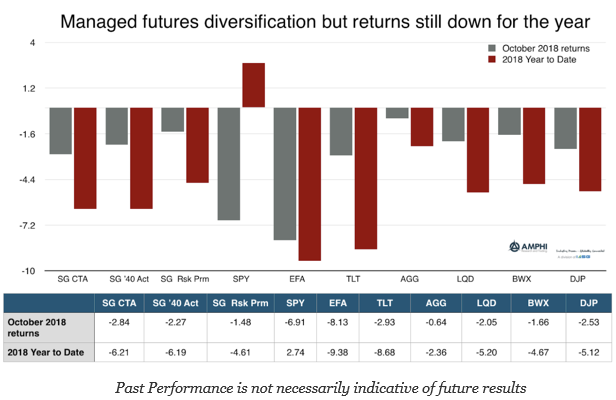

Managed Futures – No Crisis Alpha in the Short-Run

Market performance for October was sobering. Investors were complacent to volatility and the fact that markets correct. The speed of adjustment hurt the average managed futures manager who was not able to get out of markets, which repriced at the beginning of the month. Although the month ended with some improvement from return lows, there is little to celebrate.

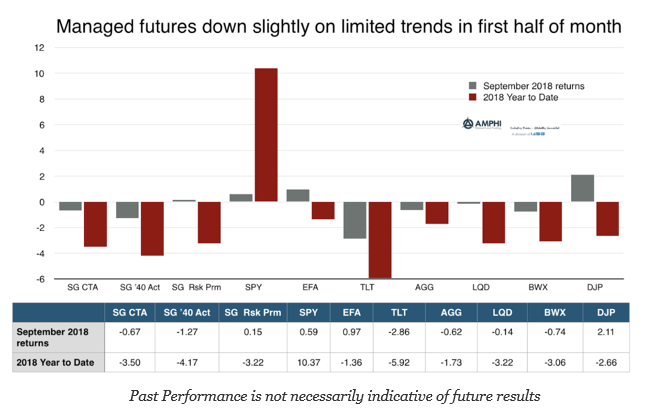

Managed Futures Down for Month but Within the Range of Performance for Other Asset Classes

Managed futures, as measured by the SocGen CTA index, showed a slight decline in return for the month, but this performance within the range of most asset classes with the exception of equities. Being long market beta is still king for the year with little absolute performance value from diversification.

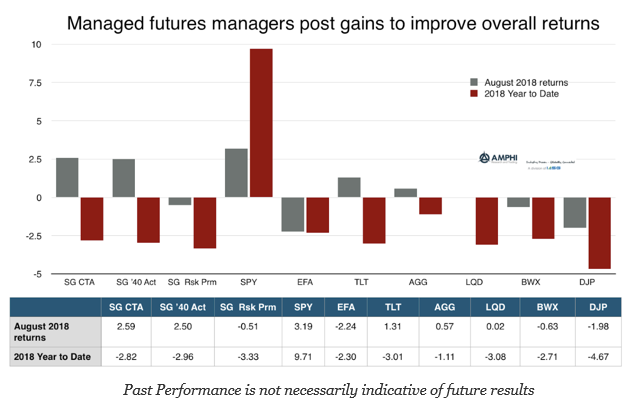

Good Month for Managed Futures – Finding Opportunities in Financial Markets

Managed futures showed good returns for August with gains in both stock indices and bonds. Given size and liquidity, as equity and global bonds goes, so goes CTA performance; however, there were also gains in selling grain markets and taking advantage of shorter-term trends in the energy sector. Other CTA indices like the BTOP50 also showed strong gains for August and similar year to date numbers at -2.66 percent. The SG alternative risk premia was down slightly for the month.