While an investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and in fact result in further losses in a portfolio. In addition, studies conducted of managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the past may not be indicative of current time periods. Managed futures indices such as the Barclay CTA Index do not represent the entire universe of all CTAs. Individuals cannot invest in the index itself. Actual rates of return may be significantly different and more volatile than those of the index.In this paper we attempt to update Professor Lintner’s work by demonstrating that the beneficial correlative properties of managed futures presented in his research persist today.

Dr. John Lintner, a Harvard Professor, presented the seminal paper entitled “The Potential Role of Managed Commodity – Financial Futures Accounts (and/or Funds) in Portfolios of Stocks and Bonds” at the annual conference of the Financial Analysts Federation in Toronto in May 1983. The findings of his work, namely that portfolios of equities and fixed income exhibit substantially less variance at every possible level of expected return when combined with managed futures, remain as true as ever more than 25 years later. In this brief paper, we attempt to update Professor Lintner’s work by demonstrating that the beneficial correlative properties of managed futures presented in his research persist today. We also reintroduce managed futures as a diverse collection of liquid, transparent hedge fund strategies that tend to perform well in environments that are often difficult for traditional and other alternative investments.

While many casual observers most closely associate managed futures and Commodity Trading Advisors with trend following, the reality is that the strategies and approaches within managed futures vary tremendously, and that the one common unifying theme is that these managers trade highly liquid, exchange-traded instruments and deep foreign exchange markets. As a result, the terms many fund managers choose to implement, including lockups, gates, side pockets, and penalties for early redemptions, rarely apply to investments in managed futures.

Liquidity and transparency also simplify risk management, and investing via separately managed accounts, a common practice among managed futures investors, mitigates the risk of fraud since investors retain custody of assets.

Trend following has demonstrated performance persistence over the more than 30 years since the first “turtle” strategies began trading, and many of the largest and best known CTAs employ variations of diversified trend following systems. These strategies should play a role in all well-diversified institutional portfolios, but they account for only one of many varieties of managed futures strategies, the vast majority of which exhibit no statistical relationship whatsoever with trend following programs.

Counter-trend strategies attempt to capitalize on the often rapid and dramatic reversals that take place at the end of trends. Some quantitative traders employ econometric analysis of fundamental factors to develop trading systems. Others use advanced quantitative techniques such as signal processing, neural networks, genetic algorithms, and other methods borrowed and applied from the sciences.

Recent advances in computing power and technology as well as the increased availability of data have resulted in the proliferation of short-term trading strategies. These employ statistical pattern recognition, market psychology and other techniques designed to exploit persistent biases in high frequency data. The countless combinations and permutations of portfolio holdings that these trading managers may hold over a limited period of time also tend to result in returns that are not correlated to any other investment, including other short-term traders.

The countless combinations and permutations of the portfolio holdings of these managers over a limited period of time also tend to result in returns that are not correlated to any other investment.

A useful analogy for different managed futures trading programs and styles, as well as for alternative investments in general, consists of thinking of each trading style or program as different radio receivers, each of which tunes into different market frequencies. Simply put, some strategies or styles tend to perform better or “tune in” to different market environments. The diverse and uncorrelated investments offered by managed futures allow institutional investors to access an entire universe of liquid transparent hedge fund strategies to add to their portfolios.

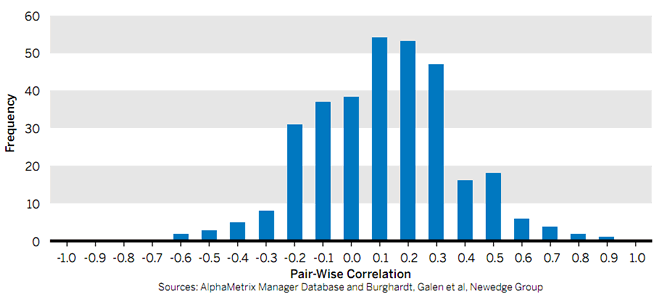

Exhibit 1

Distribution of Pair-Wise Correlations Among Constituents in the AlternativeEdge Short-Term Traders index, January 2003 – October 2008.

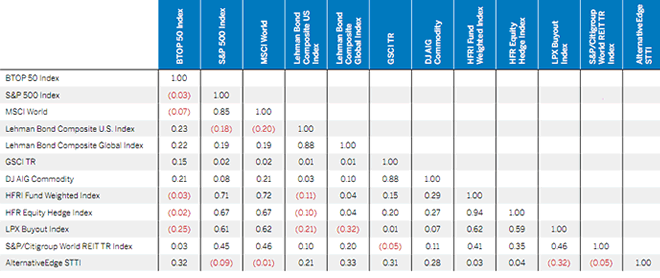

Exhibit 2

Correlation Matrix of Traditional and Alternative investment Benchmarks

Sources: AlphaMetrix Alternative investment Advisors, Bloomberg, LPX GmbH. All statistics calculated to maximize number of observations, as such number of observations used for calculations varies (BTOP 50 – Jan 1987, S&P 500 – Jan 1980, MSCI World – Jan 1988, Lehman Bond Composite US index – Sep 1997, Lehman Bond Composite Global index – Feb 1980, GSCI Tr – Jan 1980, dJ AiG Commodity index – Feb 1991, HFr Fund Weighted index – 1990, HFr Equity Hedge index – Jan 1990, LPX Buyout index – Jan 1998, S&P/Citigroup World REIT TR index – Jan 1990). All statistics calculated through Sep 2008 with the exception of the Lehman Bond indices, which are calculated through Aug 2008. The AlternativeEdge STTI begins in January 2003 and assumes equal weightings to 23 short-term traders, the constituents, defined as futures traders with an average holding period of less than 10 days. The constituents’ returns are actual, but the index returns are proforma. in instances where the track record for a program or programs had not yet commenced, its weighting is divided on a pro-rata basis among all other constituents.

The long-term correlations among equities, fixed income and managed futures remain low even 25 years after Lintner’s study, suggesting its continuing relevance to investors interested in attaining the “free” benefits of diversification. Exhibit 2 illustrates the low and occasionally negative correlations among managed futures and other investments.

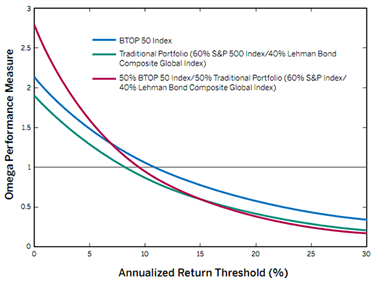

Studying the potential role of managed futures in traditional portfolios of stocks with the Omega lens for risk-adjusted performance takes a modern approach to the Lintner study. Lintner did not have the benefit of the Omega tool during the time he conducted his work, and the Omega function encodes all the higher statistical moments and distinguishes between upside and downside volatility, whereas the Sharpe ratio does not.

Exhibit 3

Correlation Matrix of Traditional and Alternative investment BenchmarksSource: AlphaMetrix Alternative Investment Advisors. Bloomberg data. Note that the Lehman Bond Composite Global Index cease reporting after August 2008 and therefore return information does not exist for September 2008.

Exhibit 3 indicates that for low thresholds, the combination of managed futures and a traditional portfolio is best, and for higher thresholds a portfolio of managed futures is dominant. Moreover, a traditional portfolio of stocks and bonds combined with managed futures is superior at every meaningful threshold (i.e., where any of the graphs have an Omega score of at least 1.0).

These Omega results yield a very compelling argument for the inclusion of managed futures in an institutional portfolio. For a review of Omega graphical analysis, please refer to [Bhaduri & Kaneshige, 2005].

Managed futures are not and should not be viewed as a portfolio hedge, but rather as a source of liquid transparent return that is typically not correlated to traditional or other alternative investments.

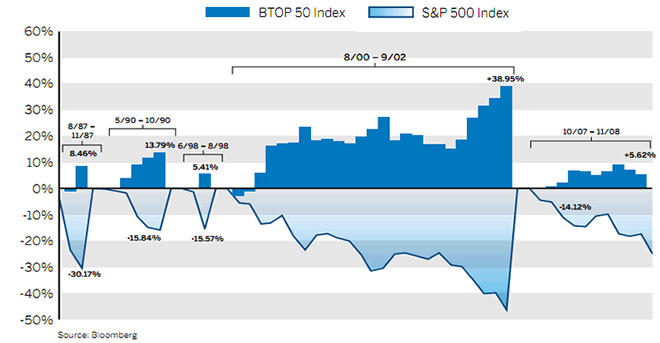

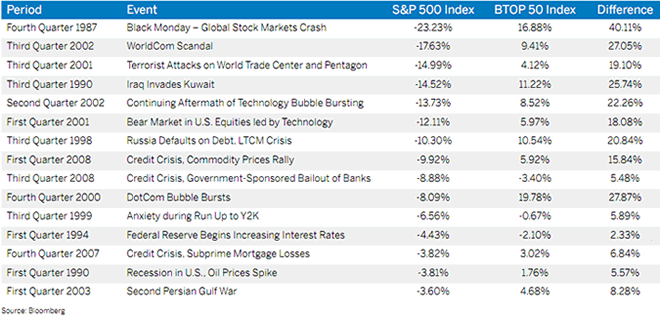

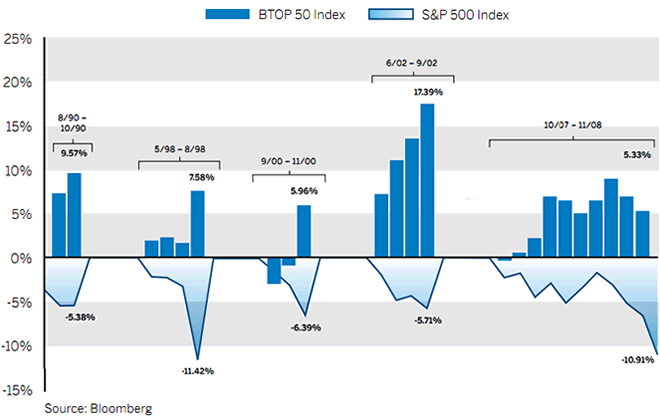

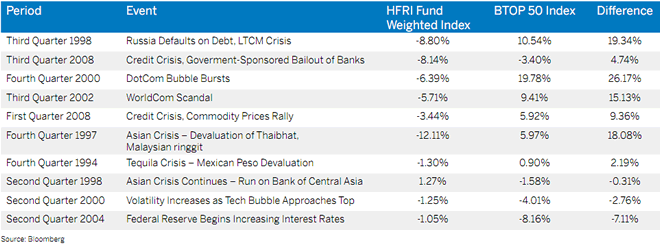

Although managed futures has often produced outstanding returns during dislocation and crisis events, it must be emphasized that managed futures are not and should not be viewed as a portfolio hedge, but rather as a source of liquid transparent return that is typically not correlated to traditional or other alternative investments. Some of the different approaches taken by managed futures managers tend to exploit the sustained capital flows across asset classes that typically take place as markets move back into equilibrium after prolonged imbalances. Others thrive on the volatility and choppy price action which tend to accompany these flows. Others still do not exhibit sensitivity to highly volatile market environments and appear to generate returns independent of the prevailing economic or volatility regime. Exhibits 4 – 7 illustrate the performance of the BTOP 50 Index during periods that have historically been difficult for both the S&P 500 Index and most hedge fund strategies.

Exhibit 4:

BToP 50 vs. S&P 500 during S&P 500’s Worst Five drawdowns Since 1987

Exhibit 5:

Performance of the BTOP 50 Index during 15 Worst Quarters of S&P 500 index Performance

Exhibit 6:

BTOP 50 vs. HFRI Fund Weighted Index During HFRI Fund Weighted Index’s Worst Five drawdowns Since 1990

Exhibit 7:

Performance of the BTOP 50 Index During Worst Ten Quarters of HFRI Fund Weighted Index Performance

Conclusion

Managed futures present very real risks for investors just like any other hedge fund style. Investors can potentially experience volatility and substantial drawdowns, especially if the trading manager has set a higher return objective and is taking more risk to try to obtain it. Investors should always conduct thorough due diligence to properly understand the potential risks and weaknesses of trading programs before investing. This is especially important because the trading methodologies employed by CTAs, the level of risk and return that is targeted, and the quality of the operational infrastructure of trading managers may vary tremendously across the space. As such, it is critical that the investor takes the time to properly understand the nuances of the trading manager’s investment strategy and risk management, as well as the domain of instruments traded and potential concentration risks. The investor should also be acutely aware of operational risks and should make every effort to understand the relationship between the trading manager, associated entities, patterns in personnel turnover, trade execution and order flow, and compliance and operational policies and procedures. The investor should also take care to read and understand any disclosure documents, prospectuses, and offering memoranda prior to investing in a manager’s fund in order to understand additional risks and relevant disclosures. It is also important to make sure that proper governance and separation of duties exists within the trading manager as well as among the trading manager, its fund, and service providers. Only by conducting proper due diligence and vetting of the trading methodology and manager’s credentials can the investor determine the suitability and potential risks of the investment.

Managed futures offer institutional investors actively managed exposure to a truly global and diversified array of liquid, transparent instruments. The returns of many managed futures funds do not display correlation to traditional or alternative investments, nor to one another. Institutional investors should view managed futures not only as a means to enhance portfolio diversification, but also as liquid absolute return vehicles with intuitive risk management.

Sadly, Litner died shortly after presenting his treatise on the role of managed futures in institutional portfolios. It is remarkable just how solid his argument has remained over the past 25 years. The inclusion of managed futures in an institutional portfolio leads to better risk-adjusted performance (either through the mean-variance framework or through the more modern Omega analysis). The results are so compelling that the board of any institution, along with the portfolio manager, should be forced to articulate in writing their justification for not having a substantial allocation to the liquid alpha space of managed futures.

It is also fitting that during the silver anniversary of Dr. Lintner’s fine work, it survived the ultimate litmus test through the historic financial meltdown of 2008. Managed futures have been one of the very few bright spots for investments (both alternative and traditional) during this recent crisis in the economy.

Indeed, one might argue that Dr. Lintner saved his very best work for last.

The results are so compelling that the board of any institution, along with the portfolio manager, should be forced to articulate in writing their justification in not having a substantial allocation to the liquid alpha space of managed futures.

Authors & References

- Ryan Abrams

rabrams@alphametrix.com - Ranjan Bhaduri

rbhaduri@alphametrix.com - Elizabeth Flores

elizabeth.flores@cmegroup.com

References:

- Bhaduri, Ranjan and Bryon Kaneshige. “Risk Management – Taming the Tail.” Benefits and Pensions Monitor, December 2005.

- Bhaduri, Ranjan and Christopher Art. “Liquidity Buckets, Liquidity Indices, Liquidity Duration, and their Applications to Hedge Funds.” Alternative Investment Quarterly, Second Quarter, 2008.

- Bhaduri, Ranjan, Gunter Meissner and James Youn. “Hedging Liquidity Risk.” Journal of Alternative Investments, Winter 2007.

- Bhaduri, Ranjan and Niall Whelan. “The Value of Liquidity” Wilmott Magazine, January 2008.

- Burghardt, Galen et.al. “Correlations and Holding Periods: The research basis for the AlternativeEdge Short-Term Traders Index”. AlternativeEdge Research Note. Newedge Group, June 9, 2008.

- Center for International Securities and Derivatives Markets (CISDM). “The Benefits of Managed Futures: 2006 Update.” Isenberg School of Management, University of Massachusetts, 2006.

- Fischer, Michael S. and Jacob Bunge. “The Trouble with Trend Following.” Hedgeworld’s InsideEdge. November 20, 2007.

- Keating, Con, and William F. Shadwick. “A Universal Performance Measure.” The Finance Development Centre, 2002.

- Lintner, John. “The Potential Role of Managed Commodity-Financial Futures Accounts (and/or Funds) in Portfolios of Stocks and Bonds.” The Handbook of Managed Futures: Performance, Evaluation & Analysis. Ed. Peters, Carl C., and Ben Warwick. McGraw-Hill Professional, 1996. 99-137.

- Ramsey, Neil and Aleks Kins. “Managed Futures: Capturing Liquid, Transparent, Uncorrelated Alpha.” The Capital Guide to Alternative Investment. ISI Publications, 2004. 129-135.

* All charts, graphs, statistics, and calculations were generated using data from Bloomberg, the Barclays Capital Alternative Investment Database, LPX GmbH, and Manager Reported Returns.