Bonds – More Than Meets the Eye

When buying equities, some investors plan for a short holding period, seeking to capitalize on short-term price fluctuations – “a trade”. Others plan on a longer holding period based on economic or fundamental analysis – “a long-term strategic investment”. Regardless of which tactic is employed, few schedule a specific day, month or even year for divestiture. Contrast this with the bond investor’s strategy, whereby many bondholders seek to hold their investment to its maturity date. Those bond investors possessing this predilection are likely unaware of potential opportunities that trading bonds offers. In this era of historically low yields the opportunity for outsized returns may be significantly larger than current yields advertise if one considers selling a bond prior to its maturity.

Consider the case of a 10-year bond maturing November 1, 2025 with a yield of 2.50%. Such a bond may be overlooked today as many believe a paltry 2.50% annual return is not worth the associated risks. These investors fail to see the opportunity of holding that bond for a shorter term and earning a much different total return. Professional bond traders, portfolio managers and a small number of retail investors frequently buy bonds with no intent to hold them to maturity. They are purely trading expected changes in bond yields and prices.

Bond Math

The duration of a bond is defined as the sensitivity of a bond’s price to a change in the yield. A bond with duration of 5 years, for example, implies that a 1% change in yield will result in a 5% change in price. Duration, expressed in years, is a function of interest rate and time to maturity. The longer the maturity date and lower the interest rate, the larger the duration and vice versa.

Let’s compare a 10-year U.S. Treasury bond using two scenarios to gauge potential total returns based on yield changes. The U.S. Treasury 10-year note has the following characteristics:

| Maturity | 8/15/2025 |

| Coupon | 2.00% |

| Current Price | 99.50 |

| Current Yield | 2.06% |

| Duration | 8.947 |

| Coupon Payments | Semi-annual |

Scenario 1: 10 year Treasury yields rise to 2.25% with a 1 year holding period.

Scenario 2: 10 year Treasury yields drop to 1.75% with a 3 month holding period.

In the first scenario, the investor purchases $100 face value of the bond at $99.50 and sold it a year later at $97.80 for a loss of $1.70. Offsetting the price loss would be 2 coupon payments worth $1 each. The total annual return for the investor would be 0.30% (-$1.70+$2.00).

In the second scenario, the investor also purchased the bond at $99.50 but sold it for $102.24 after a 3 month holding period, resulting in a gain of $2.74. Additionally the investor earned 3 months of the coupon (3/12 * 2%) or $0.50. The total return gained over the 3 month period would be $3.24 (3.26%), or about 13% annualized. Despite the relatively small change in yield and short holding period, the duration allowed the investor a return much greater than the stated annual yield 2.06%

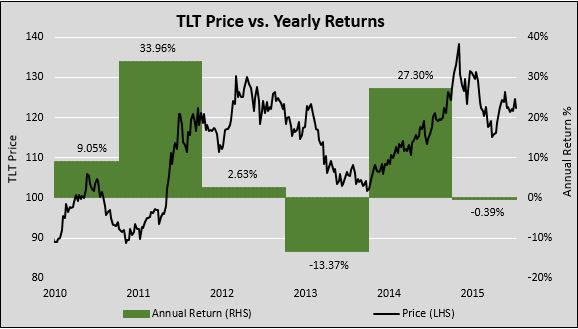

The graph below expands on the scenarios. It plots the price and annual returns of TLT, a 20 year U.S. Treasury bond ETF.

The graph and the examples highlight that when holding bonds for shorter periods of time, total returns can differ sharply from current yields. Despite historically low yields, bonds offer the potential opportunity to make significant returns. Slowing domestic and global economic growth coupled with deflationary pressures are one of many reasons to consider “trading” bonds as both a source of meaningful returns and diversification.

The follow up to this article will highlight various fundamental and technical indicators which are helpful in predicting future bond returns.

**Bonds tend to trade with higher commission rates and wider bid/offer spreads than stocks. In addition to price risk, bonds also carry credit risk which can significantly affect returns. Those lacking in-depth knowledge of the workings of the bonds markets, should consult a professional, such as a CTA, to help manage trading opportunities in the bond markets.

Article contributed by Michael Lebowitz of 720Global