Absolute return strategies aim to generate positive returns irrespective of market direction. A more accurate and appropriate definition is that absolute return, or active investment management, always seeks to minimize losses. We mentioned this as a core attribute of an absolute return strategy in “Why an Absolute Return Strategy,” but this simple concept is worth further description.

On the surface, advising one to limit losses would seem to re-state the obvious, but few investors truly understand why this is so important. This piece provides examples that drive this point home. Doing so demonstrates the value added to an investment portfolio that is partially allocated or possibly fully committed to an absolute return strategy.

Example 1: Recovery Percentage and Loss Magnitude

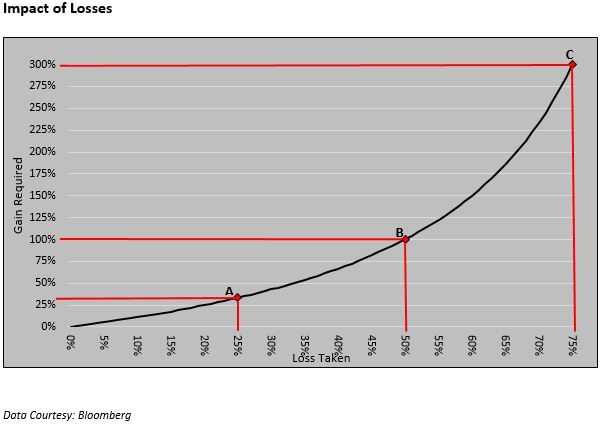

First, consider the percentage gains required to recover from losses fully. If one takes a modest loss of 10% in their portfolio, then the math demands a gain of 11.1% to break even. If a stock priced at $100 drops 10% to $90, an identical 10% gain from $90 only affords a recovery to $99 ($90 x 10% = $9). The subsequent percentage gain must be larger than the original percentage loss to fully recover what one has lost ($10/$90 = 11.1%). The chart below demonstrates why smaller losses may be manageable, but large losses are devastating.

In scenario A, a return of 33.33% is required to recover from a 25.00% draw-down fully. However, As losses grow, the return needed to offset the losses grows exponentially. Scenario B, for instance, requires a return of 100% to offset a 50% loss, while an investor who lost 75%, as in scenario C, requires a whopping 300% to break even. The takeaway from the graph above is that the subsequent percentage gain needed to recover a loss is much lower when losses are diminished. Additionally, the recovery percentage required to break even rises at an increasing rate as losses escalate.

Example 2: Real-World Scenario of S&P 500 Setbacks

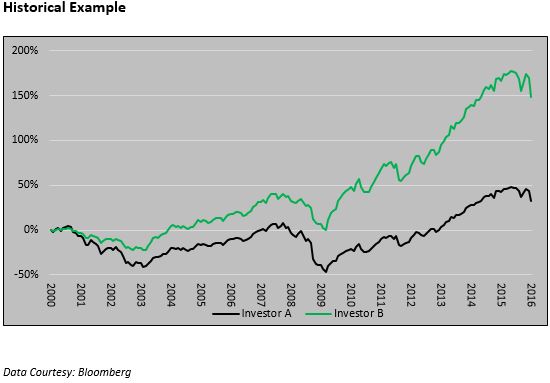

We present a real-world example to emphasize further why limiting losses is essential to building wealth. Since March 2000, the S&P 500 has suffered two serious setbacks – the first one, beginning in the year 2000 and extending through 2002, was a decline of over 47%, and the second, during the more recent 2008 financial crisis, was a drop of over 55%. The robust equity market recovery since 2009 produced a full re-capture of the pri

or two setbacks resulting in a 1.80% annualized total return for those that held stocks through the 15 years.

The chart below considers an alternative scenario, however. Suppose an investor had astounding foresight and reduced their equity positions in half during the above two downturns. In this case, the fortunate investor (investor B in the chart below) would have amassed a gain of 148%, approximately 4.5 times greater than an investor (investor A) who held a steadfast 100% position in the S&P 500.

Summary

There are two perspectives one can use in investing. Either invest capital in a way that will maximize gains or invest it in a manner that will prevent significant losses. Investing to maximize gains generally implies that the risk of loss is subordinated to the opportunity to make money. In this way, the gains that can be garnered are given psychological precedent in this strategy. Alternatively, focusing on the loss of exposure radically changes how one evaluates opportunities.

Limiting losses, which may sometimes reduce potential gains, produces a much more powerful positive compounding effect over the long run and helps make wealth objectives more easily achievable. Lance Roberts, Realinvestementadvice.com, sums this up nicely as follows:

“It is ALWAYS okay to miss out on an opportunity, as opportunities come as often as a taxi cab in New York City. However, it is IMPOSSIBLE to make up losses as you can never regain the time lost getting back to even”.

CTA’s offer unique strategies, many of which were discussed in “Absolute Return Strategies,” that can play a role in helping an investor build an absolute return portfolio.

**This discussion on losses is supported by the research of Ed Easterling at Crestmont Research. We highly recommend reading Half & Half: Why Rowing Works by Ed Easterling for further reading on the topic.