The Absolute Return (AR) series of articles provides a primer on alternative investment styles to which few investors have access. Global markets and economies appear to be at the precipice of a paradigm shift making the timing of the AR series of unique value.

In the 7 years since the financial crisis, most asset prices have experienced significant appreciation allowing for even the most inexperienced investor to increase his or her wealth. As the saying goes, “a rising tide lifts all boats”. For investors, understanding the tide of financial momentum is extremely important. Accordingly, we summarize 4 primary drivers of past returns to help gauge whether the tide can continue to rise or if retreat is more likely.

Central Banks (CB) – There are two issues of concern related to the actions of the CBs. First, policy divergence between the Federal Reserve (Fed) and all other developed countries’ central banks is occurring. Beginning with the Fed decision to taper Quantitative Easing (QE) in late 2013, and more recently the increase in the Federal Funds interest rate, the Fed has initiated a policy path opposite that of the other central banks. Given the U.S. dollar is the world’s reserve currency, this policy divergence has an outsized effect on global liquidity and markets. In fact it is negating significant incremental easing in Europe, Japan and China.

The second and more concerning issue is the question of the efficacy of CB policy actions going forward. For all of the extraordinary monetary policy actions taken since the great financial crisis, there is growing anxiety that each incremental move – more QE, negative interest rates, etc. – offers diminishing returns. In fact, based on recent markets reactions to Japan implementing negative rates, there is belief that such actions are having a counterproductive effect on economic growth and equity markets.

China – Last August, China initiated a currency devaluation in what appears to be the end of a peg to the U.S. dollar. The structural slowing of the Chinese economy since the financial crisis has been largely offset by a rapid accumulation of debt which was largely deployed to build unused infrastructure. This acute misallocation of capital is nearing its limits and leaving China with less economic growth and a multitude of serious financial imbalances. These problems, which will take years to work through, create significant impacts globally.

Debt Burden – Despite isolated pockets of deleveraging since the financial crisis, total debt outstanding, in absolute terms and relative to global GDP, has risen substantially. The ability of governments, corporations and individuals to service the rising mountain of debt has thus far been enabled by persistently falling interest rates and other extraordinary CB policy actions. The accumulation of debt has largely been unproductive, and leaves a condition where interest rates need to keep declining in order to allow for the debt to be serviced and repaid. In this scenario, the growing debt burden will shift from an economic tailwind to an extreme headwind. Rising delinquencies and climbing default rates may be a sign that a change in the credit cycle is already upon us.

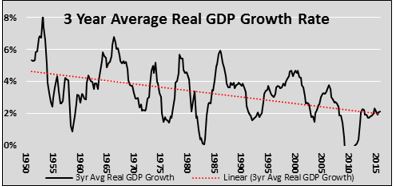

Economic Growth – The rising overhang of unproductive debt has pulled years of consumption forward, stifled economic progress and halted productivity growth.  As a result, governments and corporations are desperately employing ever more creative means of generating economic growth and profitability. These efforts, while largely cosmetic in nature, do little more than create one-time economic gains, while adding to the future strains. The chart to the left shows the concerning trend of U.S. economic growth over the past 65 years.

As a result, governments and corporations are desperately employing ever more creative means of generating economic growth and profitability. These efforts, while largely cosmetic in nature, do little more than create one-time economic gains, while adding to the future strains. The chart to the left shows the concerning trend of U.S. economic growth over the past 65 years.

Summary

Those that continue to rely on relative value strategies may find generating positive returns increasingly difficult as the aforementioned factors, and others, negatively affect the global economy and financial markets. Given this likelihood, investors may want to consider a partial or complete allocation to managers adept at managing an absolute return strategy.