Being on both side of the table concerning the due diligence of managers, I can argue that there has been a significant improvement with the skill at conducting operational due diligence. Operational risks can be effectively identified and measured. There will be fund failures, but investors can do a good reasonable job of handicapping firm-specific risk. There are checklist and processes that can support the choice of managers. The operational due diligence has been effectively institutionalized.

While there have also been improvements with investment due diligence, there still needs to be better ways of assessing skill than asking the usual set of canned questions about performance, risk management, and portfolio construction.

We have advanced with our ability to decompose performance numbers versus factors, but it is less clear whether we have improved our ability to assess investment skill. Alpha generation can move in cycles and skill may require adaptation. Firms do a good job of tearing apart the numbers verse benchmarks, but our ability to understand how managers cope with change in order to generate future returns is less clear. It is not clear they are as effective at doing a deep dive into the behavior of the manager. Recurring behavior drives skill.

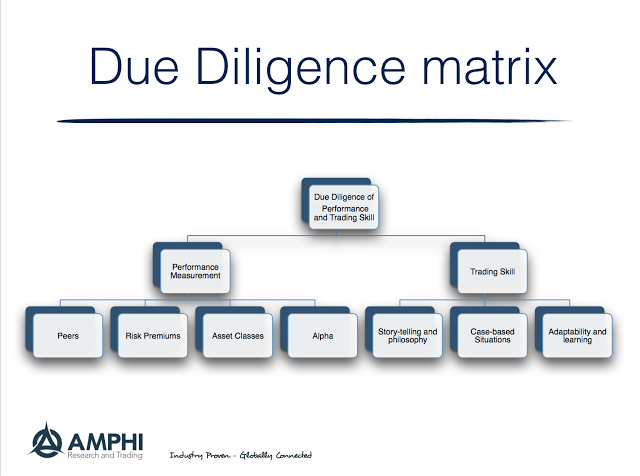

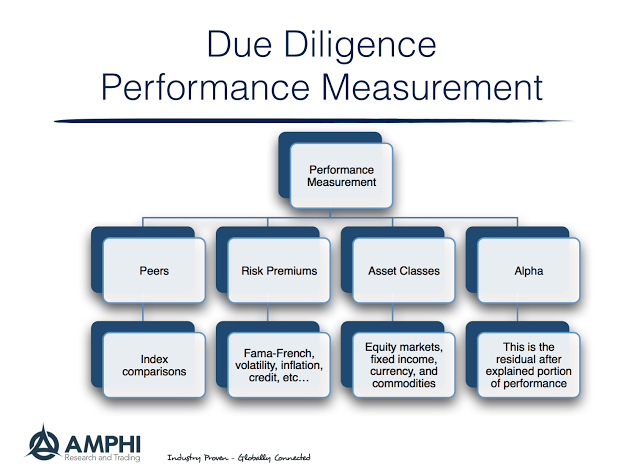

The hedge fund investment due diligence can be divided into two parts: one, determining whether there has been measurable skill and two, determining whether the skill is repeatable. Investors have made strong advancements with the measuring skill through past performance. Investors have factor analysis, alternative measures of different risk premiums or betas, as well as peer group benchmarks to measure skill ex post. We can slice a portfolio any number of ways to determine the risk of the manager and find their ability to generate alpha from their past performance.

In fact, we can see performance breakdown in four dimensions. There is peer analysis through a number of hedge fund peer indices. This provides good relative value performance measures. There is asset class factor analysis where we can determine what are a fund’s risks based on exposures to asset classes. Factor analysis can be used to analyze a broader set of risks. For example, a classic factor set would be the Fama-French three or four factor set. From these performance measure sets, we can isolate the alpha for a manager which will be the constant term from a regression equations. We have moved well beyond a measure of alpha relative only to the market portfolio, yet the amount of variation explained by these models is still relatively low. So much of skill cannot be measured through systematic means.

The due diligence problem is extrapolating this performance breakdown of risk into the future. Our ability to predict future returns of managers given their risk breakdown is at best, less precise. In a world where hedge funds can dynamically adjust their risks, past data may not tell us about the risks in the future.

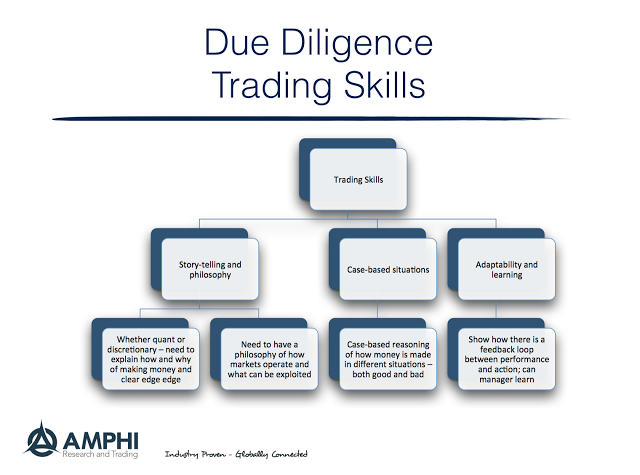

Yet, there is help with measuring trading skill through focusing on three key issues. A primary focus should be on case-based reasoning and story-telling. Can managers explain how they made money in certain situations? What are the stories for how gains were made? Similarly, cases can also describe failure. This will include what a model may have been telling the manager and why it did not work. It may include how and why position were exited. We separate the description of case situations with the overall story-telling of the manager’s edge and how he views the market and the process for generating returns. The narrative is important for explaining how a manager makes money and why he should make money in specific cases.

As important is a focus on adaptability. How have managers learned and acted to improve their performance? The ability to admit mistakes and adjust is the most important skill for managers who have long track records that show periods of underperformance. There will be loses. The question is how managers deal with these underperformance periods and learn to change their thinking in both the short and long-run.

Due diligence of skill should be systematic so a framework for manager skill discussions is as repeatable and comparable as operational reviews.