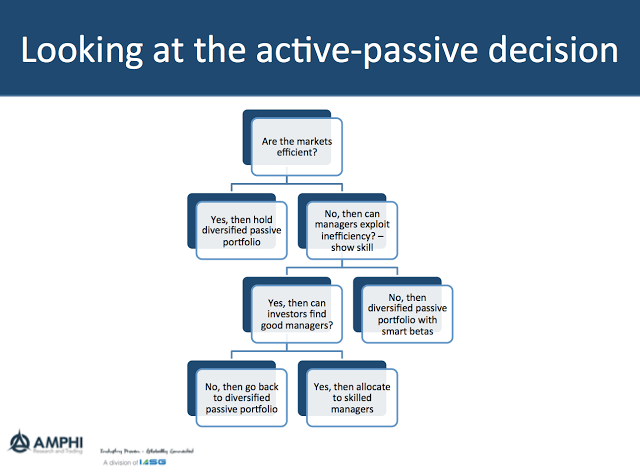

The choice between active and passive investing has been a battle that has been raging for years, but it can be simplified through a set of easy questions. The answers to these questions are not easy, but by forming a direct set of straightforward questions with a decision tree, the issues can be discussed in the open. The first question is about market structure and efficiency.

1. Are markets efficient?

If the answer is yes, markets are efficient, then the choice is simple. Invest with passive indices and hold a diversified portfolio. There can be a wide range of answers to the question of what is an appropriate portfolio, but the question of choosing active managers should be off the table. Surprisingly, the market has moved more to passive investing simultaneously as more agree that markets are inefficient. The investor must shift to a second question if the answer is no.

2. Are there managers who can exploit market inefficiencies? That is, are there managers with skill?

Markets can be inefficient, but that does not mean all active managers trying to exploit these inefficiencies have skill. There can still be only a tiny number who have the skill of being able to exploit inefficiencies. If the answer to the question is no, then there could be room for specific strategy benchmarks or smart beta alternatives that may be able to exploit some inefficiencies. For example, strategies could include a rules-based portfolio exploiting inefficiencies through low-cost benchmarking.

3. Can investors identify skilled managers or forecast their performance?

This is not easy because differentiating between managers with and without skill may take a lot of data, and there may be switching between skilled managers based on the environment or successful strategies. For example, a manager could be experienced at value investing but unable to make significant gains when value is out of favor. If an investor cannot identify the manager with skill, he should return to the passive, diversified portfolio.

The conclusion is that any holding of active managers has to be based on the market environment, managers’ quality, and investors’ ability to identify an inefficient environment and skilled managers. Since the markets are generally efficient, good managers are rare, and it is hard to find those managers, active management should be an exception, not the norm.