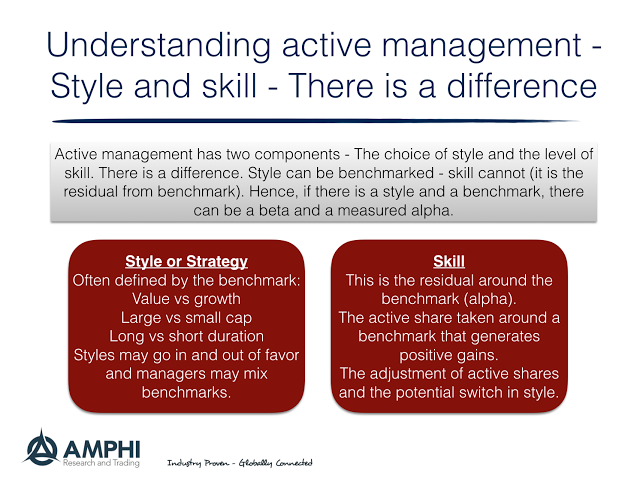

There has been much discussion about benchmarks and beta with hedge funds, but it is important to take a step-back and discuss how active returns are generated. Active management can be divided into two parts, the style used and the skill employed within that style. You can call a style a risk premium as is the case for value or small investing; however, all returns from styles may not be from risk premiums. Style is simply a descriptor or means for generating returns. Skill comes with the method of employing the style. Within a style, some managers are better at it than others.

Styles will differ because they attempt to capture different return streams. A value investor will be different than a global macro manager because they are attempting to find different return phenomena. A momentum manager will clearly be different from merger arbitrage. If the style is not associated with a clear risk premium, then it may have to be measured by a peer group. In this case, skill is ability to beat the average of a set of peers.

Styles may go in and out of fashion no different than risk premiums may be time varying and change with a market or business cycle. Hence, there can be a skilled manager within a style, but if the style is generating poor returns, the manager’s skill may not be able to offset the negative style effect. Finding the best may not be good enough. Style choice and diversification matters. Some will say choose your manager wisely. Perhaps more important is choosing your the styles for your portfolio wisely.