Do speculators drive prices away from commodity fundamentals? This is one of the core commodity futures markets questions. One approach to answering this question is through looking at the price dynamics, but the advantage of futures is that we have reporting of position information by specific traders groups. Trade flows can be divided into producers, money managers (speculators), swaps dealers, and indexers. The relative balance between these groups can tell us about the market structure, a dynamic agent-based analysis.

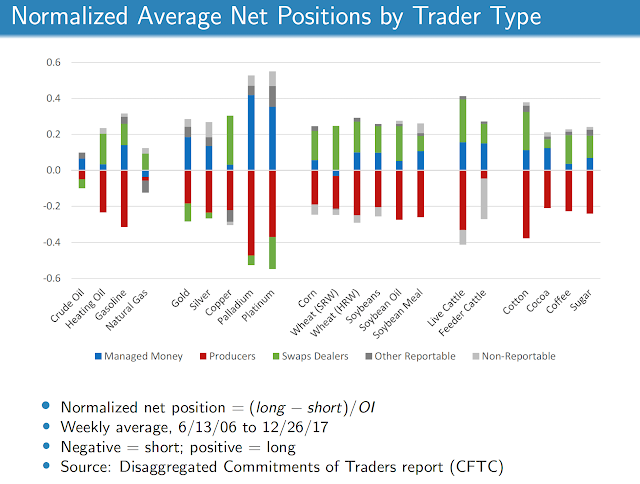

The questions was tackled by Aaron Smith of the UC Davis at the Protecting America’s Agricultural Markets: An Agricultural Commodity Futures Conference in his presentation, “Do speculators drive commodity prices away from supply and demand fundamentals?”. This provides good answers to some very basic commodity futures questions. On average producers (hedgers) are net short and managed money is net long. Swaps dealers are also generally net long. This numbers are consistent with the traditional stories that speculators are needed to take the other side of risk from hedgers. Speculators receive a risk premiums for that the other side of hedger activity.

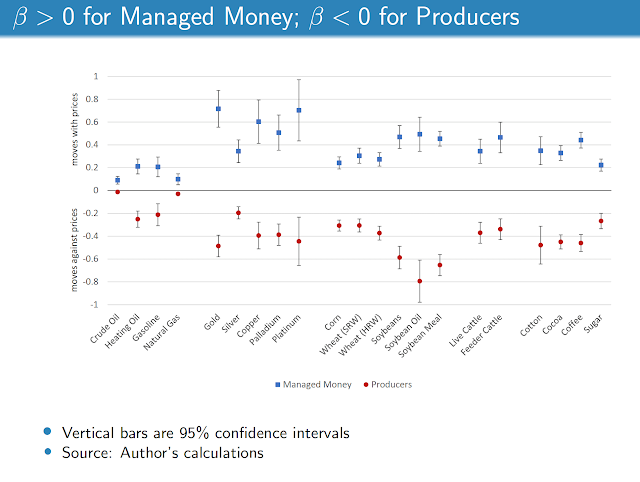

This work can be extended by looking at the relationship between price and agent behavior. Across a board set of commodities, the data show that changes in producer positions have a negative relationship with changes in futures prices while managed money has a positive relationship with price changes, This is consistent with the story that speculators follow trends in prices while hedgers will be behaving in manner to offset price risk.

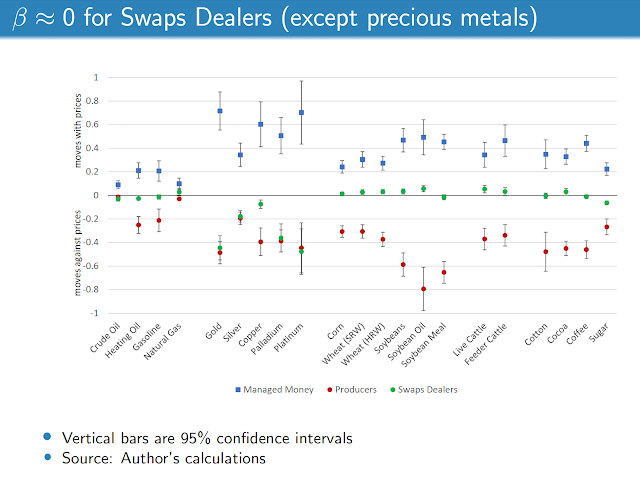

Swap dealers, in general, are price independent except in the metals markets given more directional hedging against OTC positions.

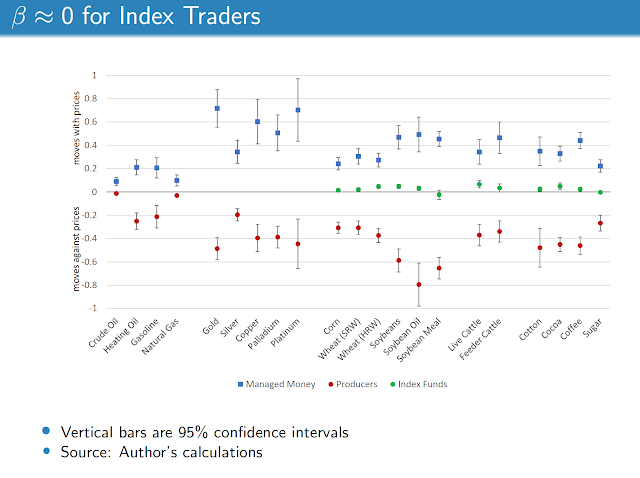

Index traders are also price indifferent. Their activities are more likely associated with diversification trades like what would be seen in risk parity programs.

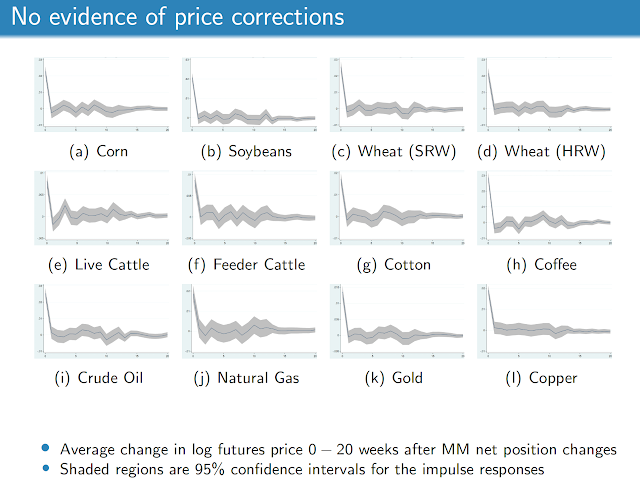

The key piece of Smith’s research is to relate the changes in positions of managed money with price corrections. He finds that managed money will be positively related price changes, but there will not be a price reversal in the subsequent weeks. There is not evidence that managed money will push prices away from fundamentals in a manner that would lead to future adjustments.

This work on the decomposition of futures traders adds to our understanding of price dynamics and speculation in futures markets. It also helps us appreciate the dynamics of different players in futures markets. There is still a symbiotic relationship between hedgers and speculations where each is needed to have an effective market.