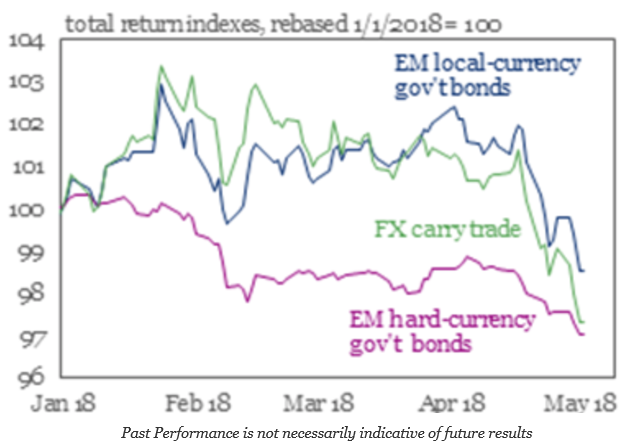

Emerging market stocks and bonds are facing difficult times in 2018. Emerging markets may have looked like potential outperformers at the beginning of the year, but they have now fallen below respective US stock and Treasury indices. This sell-off has been further enhanced by the negative economic events in Argentina. Higher volatility, rising interest rates, and a refocus on core fundamentals are all affecting investor outlooks for EM investments.

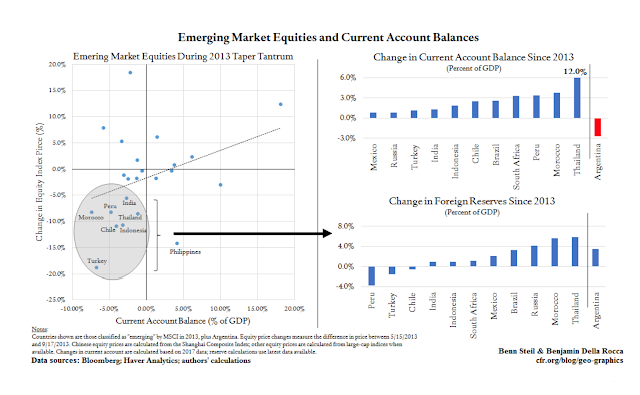

Perhaps EM is reacting to a new “taper tantrum”. With the Fed raising rates and starting to sell balance sheet, credit markets are starting to adapt and adjust to a new monetary environment. Regardless of forward guidance or the level of gradualism, the impact of Fed policy is to taper the liquidity of the past. Is the reaction a tantrum or just the likely response to this change in direction?

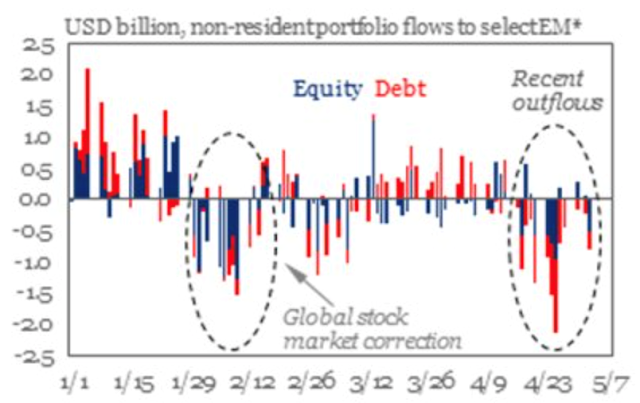

The reaction to declining performance and what is perceived to be a more difficult fundamental environment is as expected. EM flows for both equities and debt have clearly been negative. These outflows place pressure on currencies as well as debt and equity markets.

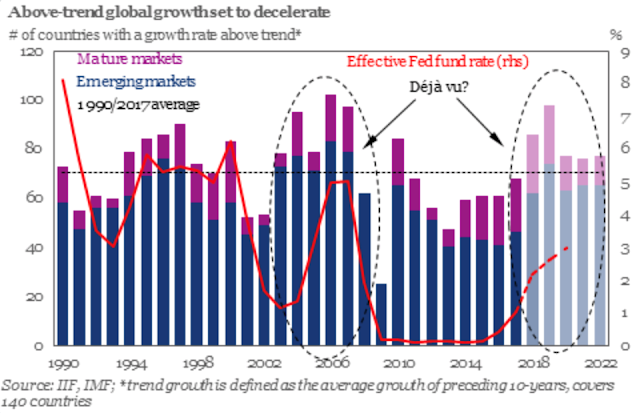

The earlier positive outlook for EM was driven by better growth prospects, but rising rates have dampened growth momentum in the past. The above trend growth in both emerging and mature markets will not last as growth will respond to the higher effective Fed funds and general reversion to the mean. Fed tightening usually translates into lower forward growth rates with a lag.

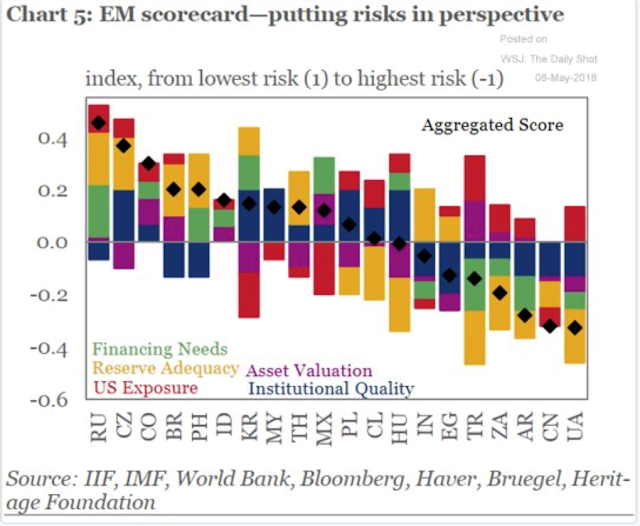

Given a potential decline in liquidity, specific country scares like Argentina, and a reversal of trends to the downside, there is a flight to quality with EM. Those countries will poorer growth, credit, and current account deficits, will see stronger deterioration.

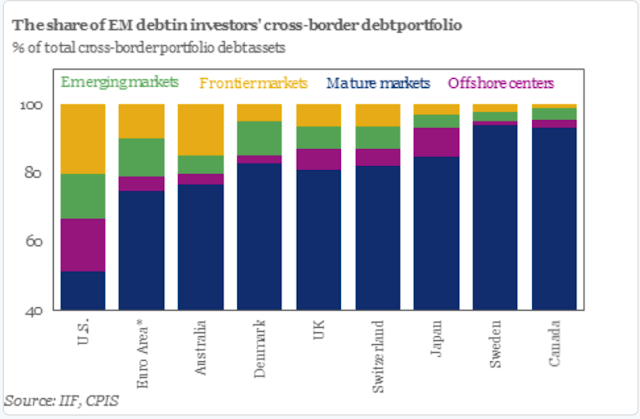

This situation becomes scary after a review of the composition of the cross-border debt. The US has an especially strong allocation to emerging and frontier markets versus other countries. If there are further EM declines, US investors will more likely be harmed.

Additionally, the ability of EM countries to weather this sell-off is made more difficult by the fact that EM borrowers have an increasing amount of debt that matures in the next few years.

While there have been strong advocates for long-term EM investing, rising US rates is a good time to review the quality of the holdings. After a country shock like Argentina, there are usually two reactions. First, there is general reduction is exposure to EM. Second, there is a new focus on fundamentals. This is the time to rebalance based on stronger credit, current accounts, and macro fundamentals.

We have seen this story before. Fed raises interest rates and credit starts to tighten, even if it is on a relative basis. Money flows out of riskiest alternatives usually when there is catalyst negative event, and portfolios are restructured to find safer alternatives. The size of the sell-off or the amount of restructuring may differ this time, but an end of EM herd behavior starts the break-up.