1. Diversify beyond the traditional asset class

Managed Futures are an alternative asset class that has achieved strong performance in both up and down markets, exhibiting low correlation to traditional asset classes, such as stocks, bonds, cash, and real estate.

2. Reduce overall portfolio volatility

In general, as one asset class goes up, others go down. Managed Futures invest across a broad spectrum of asset classes to achieve solid long-term returns.

3. Increase returns and reduce volatility

Managed Futures, as well as commodities, when used in conjunction with traditional asset classes, may reduce risk while at the same time potentially increasing returns.

4. Returns are evident in any kind of economic environment

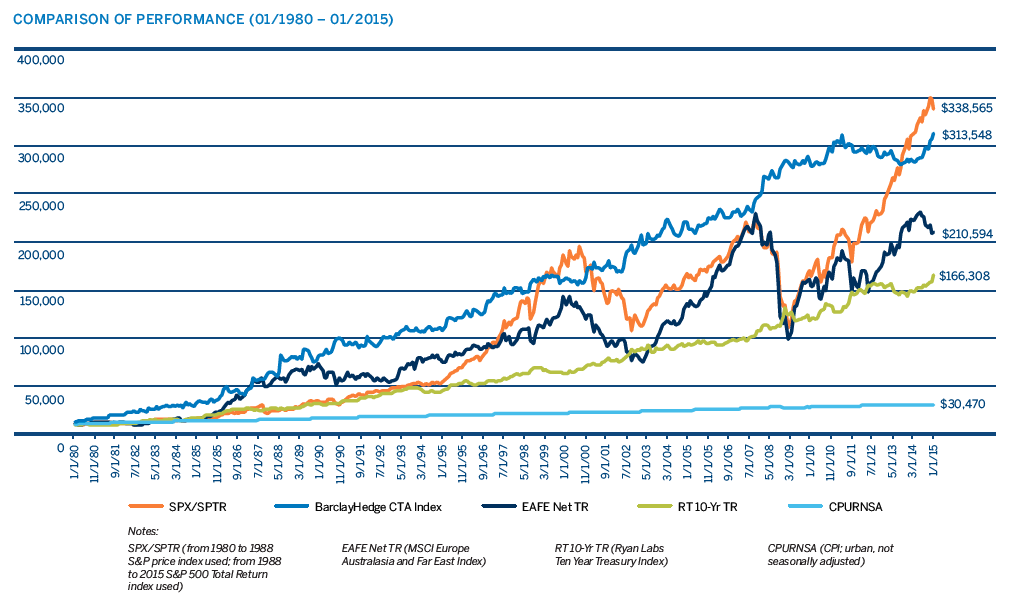

Managed Futures may generate returns in bull and bear markets, boasting solid long-term track records despite economic downturns.

5. Strong performance during stock market declines

Managed Futures may do well in down markets because they employ short-selling and options strategies that allow them to profit in such markets.

6. Successful institutions use them

Pension Plan Sponsors, Endowments, and Foundations have long used Managed Futures to generate returns in excess of the S&P 500.

7. Access to a wide variety of global futures products

There are more than 150 liquid futures products across the globe, including stock indexes, fixed income, energies, metals, and agricultural products.

8. Regulated trading environment

Trading in a regulated marketplace builds the credibility and trustworthiness of the CTA/CPO community.

9. Robust risk management and clearing practices

CME Clearing institutes some of the most sophisticated risk management practices in the financial world. For more than 100 years, CME Clearing has provided services that substantially mitigate the risk of clearing member failure. CME Clearing has provided the resources to ensure the performance of every contract on our exchanges for more than a century.

10. Exceptional industry growth

In the last 35 years, assets under management for the Managed Futures industry have grown 1000 fold. Current assets under management stand at over $310 billion.

From CME Group Managed Futures Team – David Lerman

Futures trading is not suitable for all investors and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a futures position. Therefore, traders should only use funds they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted to any one trade because they cannot expect to profit on every trade. All references to options refer to options on futures.

CME Group is a trademark of CME Group inc. The Globe logo, CME, and Chicago Mercantile Exchange are trademarks of Chicago Mercantile exchange inc. Chicago Board of Trade and CBOT are trademarks of the Board of Trade of the City of Chicago, inc. New York Mercantile Exchange and NYMEX are trademarks of New York Mercantile Exchange, Inc. All other trademarks are the property of their respective owners.

S&P 500 is a trademark of The McGraw-Hill Companies, Inc., and have been licensed for use by Chicago Mercantile Exchange Inc.

“S&P GSCI,” “S&P GSCI Index,” “S&P GSCI” (Total/Excess/Spot) Return Index,” and the “S&P GS Commodity Index” are trademarks of Standard & Poor’s.

“Dow Jones,” “AIG,” “dow Jones-AIG Commodity index,” and “ “DJ-AIGCI” are registered trademarks or service marks of Dow Jones & Company, inc. and American International Group, Inc. (AIG).

The information within this brochure has been compiled by CME Group for general purposes only. CME Group assumes no responsibility for any errors or omissions. Additionally, all examples in this brochure are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. All matters pertaining to rules and specifications herein are made subject to and are superseded by official CME, CBOT and NYMEX rules. Current rules should be consulted in all cases concerning contract specifications. Copyright © 2015 CME Group. All rights reserved.

Disclaimer:

While an investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and, in fact, result in further losses in a portfolio. In addition, studies conducted of managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the past may not be indicative of current time periods. Managed futures indices such as the Barclay CTA Index do not represent the entire universe of all CTAs. Individuals cannot invest in the index itself. Actual rates of return may be significantly different and more volatile than those of the index.