The end of the year is usually filled with reviews and facts about what happened and speculation on what may happen in the future, yet investors can be cluttered with too many facts. Some facts can be very interesting and great for conversations, but that does not mean they are useful for plotting a course for 2019.

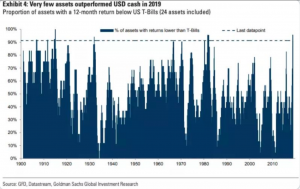

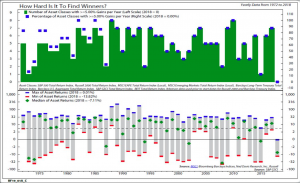

One of the more interesting facts about 2018 is that just about all assets underperformed cash or were just outright negative. It was a bad year and the numbers prove it. It was an unusual in its badness because there was no protection, but these facts may not suggest what will happen to 2019. These facts are interesting but not useful.

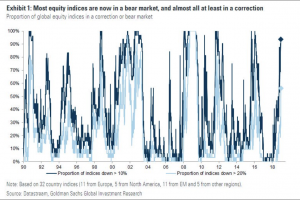

Now, another interesting fact is the number of global stock indices that are in correction or a bear market. This is interesting, but actually useful in context. We see that the numbers for 2018 are high and have exploded from a low base. But, we have seen the same thing in 2016 as well as 2012. The number of markets in correction or worse is high but this state of the world is bad but not unusual.

What makes this more useful is that a US perspective may have warped our view of what should be normal for equity markets. The high returns for the US and the long period without a bear market or a correction suggest that current conditions are not unusual, but that much of the behavior for US equity markets post the Financial Crisis was the extraordinary fact. If you are a US only investor, get used to what the rest of the world has been facing.