Disclaimer

While investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and, in fact, result in further losses in a portfolio. In addition, studies conducted on managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the past may not be indicative of current periods. Managed futures indices such as the Barclay CTA Index do not represent the entire universe of all CTAs. Individuals cannot invest in the index itself. Actual rates of return may be significantly different and more volatile than those of the index.

Individual and institutional investors increasingly include Managed Futures as part of a diversified investment portfolio as they search for non-traditional and alternative investment opportunities, which can include commodities, private equity, venture capital, and hedge funds. The following are some frequently asked questions about Managed Futures:

1. What are Managed Futures strategies?

Managed Futures are a diverse subset of active hedge fund strategies that trade liquid, transparent, centrally-cleared exchange-traded products and deep interbank foreign exchange markets. Managers in this sector are called Commodity Trading Advisors (CTAs). This name goes back to the origin of the strategy when, unlike today, most CTA activity was in commodities. Their strategies are primarily focused on financial futures markets — equity indices, fixed income, and foreign exchange — with additional allocations to energy, metals, and agricultural markets. Commodity Specialist Managers also focus mainly or exclusively on commodity markets. They may specialize in one or more asset classes within the commodity space, such as energy or agriculture.

2. Have Managed Futures strategies changed since they became popular in the 1970s?

The predominant strategy remains trend-following, but this approach has evolved significantly in sophistication in recent years, and the overall space has become increasingly diverse.

- Generally, trend followers aim to identify and exploit sustained capital flows across asset classes as markets move back out of and into equilibrium, often after prolonged imbalances. Other CTA styles thrive on volatility and choppy price action accompanying these flows and various market phenomena.

- The number and variety of short-term programs have risen sharply with the advances in trading technology, data analysis, and increased interest from quantitative traders in establishing their trading firms.

3. How do the economic worldviews of investors influence their hedge fund strategy choices?

The worldviews of investors can directly influence their choices of hedge fund strategies because many widely-adopted strategies implicitly assume that markets will be stable and mean-reverting. These strategies are often designed to capitalize on steady or declining volatility and are inherently optimistic about overall market conditions.

Systematic Trend Followers, to take one CTA style as an example, are, by contrast, not constrained by any economic forecast or view. They can employ directionally unbiased, divergent strategies that are designed to benefit when prices diverge from equilibrium levels and when capital flows create price trends, either upward or downward. They also aim to exploit situations in which markets re-establish equilibrium in the wake of new information or the transition from one economic cycle to another. This diversification attribute has helped investors reduce the risk that portfolios face from extremely adverse overall market conditions, sometimes called tail risk, that punish nearly all asset classes and strategies.

Managed Futures strategies, however, should not be treated as a portfolio hedge. Instead, they may be viewed as additional sources of uncorrelated returns. Although Managed Futures returns tend to be uncorrelated to other investments over the long run, correlations may be non-stationary over shorter time horizons and temporarily converge during crises. Not all market dislocations are the same, making CTAs vulnerable to rapid reversals or the sudden onset of volatility.

4. Why should investors include Managed Futures in their portfolios?

Managed Futures strategies can be a source of an uncorrelated alpha because they are directionally unbiased, often cover a variety of time frames in their position-holding periods, and have historically sought returns independently of the prevailing economic or volatility regime.

These strategies have performed well during many difficult periods for equity markets and other hedge fund strategies. This results from the internal diversification, unbiased directionality, and risk management styles of CTAs. The market conditions that have traditionally been difficult for CTAs employing trend-following strategies have been those in which there is no follow-through on trends, such that prices are mean-reverting. As a result, many CTAs incorporated additional strategies to capture these market characteristics to complement their trend following.

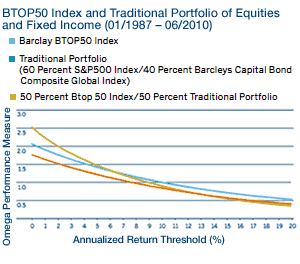

- Managed Futures strategies tend to reduce portfolio variance. The addition of uncorrelated variance may also have a beneficial effect on other performance and risk metrics.

- The exchange-listed underlying instruments used by CTAs facilitate risk management and mitigate many of the risks associated with model risk. The margining process also allows for flexible and effective cash efficiency.

On the risk side, Managed Futures present risks for investors like any other hedge fund style. Investors can experience volatility and substantial drawdowns, especially if the trading manager has set a higher return objective and takes more risk to obtain it. Investors should always conduct thorough due diligence to properly understand trading programs’ potential risks and weaknesses before investing. This is especially important because the trading methodologies employed by CTAs, the level of risk and return that is targeted, and the quality of the operational infrastructure of trading managers may vary widely across the space.

Regarding model risk, it is essential to note with any hedge fund strategy that there is no guarantee that any model will capture or adequately account for every aspect of reality. Certain types of modeling techniques may be susceptible to curve-fitting or over-optimization.

5. What is the general approach CTAs take to risk management?

The risk management style of trend followers tends to create a positive convexity return profile, similar to what can be achieved using options. Although there is no guarantee that risks can be strictly controlled, trend-following managers generally seek to preserve upside potential and limit downside risk to predetermined levels through stop-loss orders and other means.

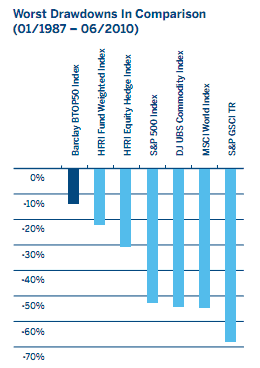

6. How do maximum drawdowns (peak-to-trough declines) of Managed Futures compare to those of other hedge fund strategies?

Historically, drawdowns in many Managed Futures strategies have been significantly smaller than in most other hedge fund strategies. As illustrated below, maximum drawdowns have been less than half those of the HFR Equity Hedge Index when comparing the Barclay BTOP 50* CTA Index from January 1987 through June 2010.

7. What is the long-term track record of Managed Futures?

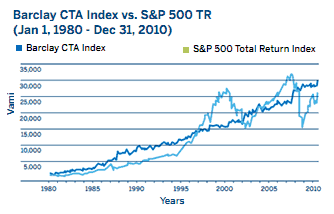

The following illustrates long-term performance comparisons among Managed Futures, equities, and several leading equity hedge funds and fund-of-funds indices. Further information and additional comparisons can be found in CME Group’s paper, “Lintner Revisited: A Quantitative Analysis of Managed Futures in an Institutional Portfolio,” and at barclayhedge.com.

Returns – From January 1980 to November 2010, the Barclay CTA Index had an average annual return of 11.55 percent vs. 7.9 percent for the S&P 500.

Correlations – During that same period, the correlation between the Barclay CTA Index and the S&P 500 was insignificant at +0.01.

The correlation between the Barclay CTA Index and the S&P 500 was –0.12 for January 1997** – November 2010, which included several well-known episodes of major market turmoil. Looking more broadly, we see low correlations when comparing CTA performance with equity long/short funds and a general fund of funds index, as expected from the diverse styles employed and the wide range of products traded by CTAs. The correlation between the Barclay CTA Index and the Barclay Equity Long/Short Index was +0.03 for the January 1997 – November 2010 period and +0.13 with the Barclay Fund of Funds Index over the same period (see the accompanying table)

| Jan 1997 – Nov 2010 | Barclay CTA Index | S&P 500 TR | Barclay Equity Long/Short Index | Barclay Fund of Funds Index |

|---|---|---|---|---|

| Barclay CTA Index | 1.00 | -0.12 | 0.03 | 0.13 |

| S&P 500 TR | -0.12 | 1.00 | 0.67 | 0.59 |

| Barclay Equity Long/Short Index | 0.03 | 0.67 | 1.00 | 0.88 |

| Barclay Fund of Funds Index | 0.13 | 0.59 | 0.88 | 1.00 |

By contrast, a high correlation is evident during the same period between the S&P 500 and two other hedge fund indices: the Barclay Equity Long/Short, +0.67, and Barclay Fund of Funds Index, +0.59.

Historical Volatility – For the January 1997 – November 2010 period again, the annualized standard deviation of returns of the Barclay CTA Index was 7.28 percent vs. 16.60 percent for the S&P 500; vs. 7.95 percent for the Barclay Equity Long/Short Index; and 5.87 percent for the Barclay Fund of Funds Index. Many investors are unaware that CTA volatility, in general, has historically been lower than equity market volatility and lower than equity long/short hedge fund volatility as measured by broad indices.

8. Do CTAs employ leverage in their trading?

CTAs do not employ leverage in the traditional sense of borrowing money to increase exposure. Funds not being used as margin can be invested in treasury securities or various liquid instruments that meet the requirements of the customer’s FCMs.

Futures contracts have implicit leverage, which is generally controlled, to a large extent, by the conservative margin-to-equity ratios employed by CTAs. These ratios imposed by clearing firms refer to the margin percentage in a customer account that can be deployed as margin. Clearing firms act as third parties that aim to protect their interests by maintaining conservative margin-to-equity ratios. It is essential, however, to note that risk policies at various clearing firms and CTAs vary and that customers should inquire with their clearing firm(s) as to what the ratio would be for the customers’ account(s).

9. Do CTAs generally offer position and strategy transparency?

Full transparency is generally available at the level of the exchange-traded instruments. This facilitates risk management because the instruments’ notional exposure, margin usage, and prices are known. Transparency at the manager level depends on the policy of the manager and the structure employed, whether a managed account or a fund. With individually managed accounts, full transparency and control of funds are available.

10. Are the products that CTAs trade liquid?

CTAs generally utilize the most liquid exchange-traded products with the highest level of open interest, which enables them to offer investors excellent liquidity terms.

11. Do CTAs impose gates and lockups on investors?

CTAs generally have liberal redemption policies, usually monthly or quarterly, with no restrictions, if not better. Some CTAs offer daily liquidity. Unlike what took place in some other hedge fund strategies, CTAs generally did not impose either gates or lockups during the financial crisis of 2008 – 2009. With separately managed accounts, investors can terminate a trading manager’s power of attorney and liquidate positions. CTAs cannot restrict customers from making withdrawals from their managed accounts.

12. Is there research that supports the inclusion of Managed Futures in portfolios?

A substantial body of research, including John Lintner’s seminal research in 1983 and numerous recent articles, demonstrates the portfolio benefits managed futures can offer. The Lintner research was updated and expanded recently and is available in a long and short version from CME Group.

Futures trading is not suitable for all investors and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a futures position. Therefore, traders should only use funds they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted to any one trade because they cannot expect to profit from every trade. All references to options refer to options on futures.

CME Group is a trademark of CME Group Inc. The Globe logo is a trademark of Chicago Mercantile Exchange Inc. S&P 500 is a trademark of The McGraw-Hill Companies, Inc., and has been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.

The information within this brochure has been compiled by CME Group for general purposes only. CME Group assumes no responsibility for any errors or omissions. Additionally, all examples in this brochure are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. All matters pertaining to rules and specifications herein are subject to and superseded by official CME, CBOT, and NYMEX rules. Current rules should be consulted in all cases concerning contract specifications.

Copyright © 2011 CME Group Inc. All rights reserved.