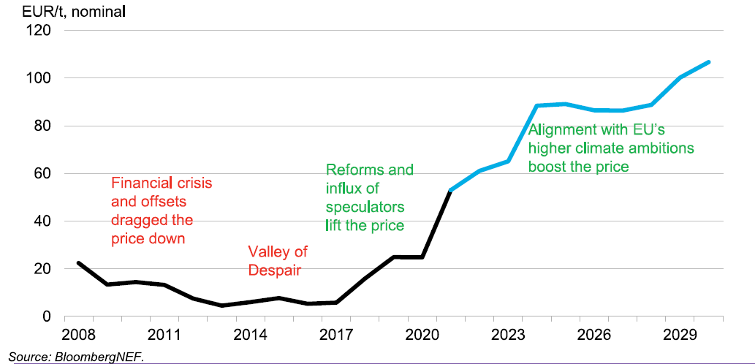

What if I told you there was a futures sector that was not only driven by governments but explicitly designed to appreciate over time? Given the monetary policy of the past few years, many of us intuitively understand the influence that central banks can have on our economics. What if I told you that corporate boards were also willingly committing to entering this market at a cost even if nobody required it? Carbon markets may truly be the next frontier in policy as leaders from around the world pledge to reduce emissions. We discussed this in-depth with our previous article on sustainable portfolios. As a recap, two types of carbon markets currently exist with the goal of limiting global warming to 1.5 degrees Celsius, the compliance market and the voluntary market. The chart below summarizes some of the differences.

Carbon Markets

Compliance (Mandatory) Markets

- Typically, cap-and-trade emission trading system (ETS) exist, with a cap on the amount of GHG that a corporation can emit.

- Companies from high-polluting industries such as energy, steel, and cement are participating in cap-and-trade schemes. The EU Emissions Trading Scheme (EU ETS) is the largest, with a market worth $300 billion.

- A carbon allowance is a traded asset, with futures and options available on it.

- A polluter who buys these credits (which cost around $80) buys the right to pollute (allowance), not the right to save CO2.

- The mandatory markets have the potential to grow to be worth $1 trillion. (Boris, 2021)

Voluntary Markets

- Markets are built on the goodwill of individuals and businesses. Allows businesses and individuals to purchase carbon offsets on a voluntary basis with no intention of using them for compliance purposes.

- When one carbon offset is purchased, it supports a project that has already saved one ton of CO2. Various registries track voluntary offset projects and grant offset credits for each verified and certified unit of emission reduction or elimination.

In many regions, the government establishes an emission cap, creates carbon credits, and sells them to polluters. Once a carbon cap and supply are determined, the permits are auctioned and exchanged in a secondary market where demand and supply determine the price. Companies that need to emit more must purchase more credits, while those with excess allowances can sell them. Then, every year, the government cuts the emission cap or the supply of these credits to incentivize higher pricing and pressure high-polluting companies to change their behavior or employ alternative energy resources.

CAP-and-Trade ETS Carbon Model

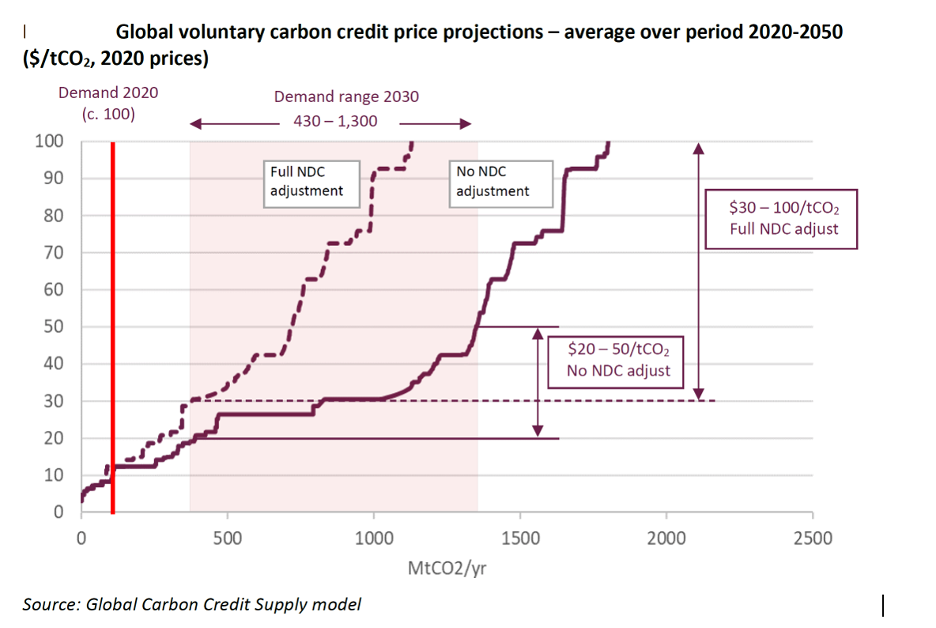

For the goals of the Paris agreement to be achieved, the world would need to cut current greenhouse-gas-emission levels in half by 2030 and reduce them to “net zero” by 2050. This means removing the same amount of greenhouse gases from the atmosphere as they put into it. However, many businesses cannot completely eliminate or even reduce their emissions as quickly as they would like. As a result, organizations will have to use carbon credits, also known as voluntary carbon offsets, to offset emissions that they cannot eliminate through other means. According to the Taskforce on Scaling Voluntary Carbon Markets, this might lead to a demand increase by a factor of 15 by 2030 and up to 100 by 2050 for carbon credits. As a result, price changes could reflect the chart below.

It is critical to understand that an allowance (credit purchased through the cap-and-trade system) gives a polluter the right to emit, whereas an emission offset (credit purchased through the voluntary market) compensates for previously emitted emissions. As more organizations commit to Net Zero Emissions and governments continue to reduce supply in the ETS market, demand for carbon markets grows, and carbon market prices rise rapidly. Higher prices mean higher costs for polluters and businesses to emit and/or offset emissions, leading to a shift in business practices and, ultimately, a reduction in global emissions.

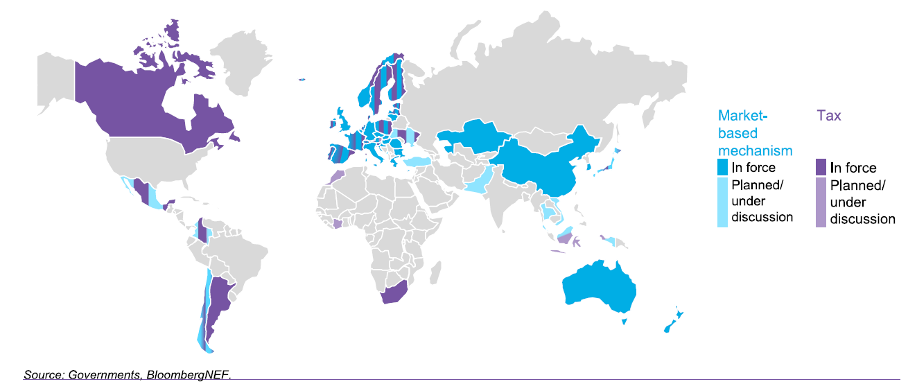

Carlos Arcila Barrera is looking to support the growth of this new asset class and contribute to the “Net Zero” revolution with his Carbon Neutral Alpha Program. With mid-century net-zero emissions commitments from governments and companies in Europe, North and South America, Asia, and nearly 100 countries and 1000+ companies, Carlos believes that the values of these contracts must rise significantly over time, as shown above, to meet the goals established to transition us away from traditional energy sources and reduce emissions.

As he points out, “This is a new market and a unique asset class; higher prices are expected in the coming year and beyond. Companies and governments recognize this and are putting their capital to work on their emission reduction commitments. Investors and asset managers can help with this transition and capitalize on this opportunity while also making a positive environmental impact.”

While we can make some assumptions about long-term trends in the carbon market, a trading strategy must be designed with a deep understanding of the various fundamental drivers and contracts available.

Carlos is more than qualified in this respect, having earned a GARP certificate focusing on the financial risks associated with climate change and being a candidate for a Masters degree in Sustainability Leadership at Cambridge University (in addition to his Notre Dame Master of Finance, Chartered Financial Analyst (CFA), and Chartered Analyst in Alternative Investment (CAIA) designations). The Carbon Neutral Alpha Program, like the other offering from Sigma Advanced, the Global Advanced Futures and Spread Program, uses relative value trades but also takes directional positions. As with any new asset class, it provides specific advantages and disadvantages.

Carlos points out, “As the carbon market expands rapidly, it creates numerous investment opportunities due to long bias and inefficiencies in this nascent market; capitalizing on these opportunities and generating alpha is possible by analyzing quantitatively and having an understanding of the fundamentals of this market.” Performance supports this statement thus far with solid returns and managed drawdowns for a Sharpe ratio over 1.5. As an investment consultant, I view programs specifically through the lens of capital appreciation and risk management and fit with an investor’s portfolio. Increasingly, government involvement is part of that evaluation, and it can help or hurt a program. The Fed’s zero interest rate policy has reduced volatility in the equity markets considerably, making most futures trading more difficult. The carbon market may even the scales a bit as policy drives prices. “Big business” agrees and leaves investors with a choice, be on the same side of the trade or fight against them. Whether you look for growth in your portfolio or want to help drive sustainability, Sigma Advanced is one to check out. You might do well by doing good.

Please check out the Carbon Neutral Alpha page. If you have any questions about this program, call or email Greg Taunt at gtaunt@iasg.com or 847-877-0887.

Photo by Patrick Hendry on Unsplash