Commentary by GZC Investment Management

November 2021 will be remembered as a month of abrupt volatility for oil, remembering September 2019, when the Saudi Aramco attack propelled oil prices $10 higher at the market open.

On the 26th of November, it was not a gap open per se, but prices started diving on news that a virus mutation was discovered in South Africa, and prices quasi straight-lined $10 lower (for an average daily move of about $1.2 in prior weeks). During the short thanksgiving trading session, it remained unclear to what degree this mutation would be a game-changer, yet, the oil market reacted by selling aggressively before the information became available. However, the Omicron variant proved to be a short-term game changer for oil demand in the following days.

Twenty-four hours before Omicron hit the market wires, oil just finished repricing two negative inputs – the Strategic Petroleum Reserves (SPR) release, a political decision not supported by supply-demand dynamics, and partial lockdowns in a few European countries – that led us to reduce our exposure after reaching our 2.5% drawdown limit on the month.

As the market stabilized, we reintroduced long directional exposure as demand remained globally supportive into the winter, and there was a strong chance that OPEC+ could balance excess SPR supply. Then, out of the blue, the new variant changed market dynamics and forced us to exit the position, as we reached our second drawdown level during November 26th trading session. While oil prices continued to dive down towards -25% for the month, the performance of our RV positions remained neutral, with a fairly robust middle distillate margin throughout the period. We finished the month at -5.5% with directional -4%, volatility -1% and RV -0.5%.

We think a new market cycle has abruptly started for two reasons. First, Omicron is most likely an actual demand destructor in the short term (in good and bad lethality scenarios). Second, Washington has a powerful political will to contain crude prices to trade around $85. A policy that should be supported by an oil system with ample spare capacity.

At this stage, we still do not know the severity of the new variant with high confidence. Still, we know its transmissibility is at least three times greater than Delta, already spreading faster than previous versions. Therefore, with a high risk that health systems will be overwhelmed in the coming weeks, there is a high chance that short-term virus containment measures will be put in place worldwide while the third booster shot is administered. Furthermore, even with third shots, Omicron is likely to spread significantly since it has notable vaccine evasion. In short, we have lowered our demand estimates globally for the next 3 to 6 months and pushed back on international air travel normalization—a loss of 1 to 1.5Mbd in demand vs. previous estimates.

Omicron may prove to be endemic and with mild symptoms. There is also no doubt that the last two years have allowed the world to be much better equipped to cope with coronavirus, including promising new pills for those with symptoms requiring hospitalization. Regardless, and as annoying as it can be, Omicron, in the short term, is likely to stress healthcare systems that should itself force government intervention to reduce mobility (which is what matters from an oil supply-demand point of view). We should have more accurate information about Omicron by the end of December. If necessary, we will adjust our demand scenario again.

Even if Omicron is only a short-term game changer that will fade as we progress into 2022, it likely reveals a more pernicious problem for Chinese oil demand. We see a real risk that the zero covid policy in China becomes a significant policy error in the context of mutations that are more and more transmissible. Even with the most stringent measures, it seems inevitable that Omicron will penetrate mainland China. As we write, the Chinese authorities have already reported two Omicron cases; who knows what the actual number is? That suggests that China will be stuck with strict containment measures for most of 2022. Beijing’s risk with major regional lockdowns is not trivial, especially after the winter Olympics. Putting this into context, Chinese oil demand has recently reverted to barely above levels experienced in 2019 at the same period. The elevated demand levels in 2020 and early 2021 have dissipated since Jun 2021.

Many expectations were built among oil market participants that China would be vigorously returning to market. Pre 2020, China represented about half of total oil demand growth. At present, the rest of the world has gone back to 2019 demand levels ex jet demand, and China has had a marginal increase in demand as of late 2021. If China and jet demand are unlikely to increase in the first half of 2022 and the rest of the world does not offer further material demand boost, then oil prices should struggle to move higher. That is especially important in the context of OPEC+ returning barrels at a pace of 400KBD per month (ahead of the curve) and non-OPEC+ production likely to increase at a rate of about 100KBD per month. That leaves the first half of the year at risk of sustained oversupply. As a result, OPEC+ is expected to taper its spare capacity release during Q122.

We shall stress a contradiction we find somewhat disturbing outside of pure supply-demand dynamics. Positioning in the oil market has materially reduced during November, leaving current positioning data from the CFTC in the middle of the range. Yet, surveys and a few anecdotes have revealed an extremely unanimous positive view regarding oil prices for 2022 and even onwards. While positioning does not reveal too much, we are concerned that a lot of good news for demand post covid have already unanimously been factored in by market participants who are holding backend contracts.

Finally, geopolitical considerations are re-emerging as a possible short-term price driver. Negotiations about Iran’s nuclear future have resumed recently and seem in a final impasse. Since there is a lot of game theory involved, the situation remains fluid. The US could support an Israeli intervention with the aval of a few gulf states. It is conceivable in this context that Saudis and a few other gulf producers support such action by pre-emptively allowing global oil stocks to grow faster than previously desired (maybe explaining why OPEC+ was less cautious about demand prospects than they had been earlier in 2021). So, counterintuitively, the worst negotiations go, the more likely it is that all parties involved will want to show complete preparation for a no-deal scenario, and that means a crude oil curve moving into contango. At this stage, from an oil market point of view, the US preferred scenario is to keep Iran being a relative threat while leveraging US defense capabilities vis-à-vis other regional producers in exchange for oil concessions.

Overall, crude oil prices are likely to remain under pressure even if OPEC+ brings supportive actions. The bright spot in the barrel should continue to be gasoil/diesel that China stopped exporting after rationalizing teapot refiners. Furthermore, that middle distillate part of the barrel is particularly competitive against very elevated natural gas prices. That leaves us concentrating more on the RV oil space and waiting to possibly position a Chinese demand accident towards the end of February. We continue to find gold upside, outstanding value vs. oil volatility outside our core oil allocation.

Trading futures involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results.

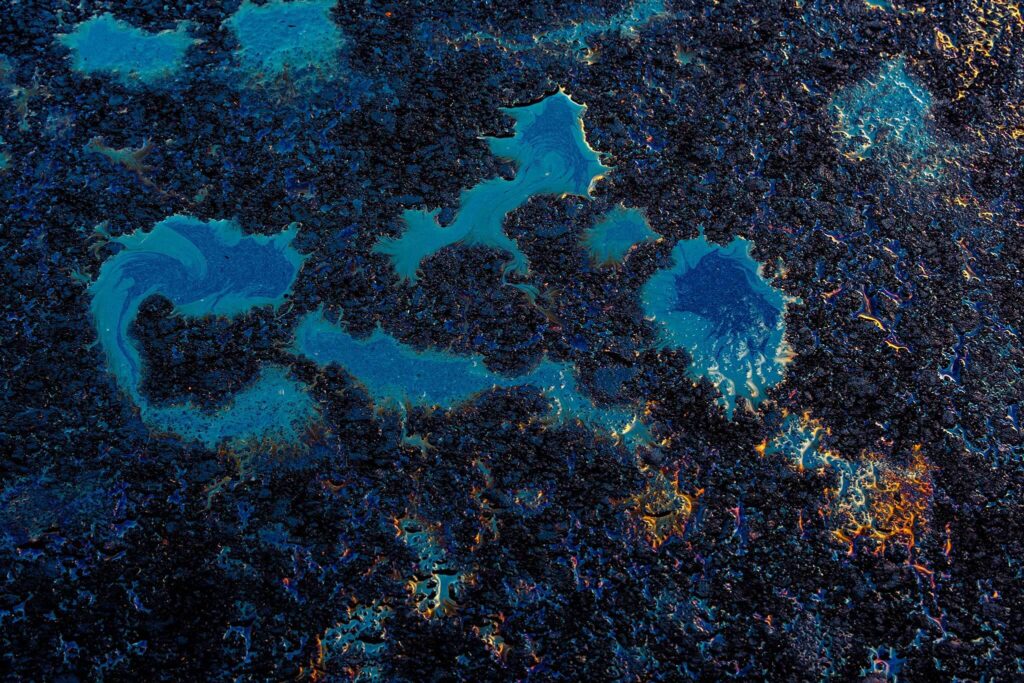

Photo by Roberto Sorin on Unsplash