Commentary by John Knott of Numberline Capital Partners.

Last month, we left off expecting a re-test of the price lows but firmly believed the “panic selling” was primarily done with. Well, we got the re-test on all three major indices. As expected, the market has stayed volatile, and sentiment has rarely been this bad. In addition, commodities are getting very volatile. As a result, our exposure in the commodity space will be limited to Gold, which also has become incredibly volatile. Our goal is to provide conservative tactical exposure to Gold to offset some inflationary headwinds to equities.

A few comments on risk. The markets go through waves of very volatile periods. They are not permanent. But while we are in that period, as we are now, exchange margins increase dramatically; markets make significant moves in both directions. While there are certainly opportunities to make significant gains, this is also when many CTA’s will blow up—even those on the “right” side of the market. We aim to survive the volatility and get through to the other end. Risk always comes first. I have traded through these commodity supercycles before. And they end very violently. Numberline seeks to avoid as much volatility as possible while maintaining our long-term growth trends.

We will never lose focus on our core strategy.

We will break down the usual models below and summarize the risk going forward.

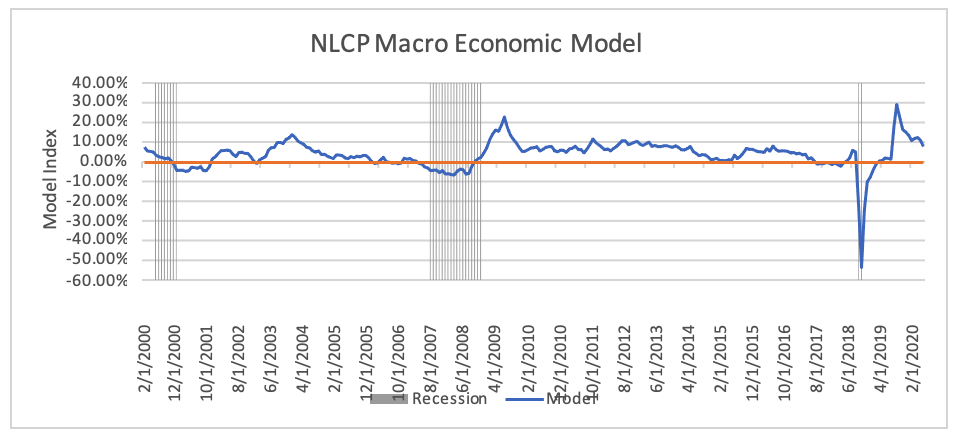

Economic Outlook

The NLCP Macro-Economic Model declined modestly this month to 8.16, down from 11.12 last month, as we predicted. This reading will continue to decline in the coming months, although we do not expect it to go negative. A negative reading would almost guarantee a recession within the following year.

The strength continues to be in the labor market and the ISM data. While there are many things to worry about in the short term, from geo-political to inflation to supply chain issues, the core foundation of the economy, the labor market, is as strong as we have ever seen. That is part of the problem and one of the worries of the Fed. How do you slow down the economy without destroying the labor market? There probably is going to have to be some middle ground here. The Fed is going to have to accept some collateral damage to get inflation under control.

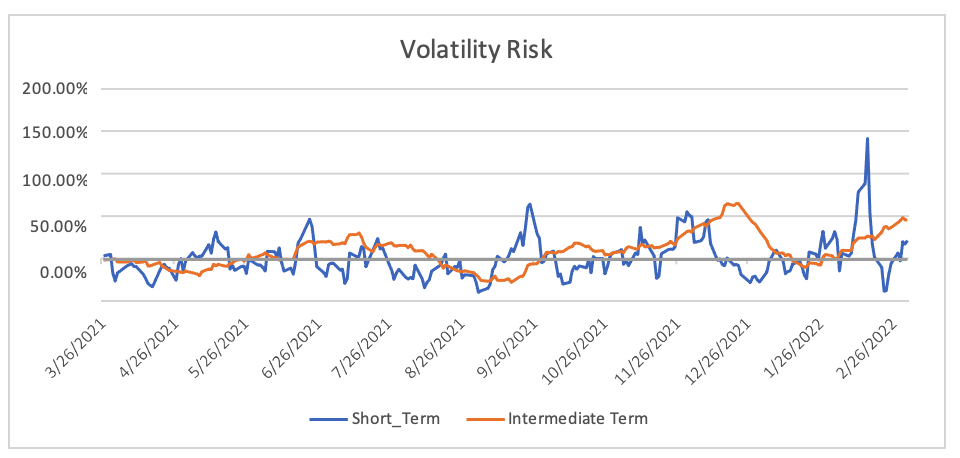

Volatility Risk

This indicator has been on fire for a while now. The longer-term vol component has been in risk-off mode since October, while the shorter-term component has been flicking on and off during the same period. And it hasn’t been wrong. It still is cautious. When this indicator is in risk-off mode, it says that the market is very vulnerable to downside risks. Another way you could interpret it from an investor’s standpoint is when it’s on, you sell the rallies. When it’s off, you buy the dips. We are still in a ”sell the rally” market. We believe most of the price damage has likely been done in the market, but there might be more time left in the correction. That means we probably will see a controlled volatile market that doesn’t go anywhere over time. We believe this should start to end going into Q2 and after the Fed meeting in 2 weeks.

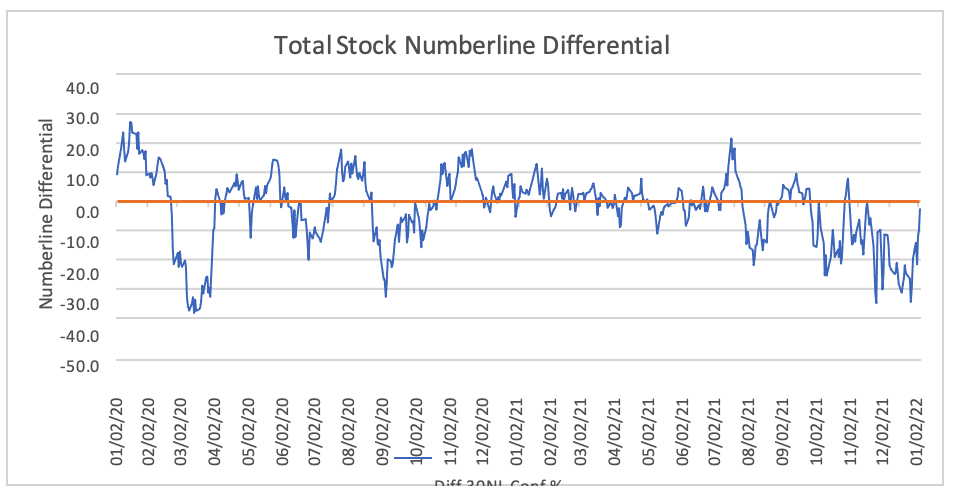

Technical Outlook

Finally, some good news. As this indicator shows, we’ve been complaining about the broad-based technical weaknesses for months on end. This breadth indicator has made lower lows and lower highs for almost all of Q4 last year and Q1 of this year. We finally are seeing the fever break. Now it could be another false signal, as we tried several other times. But the difference is this time; the Nasdaq finally corrected 20%. What’s also important is we have this data for the S&P 500, Nasdaq, and Russell 2k separately, and all three indices are finally showing the same strength simultaneously. This means that the “broad-based” selling is probably close to finished; while it’s possible at the index level, there could be a further weakness. We think this still favors the Russell 2k since its value is not controlled by a small group of large-cap stocks that might not be done selling off (the FANG names). This is certainly encouraging.

Summary

Just as Meat Loaf once sang, “Two out of three ain’t bad,” that’s what we have here. A good economic backdrop that needs to weaken a little, a recovering technical outlook, and a concerning volatility outlook whose bark is probably worse than its bite. It’s hard to be bullish risk assets when the media discusses war, inflation, and slowing economic growth daily. But markets don’t bottom with good news. They bottom with bad news. We still believe the 2nd half of the year will be better than the first half and that most of the damage has been done. The market is going to get CPI this week, which will be bad, and a Fed Meeting the week after. Once we get past these events, we think Vol will start to come in, and we might see some relief in the form of a yield curve steepening. That would happen if the market believes the Fed can slow inflation “without” killing the economy. If they can’t do that, we will get that recession sooner than anticipated.

Past performance is not necessarily indicative of future results.

Photo by Pawel Czerwinski on Unsplash