It is time to consider the possibility that a recession is coming. While few seem to be talking about it, signs increasingly seem to be pointing in that direction. The confusion is justified as GDP growth accelerates, employment is at record lows, and the stock market remains mostly stable. Perhaps I am a pessimist, so I will look at the positive numbers before addressing the potential storm clouds on the horizon.

The re-opening of the US economy following the COVID-induced lockdowns in conjunction with the approval of vaccines across the world resulted in a strong expansion of almost 5% in 2021, the fastest in decades. Unemployment stands at just 3.6%, below the 5% number often associated with full employment. The tightness in the labor markets led to a 4.4% increase in wages for 2021 amid reports that hiring workers continues to be an issue for many employers. Housing prices went up 25% last year alone. Consumer spending is a large part of what drives the economy, so this additional income is a positive for the economy.

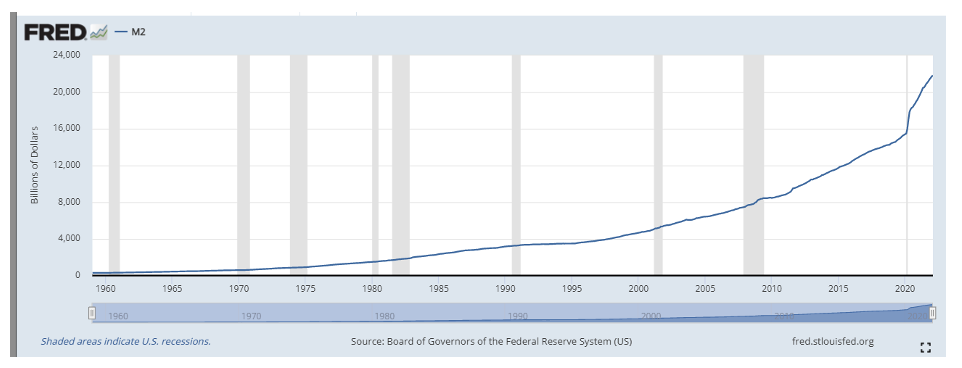

Like many things, rising wage growth is a double-edged sword. Ultimately, costs are passed down to end customers. We see this with the highest level of inflation seen since January of 1982 at 7.9%. Energy costs continue to be a significant driver here, even before the Russian invasion of Ukraine. This coincided with a supply chain crisis spurred on by stimulus spending for durable goods. We see signs that pandemic support that allowed investors to save more money is running out. Credit card debt increased by $41.8 billion in the US in February, up from an $8.9 billion increase in January, and appears to be accelerating. This shows that while wage growth is strong, it is not keeping up with inflation. An increase in money supply coincided with these signals as well. The chart below shows the noticeable uptick in 2020 that continued.

Adding to the recession case, the yield curve recently became inverted. A normal yield curve is upward sloping, meaning longer-term rates are higher than current rates. This makes sense as the future is unpredictable, and the longer maturity comes with additional risk. In this case, the 2-year rate dropped below the 10-year rate, which often signals a recession. Interest rates continue to be a hot topic as the Fed looks to accelerate the shrinking of its balance sheet and get more aggressive with rate increases. We discussed the balance they must strike in our previous article, “The Fed Pickle.” The dilemma discussed there proceeded with the Russian invasion, which pushed energy, food, and metals prices further. The Fed warns that “There is growing concern that U.S. house prices are again becoming unhinged from fundamentals,” according to researchers for the Dallas Fed. We have seen this happen in recent memory already. What could go wrong?

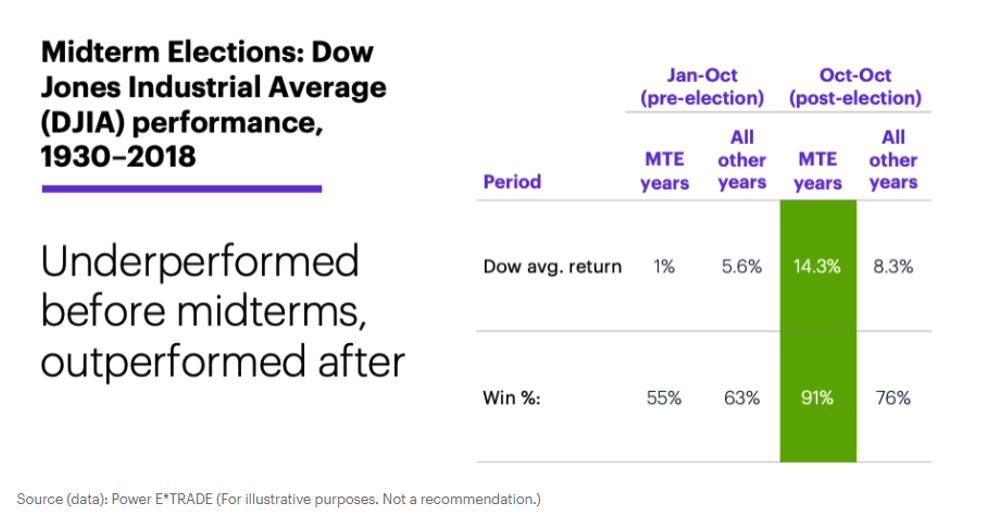

With midterm elections looming in the US, expect leaders to try to “do something” to stem the tide. But unfortunately, history is not on their side for equity gains until the election is over. The chart below shows what the market typically returns in a midterm election year (MTE), and after the first quarter of 2022, we seem to be on pace.

It would probably be best if politicians did nothing. In the past two years, we have heard that COVID would be gone quickly, vaccines would stop the spread, Russia is unlikely to invade Ukraine, and inflation is transitory. The same groups are now saying that the future looks even better. I hope I am wrong, but in the meantime, I am looking for options that will do well if I am right. Fortunately, many programs on our site show this is possible with solid returns in March.

If you are interested in diversifying your equity portfolio further, please reach out to me at gtaunt@iasg.com.

References:

- E*Trade: The stock market in midterm election years

- United States GDP Growth Rate

- Yahoo! Finance: U.S. Wage Growth Increased Substantially by 4.4 Percent

- Washington Times: Americans ramp up credit-card debt as inflation spikes to 40-year high

- BPR: Federal Reserve warns of a potential housing bubble as ‘prices are again becoming unhinged’

- MSN News: U.S. recession not imminent despite yield curve inversion, BlackRock executive says

Photo by Dave Hoefler on Unsplash