Many of my favorite traders focus on the grain markets. After all, we all need food, so the demand is more inelastic compared to many markets and, therefore, less sensitive to financial market conditions than most commodities. We rarely need to think much about where it comes from until recently, when we realize that our food supply might not be as secure as previously hoped. Ukraine alone produced 6% of all food calories (80 MMT of grain) for the world in 2021. It is estimated that this could fall by half this year because of the war with Russia, which produces 17% of the world’s wheat. Perhaps now more than ever, it is essential to understand what drives these prices and how we use grains daily.

Types of Grains and Their Uses

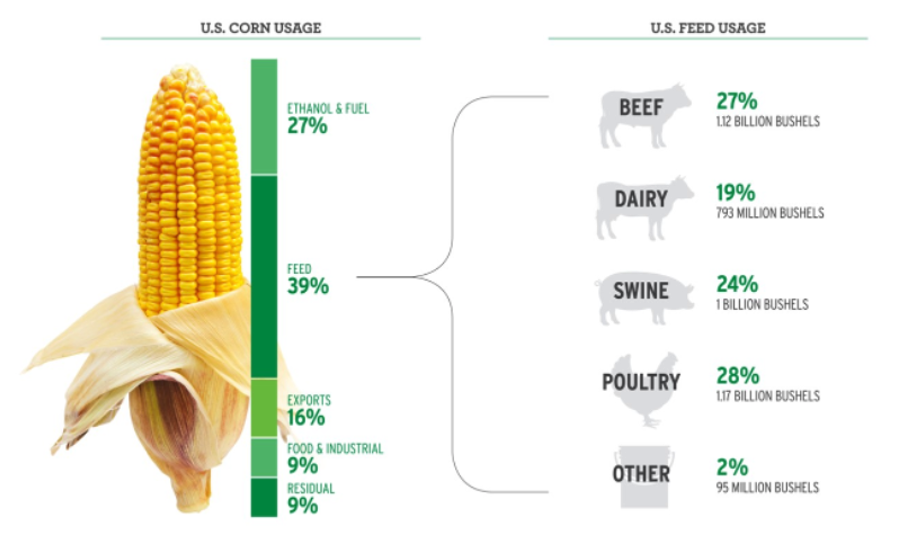

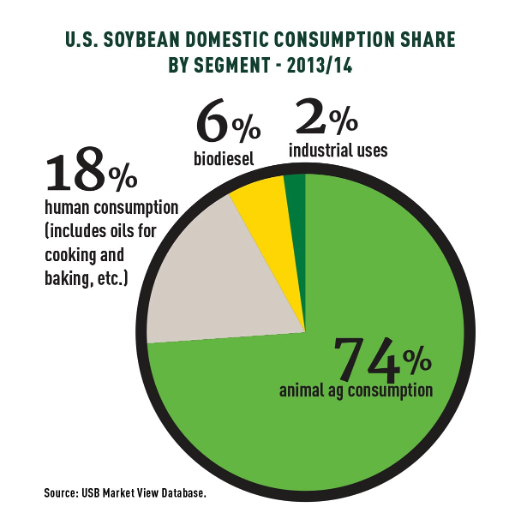

While there are many different types of crops, I will focus primarily on corn, wheat, and soybeans and their uses. The amount of grain dedicated to fuel and animal feed always surprises me the most. 39% of corn and 74% of soybeans go exclusively for livestock feed, and almost a third of all corn goes into ethanol and other fuel production. Wheat comes in different varieties but is primarily used for baked goods.

Supply and Demand Factors

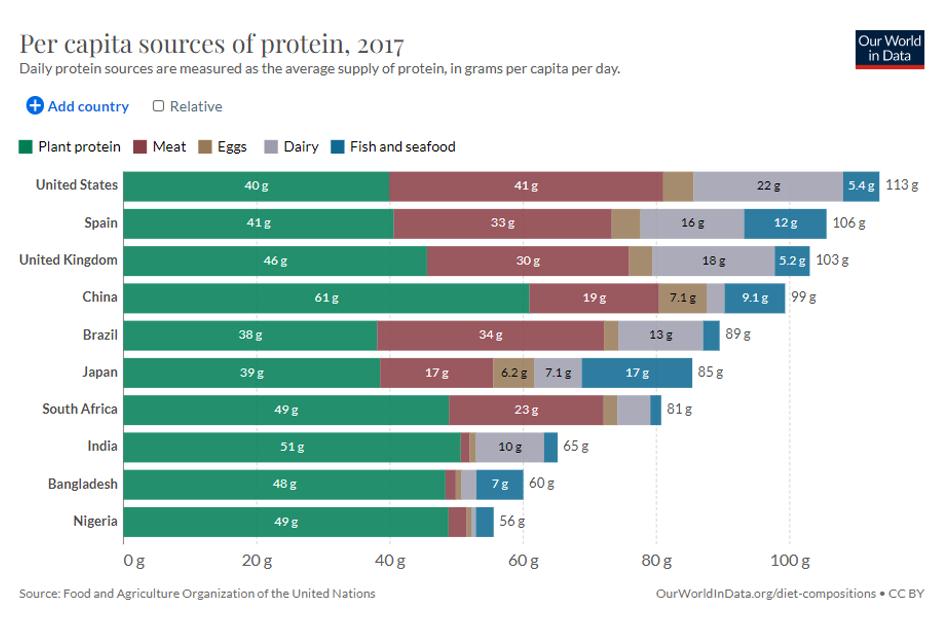

Like all commodities, supply and demand drive grain prices. The chart below shows a breakdown of protein sources across the world. A couple of items jump out to me on this chart. First, the United States consumes the most protein (not surprising), and second, China consumes a massive amount of plant protein. China consumes the most soy oil and soybeans of any country. Therefore, lockdowns in Shanghai and other large cities create demand destruction, affecting farmers in the United States, Brazil, and other exporting countries. Even with the outbreak of COVID-19, however, meat consumption continues to grow in China along with their standard of living. Government policies worldwide drive demand by focusing on reducing carbon dioxide and using fossil fuels. Emissions from livestock alone are estimated to produce 8-18% of all global emissions, similar to car exhaust emissions. Forced usage of ethanol and other biofuels contributes heavily to demand and is proposed as a solution to lower gasoline prices. Despite the growth of electric cars, substitutes for energy tend to be inferior at this point, and outside of mandated shutdowns, usage is consistent.

Agricultural Traders’ Focus on Supply

Agricultural traders spend most of their time focused on the supply side of the equation. While demand can be pretty predictable, supply drivers can change dramatically from year to year. A manager like Malinda Goldsmith at Four Seasons Commodities spends much of her time focusing on fundamental inputs like weather and planted acres. While a drought would negatively impact yields, too much rain or too little rain and the timing of either can prevent crops from getting into or out of the ground. Specific temperature ranges provide optimal or suboptimal conditions for growth as well. Small changes across millions of acres make a significant impact.

The Geneva Agricultural Relative Value Program

The new Geneva Agricultural Relative Value Program indeed incorporates the fundamentals but specializes in understanding where grains are located and where there are surpluses or shortages. The situation in Ukraine provides an excellent example of a top producer that suddenly cannot move its harvest quickly. This causes a ripple effect as shipping costs increase; countries that generally get their grain from them are forced to buy from others, and ultimately, supply is decreased. His relative value strategy attempts to go long contracts with shortages and short contracts where ample supply exists. Thus far, he has done this exceptionally well.

Changing World Dynamics

We can always count on the world to be changing. Sometimes, an event like COVID-19 affects all of us quickly. The current situation in Europe will affect all of us, with supply chains snarled, energy and grain production in flux, and a race to prevent a potentially devastating food shortage. Meanwhile, currency values fluctuate dramatically as central banks adjust policy, which changes what we pay at the store. The storm is finally here after several quiet growing seasons with near-perfect weather. Perhaps a grain trader can be an umbrella for your portfolio?

If you want to learn more about this sector or its traders, please call me at 847-877-0887.

Photo by Taylor Siebert on Unsplash