Is the equity market giving you heartburn? Bond market, too? Perhaps traditional asset classes lulled us into a false sense of confidence. After all, since 2008, outside of a few hiccups, returns provided ample reason to believe that our portfolios were destined to keep growing. But, as a trader once said to me, “Sometimes trading is hard, and sometimes trading is easy. When it is hard, I remind myself that I just need to be patient because the opportunity will come.” This may sound simplistic, but when we look at asset classes, the truth is closer to reality than we might admit.

Investment advisors and portfolio managers often want to take credit for making their clients’ money, but it is essential to separate skill from timing. The period from 2010-2020 yielded one down year for the stock market and two down years for bonds. An astonishing 80-90% annual win ratio. Results like these explain the growth in passive investing, where it is simple to let your money grow with low fees. Sadly, periods of calm often hide the underlying problems we see now.

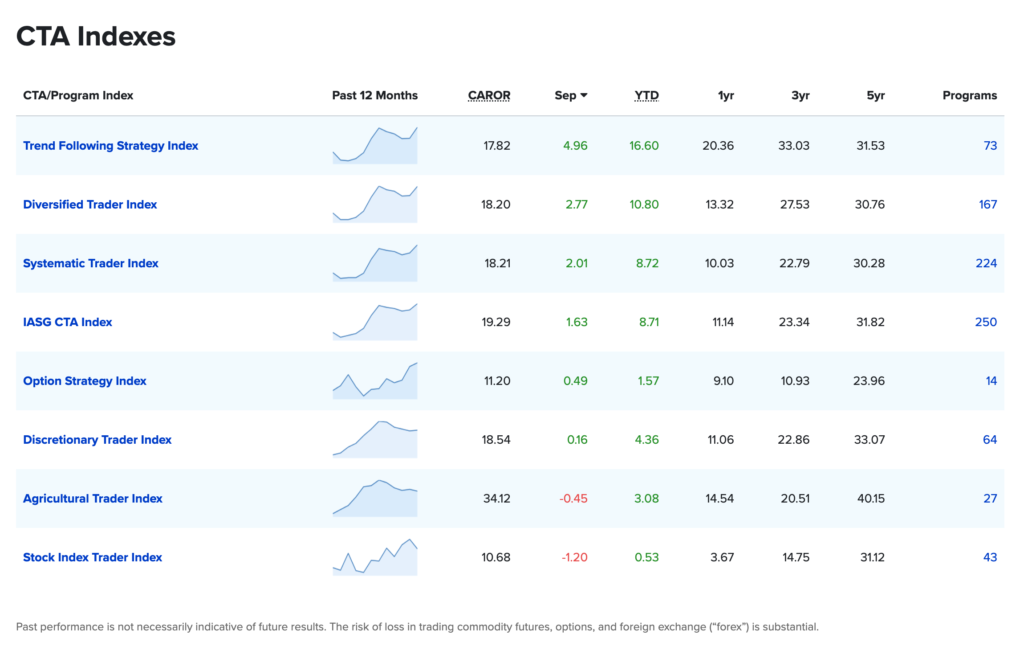

History proves that various periods are “easy” for different types of trading. Unlike stocks and bonds, which often do well in steady, predictable environments, futures traders usually thrive with volatility. This happens for a couple of reasons. Falling markets, in particular, yield more consistent movement and stronger trends. Since many systematic traders look for these patterns and use technical indicators to trigger trades, they find more opportunities and profitable setups. The ability to go long and short and capture movement in both directions is also easier with large swings. The IASG Indexes show the results of this year to date.

While active investing requires considerable skill, when every one of our indices is positive year to date, it shows that this environment is “easy” for CTAs. I am not advocating that this will be the case forever or even in the near term, but it proves once again that diversification is the key to portfolio construction because there is always a place to hide. By balancing risk between asset classes that perform across different market regimes, we can all sleep better at night. This means that often, we will have something in the portfolio losing. This is usually not because a strategy is “broken” but rather that the environment is difficult for that methodology while it is probably easy for others.

Predicting direction for asset classes is notoriously difficult, but sitting on the sidelines praying that you are in the right ones could be devastating. The best combination of strategies might not be fun all the time, but in a portfolio where all the positions go down at once proves that the construction was not sound to begin with—time to find better hiding places.

Photo by engin akyurt on Unsplash