Empires rise and fall. This often happens slowly and then quickly. In hindsight, we can identify critical events that should have raised alarm bells but did not. So, like asset bubbles that can crash an economy, identifying the next catalyst can be difficult. But perhaps the mounting debt of countries like the United States, most of Europe, and even Canada is the tipping point that will rearrange the global order and determine the dominant economies of the next century.

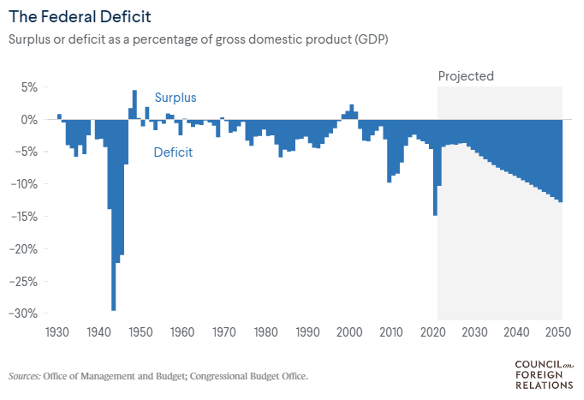

The United States public debt now clocks in at an astounding $247,000 per taxpayer. This coincides with “Public Social Spending” increases of 30.7% from 2000 to 2019. Mandatory spending for Social Security, Medicare, Medicaid, and social programs constitute the primary drivers of this growth. These outlays continue automatically unless Congress changes legislation. This seems politically unfeasible but will become more pressing as the population ages. This growth predates much of the large spike due to COVID-19, which will be reflected in 2020 numbers, so expect a large jump. A sample of this difference is shown in the picture below with the significant deficit in 2020. Naturally, politicians take credit for the reduction of this deficit in 2021. This is pretty comical as it still registers at approximately -5% of overall GDP.

Not to be left out, France spends the most of any country on social spending at 31.2% of their GDP, with a 13.4% increase over the same period. This puts their debt-to-GDP ratio amongst the highest in the world, along with Canada, near 125% of GDP. Japan, where debt per citizen is almost $103,000 per person, beats everyone at 296% of public debt to gross domestic product. Government spending throughout COVID dramatically accelerated these rates and inadvertently created inflation. The problem compounds now with higher interest rates on massive new debt.

Issues begin if borrowers begin to question sovereign debt. This would impact the United State’s status as a reserve currency and the world’s desire to hold US Treasury Bonds. Interest costs and the ability to finance the government would quickly deteriorate. Much like any country, this would necessitate painful tax increases and/or spending cuts. Given that 20 major countries spend more on public social spending, others might fall. We saw brief previews of these issues with Greece beginning in 2009, which led to 12 rounds of tax increases and spending cuts from 2010 to 2016. Japan, with its high public debt, anemic growth of less than 0.5% per year from 2000-2021, deflation for much of this period, and an aging population, show the risks that could also be coming. If large countries cannot pay, they could take many down with them as contagion spreads.

Strong leadership to control government budgets could delay or reverse this trend. If there is evidence of those politicians worldwide, I clearly missed them. Alternatively, we could just print new dollars and allow inflation to take its course. This will reduce everyone’s purchasing power and affect savers the most. It seems that we have tried that plan with poor results already. Growth is the best option. Unlike the previous decade, it might need to happen without much government support. It seems the current route is unsustainable. Hopefully, if this proves to be the tipping point, history will look kindly at us for missing the signs.

Also see:

- World Debt Clocks

- US Debt Clock

- Canada Debt Clock

- France Debt Clock

- Wikipedia: List of countries by social welfare spending

Photo by Ahmad Ossayli on Unsplash